- United Kingdom

- /

- Retail Distributors

- /

- AIM:SUP

Should You Be Adding Supreme (LON:SUP) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Supreme (LON:SUP). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Supreme

How Fast Is Supreme Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Supreme has grown EPS by 18% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

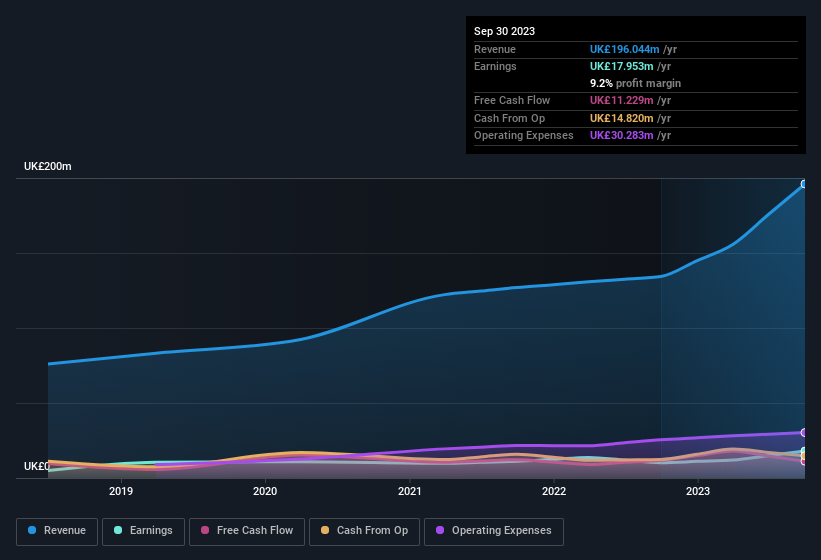

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Supreme remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 46% to UK£196m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Supreme's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Supreme Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Supreme insiders walking the walk, by spending UK£506k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. We also note that it was the CEO & Director, Sandeep Chadha, who made the biggest single acquisition, paying UK£485k for shares at about UK£1.28 each.

On top of the insider buying, it's good to see that Supreme insiders have a valuable investment in the business. With a whopping UK£45m worth of shares as a group, insiders have plenty riding on the company's success. At 34% of the company, the co-investment by insiders fosters confidence that management will make long-term focussed decisions.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Sandy Chadha is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Supreme with market caps between UK£79m and UK£317m is about UK£587k.

The Supreme CEO received total compensation of just UK£232k in the year to March 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Supreme Deserve A Spot On Your Watchlist?

For growth investors, Supreme's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. However, before you get too excited we've discovered 1 warning sign for Supreme that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Supreme, you'll probably love this curated collection of companies in GB that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SUP

Supreme

Owns, manufactures, and distributes fast-moving branded and discounted consumer goods in the United Kingdom, Ireland, the Netherlands, France, rest of Europe, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives