Insider Buying Highlights These 3 Undervalued Small Caps In United Kingdom

Reviewed by Simply Wall St

In the last week, the United Kingdom market has remained flat but has shown an impressive 11% increase over the past year, with earnings forecasted to grow by 14% annually. In this context, identifying stocks that are currently undervalued and have insider buying can be a promising strategy for investors seeking opportunities in small-cap companies.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 17.4x | 0.5x | 39.15% | ★★★★★★ |

| Bytes Technology Group | 22.1x | 5.6x | 11.77% | ★★★★★☆ |

| NWF Group | 8.0x | 0.1x | 39.19% | ★★★★★☆ |

| Genus | 171.7x | 2.0x | 8.06% | ★★★★★☆ |

| Essentra | 727.5x | 1.4x | 26.31% | ★★★★☆☆ |

| Oxford Instruments | 24.1x | 2.6x | 12.21% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 42.01% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 38.83% | ★★★★☆☆ |

| Robert Walters | 41.5x | 0.2x | 41.99% | ★★★☆☆☆ |

| Petra Diamonds | NA | 0.2x | -34.21% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

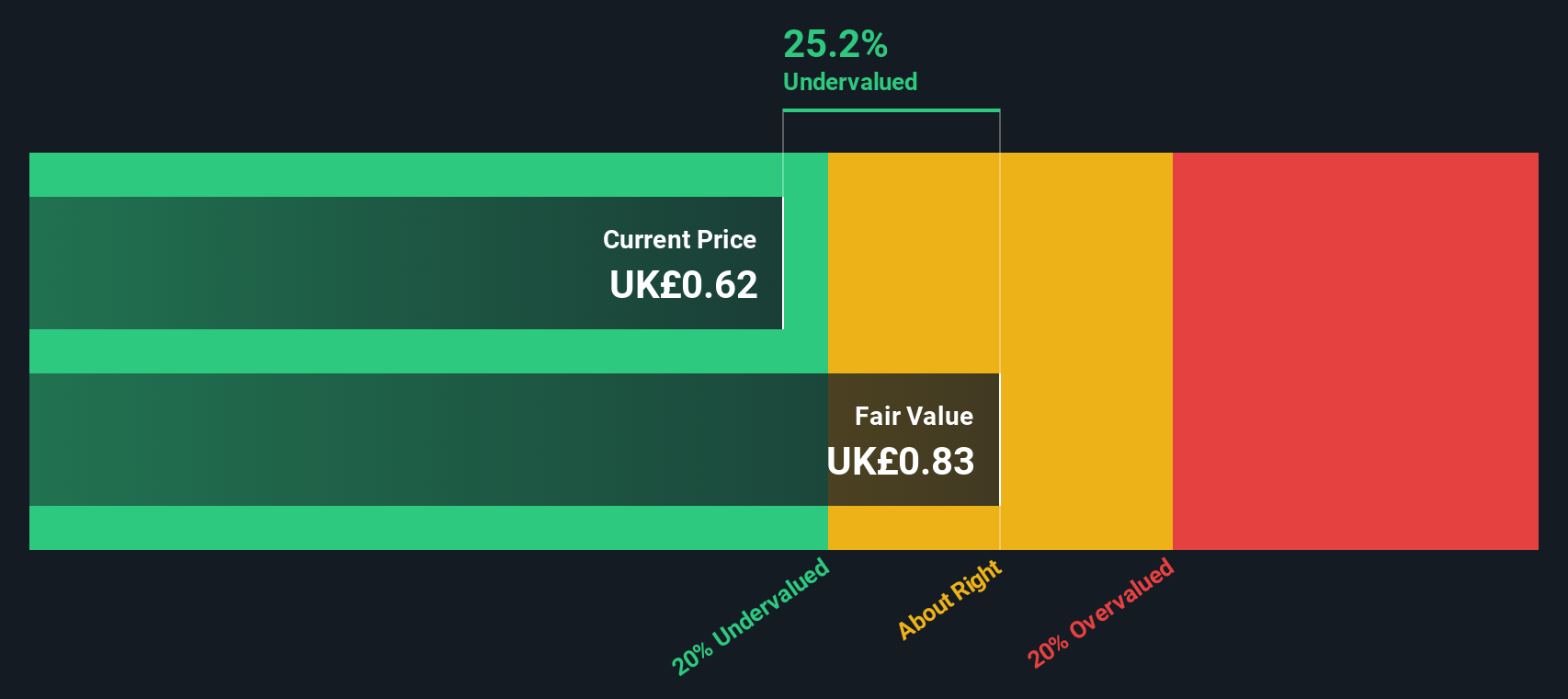

Vertu Motors (AIM:VTU)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vertu Motors operates as an automotive retailer, primarily dealing in gasoline and auto sales, with a market capitalization of £0.23 billion.

Operations: The company generates revenue primarily from the retail segment, specifically gasoline and auto dealers, with recent figures reaching £4.79 billion. The cost of goods sold (COGS) is substantial, amounting to £4.27 billion in the latest period, impacting profitability. Operating expenses have shown a consistent upward trend, contributing to a net income margin that has decreased to 0.40%. The gross profit margin has remained relatively stable at around 10.91% in recent periods.

PE: 11.2x

Vertu Motors, a smaller player in the UK market, has recently demonstrated insider confidence through share purchases from May to August 2024. Despite a dip in net income to £15.96 million for the half-year ending August 31, 2024, compared to £22.42 million last year, sales increased slightly to £2.49 billion. The company completed a buyback of over three million shares worth £2.23 million by September 27, 2024. While profit margins have narrowed from last year’s figures and funding relies solely on external borrowing, revenue is projected to grow annually by over four percent offering potential growth opportunities amidst its financial challenges.

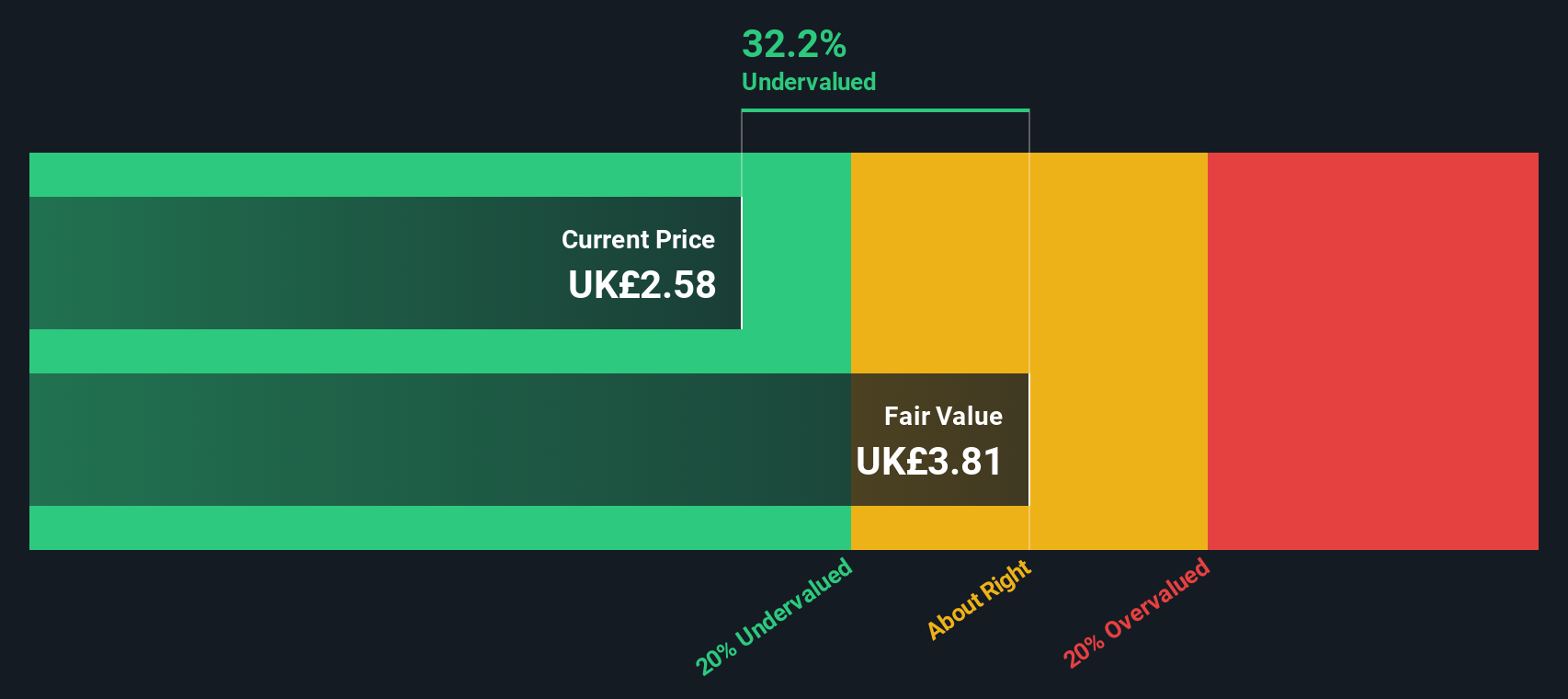

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates as a pizza delivery and carryout company, primarily generating income from sales to franchisees, corporate store operations, advertising and ecommerce services, property rentals, and various franchise-related fees.

Operations: Domino's Pizza Group generates revenue primarily from sales to franchisees, royalties, and advertising income. The gross profit margin has shown a notable trend, reaching 47.48% by mid-2024. Operating expenses are significant, with general and administrative costs consistently being the largest component.

PE: 15.6x

Domino's Pizza Group, a UK-based company, is navigating challenges with high debt levels and declining profit margins, but it's taking strategic steps to enhance shareholder value. The company initiated share repurchases in August 2024, completing the buyback of over 25 million shares for £90.1 million since May 2023. Despite a drop in net income to £42.3 million for H1 2024 from £80.2 million last year, Domino's remains optimistic about future growth through strategic initiatives and expects increased order counts and sales by year-end.

- Navigate through the intricacies of Domino's Pizza Group with our comprehensive valuation report here.

Evaluate Domino's Pizza Group's historical performance by accessing our past performance report.

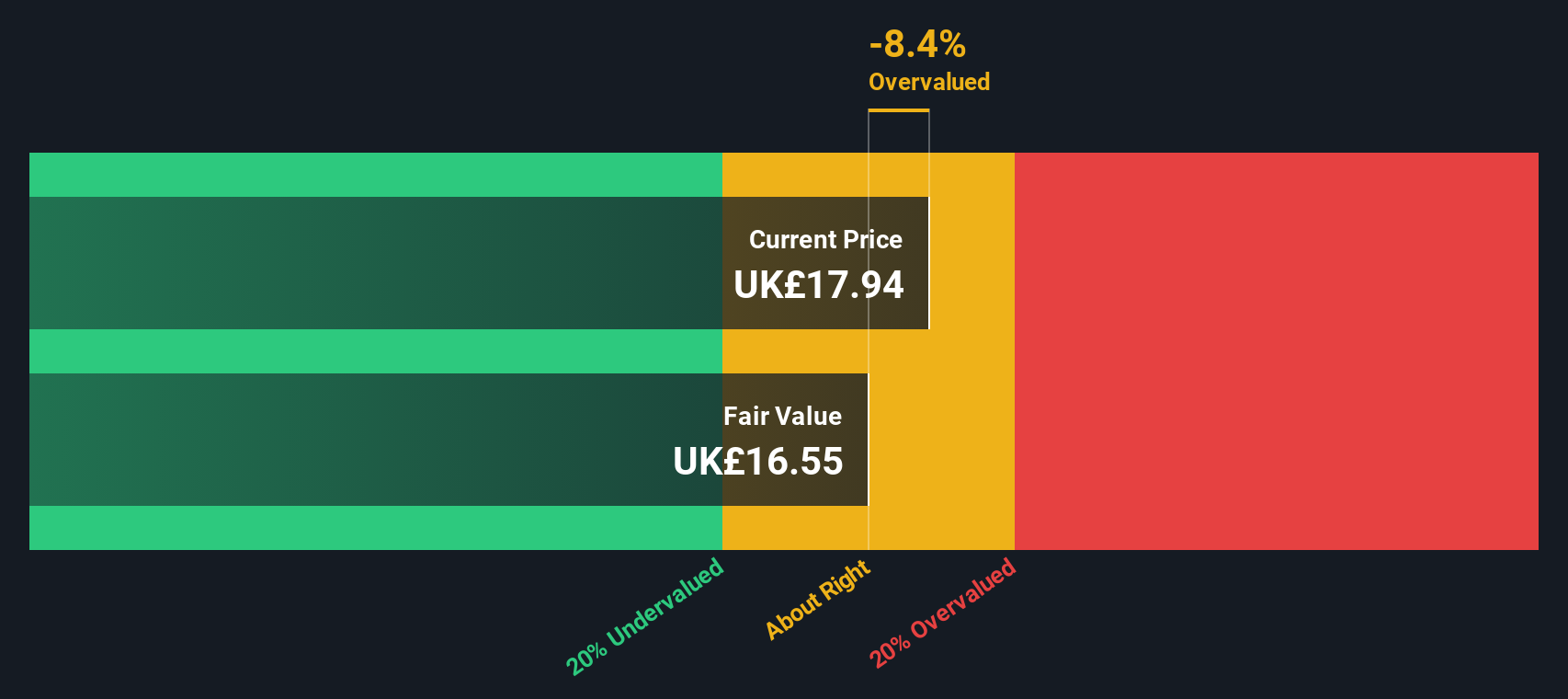

Oxford Instruments (LSE:OXIG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Oxford Instruments is a company that specializes in providing high-technology tools and systems for research and industry, with a market capitalization of £1.35 billion.

Operations: Oxford Instruments generates revenue primarily from Materials & Characterisation, Research & Discovery, and Service & Healthcare segments. The company's gross profit margin has shown a notable upward trend, reaching 52.24% as of September 2023. Operating expenses are largely driven by sales and marketing, R&D, and general administrative costs.

PE: 24.1x

Oxford Instruments, a notable player in the UK's small-cap landscape, is capturing attention with its potential for growth and insider confidence. Recently, insiders have shown confidence by purchasing shares consistently over the past year. The company is poised for an annual earnings growth of 10.45%, driven by innovative presentations at key industry conferences such as NanoFabUK and Faraday Institution Conference in September 2024. Despite relying on external borrowing, Oxford Instruments remains a compelling prospect within its sector.

- Delve into the full analysis valuation report here for a deeper understanding of Oxford Instruments.

Examine Oxford Instruments' past performance report to understand how it has performed in the past.

Taking Advantage

- Explore the 31 names from our Undervalued UK Small Caps With Insider Buying screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OXIG

Oxford Instruments

Oxford Instruments plc provide scientific technology products and services for academic and commercial organizations worldwide.

Flawless balance sheet and good value.