- United Kingdom

- /

- Specialty Stores

- /

- AIM:WRKS

TheWorks.co.uk plc's (LON:WRKS) 28% Dip In Price Shows Sentiment Is Matching Earnings

TheWorks.co.uk plc (LON:WRKS) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 83% in the last year.

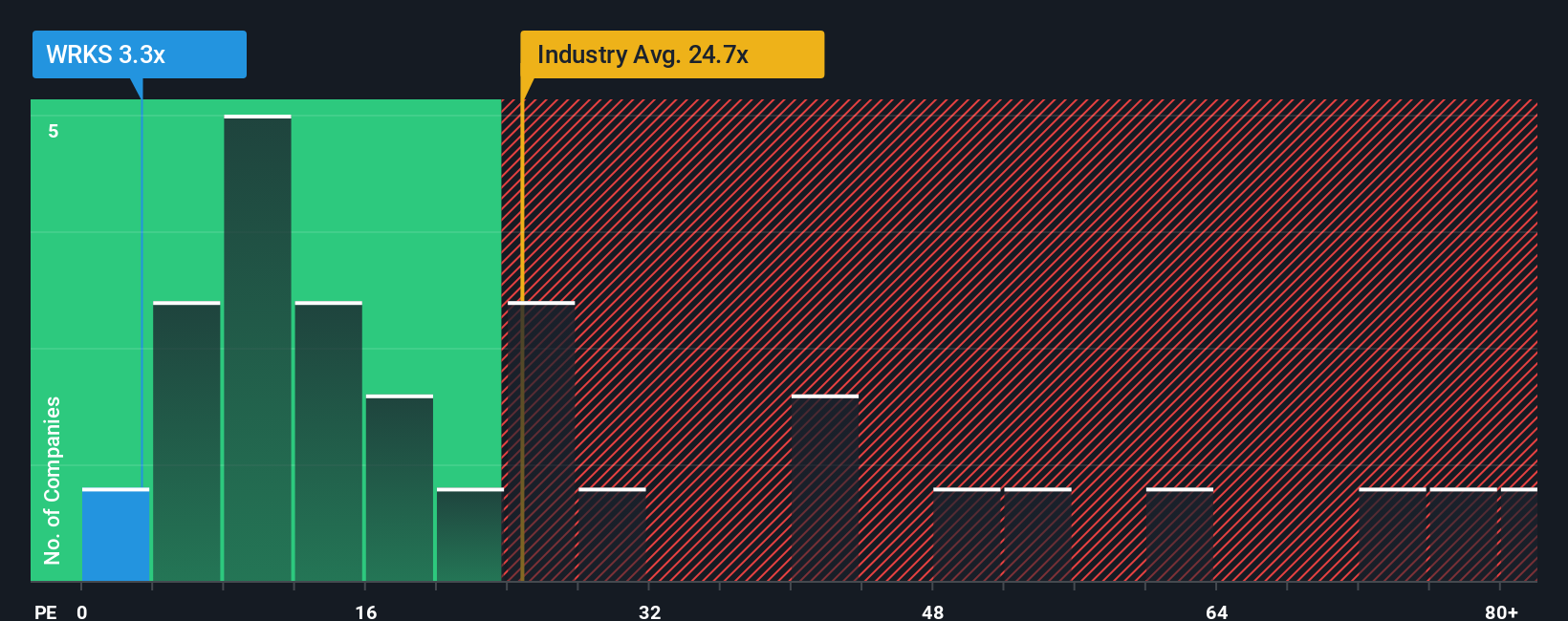

Even after such a large drop in price, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 16x, you may still consider TheWorks.co.uk as a highly attractive investment with its 3.3x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at TheWorks.co.uk over the last year would be more than acceptable for most companies. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for TheWorks.co.uk

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as TheWorks.co.uk's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 29% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 41% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's an unpleasant look.

In light of this, it's understandable that TheWorks.co.uk's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On TheWorks.co.uk's P/E

TheWorks.co.uk's P/E looks about as weak as its stock price lately. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of TheWorks.co.uk revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for TheWorks.co.uk that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if TheWorks.co.uk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:WRKS

TheWorks.co.uk

Engages in the retailing of art and craft products, stationery, toys, games, books, gifts, and seasonal products in the United Kingdom and Ireland.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success