Stock Analysis

- United Kingdom

- /

- Software

- /

- AIM:ALT

UK Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn influenced by weak trade data from China and declining commodity prices. Despite these broader market pressures, investors often find potential in penny stocks—smaller or newer companies that may offer growth opportunities at lower price points. While the term "penny stocks" might seem outdated, their relevance remains strong as they can present unique investment opportunities when backed by solid financials and resilience.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.44 | £353.13M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.92 | £474.22M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.78 | £207.57M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.86 | £65.13M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.48 | £188.48M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.326 | £204.51M | ★★★★★☆ |

| Castings (LSE:CGS) | £2.88 | £125.16M | ★★★★★★ |

| Central Asia Metals (AIM:CAML) | £1.732 | £301.32M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Altitude Group (AIM:ALT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Altitude Group plc offers comprehensive solutions for branded merchandise across corporate promotional products, print vertical markets, and the higher-education sector in North America, the United Kingdom, and Europe, with a market cap of £2.50 million.

Operations: The company's revenue is primarily derived from North America, contributing £22.86 million, with an additional £1.15 million coming from the United Kingdom and Europe.

Market Cap: £25M

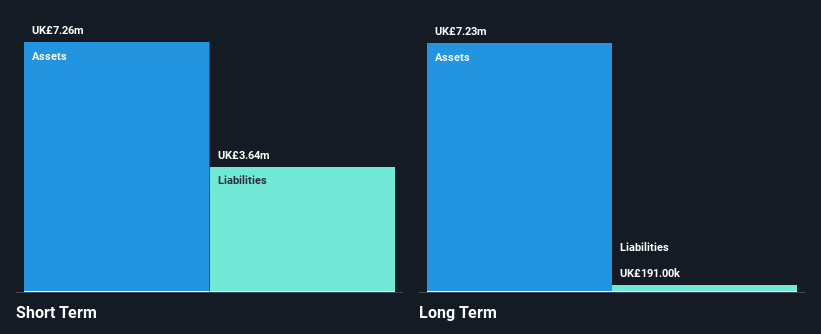

Altitude Group plc, with a market cap of £2.50 million, primarily generates revenue from North America (£22.86 million) and has shown impressive earnings growth of 78.7% over the past year, outpacing the software industry average. The company is debt-free and has improved its net profit margins from 2.1% to 2.9%. Despite this growth, shareholders faced dilution in the past year with a 2.3% increase in total shares outstanding, and financial results were impacted by a significant one-off loss of £295K as of March 2024.

- Click here to discover the nuances of Altitude Group with our detailed analytical financial health report.

- Gain insights into Altitude Group's outlook and expected performance with our report on the company's earnings estimates.

Angling Direct (AIM:ANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Angling Direct PLC, with a market cap of £28.98 million, operates in the sale of fishing tackle products and equipment across the United Kingdom, Europe, and internationally.

Operations: The company's revenue is derived from its UK Stores (£46.48 million), UK Online sales (£33.39 million), and operations in Europe (£4.29 million).

Market Cap: £28.98M

Angling Direct PLC, with a market cap of £28.98 million, has demonstrated solid financial health and growth. The company reported half-year sales of £45.84 million, an increase from the previous year, and net income rose to £1.73 million. Angling Direct is debt-free and its short-term assets significantly exceed liabilities. Earnings have grown by 66.1% over the past year, surpassing both its five-year average growth rate and industry performance despite a low return on equity of 4.1%. Revenue is projected to grow by 9.63% annually while profit margins have improved from last year's figures.

- Get an in-depth perspective on Angling Direct's performance by reading our balance sheet health report here.

- Gain insights into Angling Direct's future direction by reviewing our growth report.

Hostelworld Group (LSE:HSW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hostelworld Group plc operates as an online travel agent specializing in the hostel market globally, with a market cap of £161.35 million.

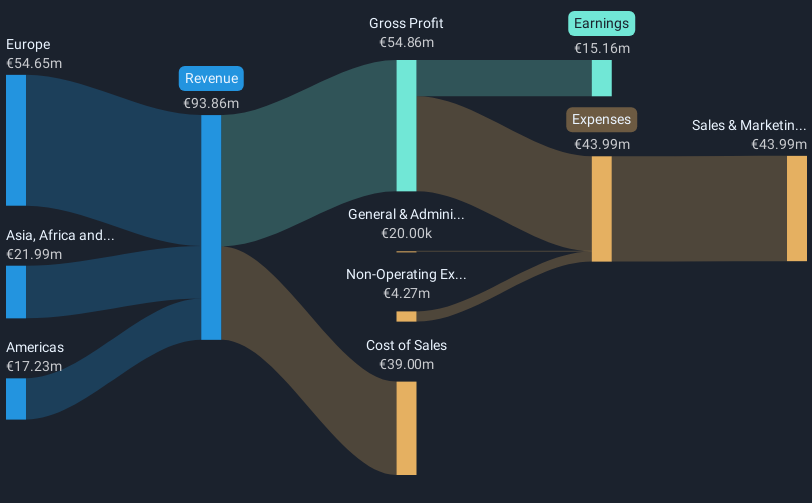

Operations: The company generates €93.86 million in revenue from providing software and data processing services.

Market Cap: £161.35M

Hostelworld Group plc, with a market cap of £161.35 million, has recently become profitable and reported half-year sales of €46.44 million, up from the previous year. The company achieved a net income of €2.52 million compared to a net loss previously, reflecting improved financial performance. Hostelworld is debt-free and trades at 59.1% below its estimated fair value, suggesting potential undervaluation relative to peers and industry standards. Despite this positive outlook, short-term liabilities exceed assets by €13.1 million, indicating potential liquidity challenges that investors should consider when evaluating this penny stock opportunity in the UK market.

- Navigate through the intricacies of Hostelworld Group with our comprehensive balance sheet health report here.

- Explore Hostelworld Group's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Unlock more gems! Our UK Penny Stocks screener has unearthed 467 more companies for you to explore.Click here to unveil our expertly curated list of 470 UK Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALT

Altitude Group

Provides end-to-end solutions for branded merchandise in corporate promotional products industry, print vertical markets, and the higher-education sector in North America, the United Kingdom, and Europe.