- United Kingdom

- /

- Machinery

- /

- AIM:JDG

European Undervalued Small Caps With Insider Buying In March 2025

Reviewed by Simply Wall St

As European markets navigate through the complexities of U.S. trade policy uncertainty and economic adjustments, the pan-European STOXX Europe 600 Index recently ended a streak of gains, highlighting investor caution. However, with Germany and the EU planning increased spending on defense and infrastructure, opportunities may arise for small-cap companies that are strategically positioned to benefit from these developments. In this context, identifying stocks that exhibit strong fundamentals and potential resilience in fluctuating market conditions can be crucial for investors seeking value in the small-cap segment.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 19.1x | 4.9x | 25.22% | ★★★★★★ |

| Macfarlane Group | 10.4x | 0.6x | 41.03% | ★★★★★★ |

| 4imprint Group | 16.0x | 1.3x | 35.83% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 26.72% | ★★★★★☆ |

| Robert Walters | NA | 0.2x | 42.86% | ★★★★★☆ |

| Gamma Communications | 22.4x | 2.3x | 36.05% | ★★★★☆☆ |

| Franchise Brands | 38.2x | 2.0x | 26.91% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 45.56% | ★★★★☆☆ |

| Axactor | NA | 0.9x | 7.43% | ★★★★☆☆ |

| Norcros | 21.1x | 0.5x | 0.48% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

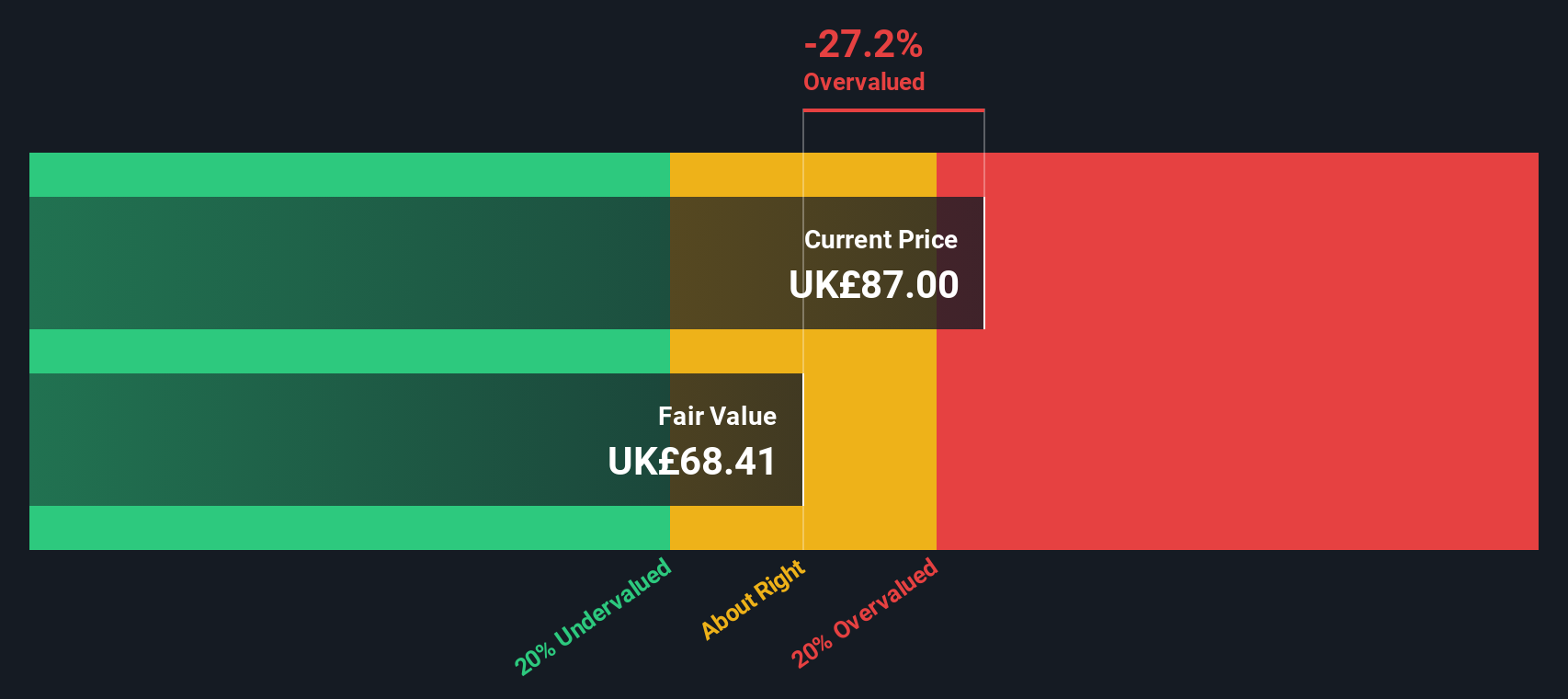

Judges Scientific (AIM:JDG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Judges Scientific is a company that specializes in acquiring and developing scientific instrument businesses, with operations primarily in the vacuum and materials sciences sectors, and has a market capitalization of approximately £0.57 billion.

Operations: Judges Scientific generates revenue primarily from its Vacuum and Materials Sciences segments. The company has experienced fluctuations in its net income margin, which was 13.83% at the end of 2019 and decreased to 6.98% by the end of 2023, before slightly rising to 9.37% by mid-2024. Gross profit margin showed an upward trend, reaching a peak of 68.95% in mid-2024 from earlier periods below this level.

PE: 37.7x

Judges Scientific, a small European company, has caught attention for its potential value. Despite relying entirely on external borrowing, which poses higher risk, the company maintains a strong financial position. Earnings are projected to grow annually by 29%. Insider confidence is evident with Lushani Kodituwakku purchasing 1,655 shares valued at £122,718 in December 2024. Leadership changes are underway as Ralph Elman prepares to become Non-Executive Chair in January 2025.

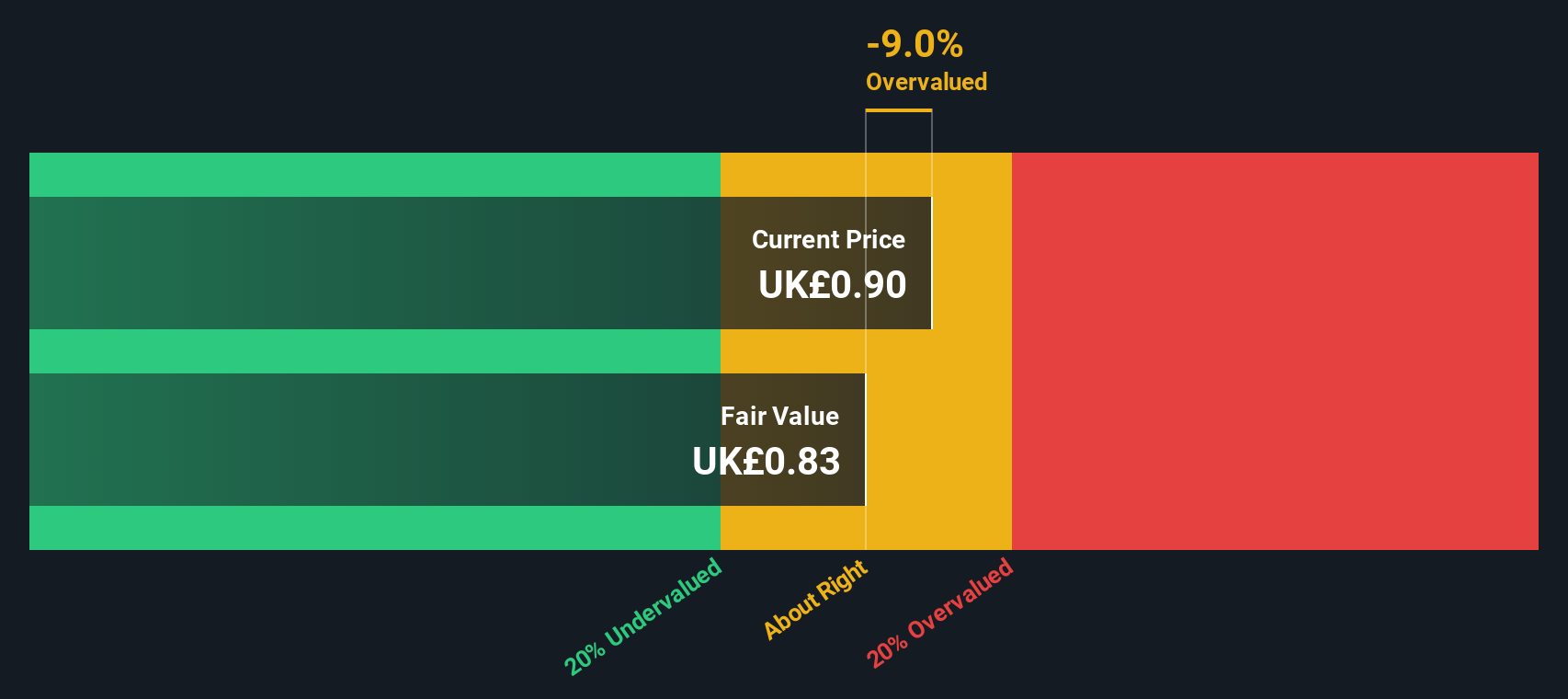

LBG Media (AIM:LBG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: LBG Media is a company operating in the online media publishing industry with a market capitalization of approximately £0.47 billion.

Operations: LBG Media's revenue is primarily derived from the online media publishing industry, with recent figures showing £85.08 million in revenue. The company's cost structure includes significant COGS and operating expenses, impacting its profitability. Notably, the gross profit margin has shown variability over time, reaching 31.68% as of September 2024.

PE: 25.0x

LBG Media, a European small-cap, is drawing attention with its financial and strategic shifts. The company reported sales of £64.95 million and net income of £7.39 million for the nine months ending September 2024, showcasing steady performance despite leadership changes. Dave Wilson's recent move to executive Chair aims to bolster finance operations during CFO transitions. Insider confidence is evident as insiders have increased their stake in recent months, signaling belief in future growth prospects amid evolving market dynamics.

- Dive into the specifics of LBG Media here with our thorough valuation report.

Explore historical data to track LBG Media's performance over time in our Past section.

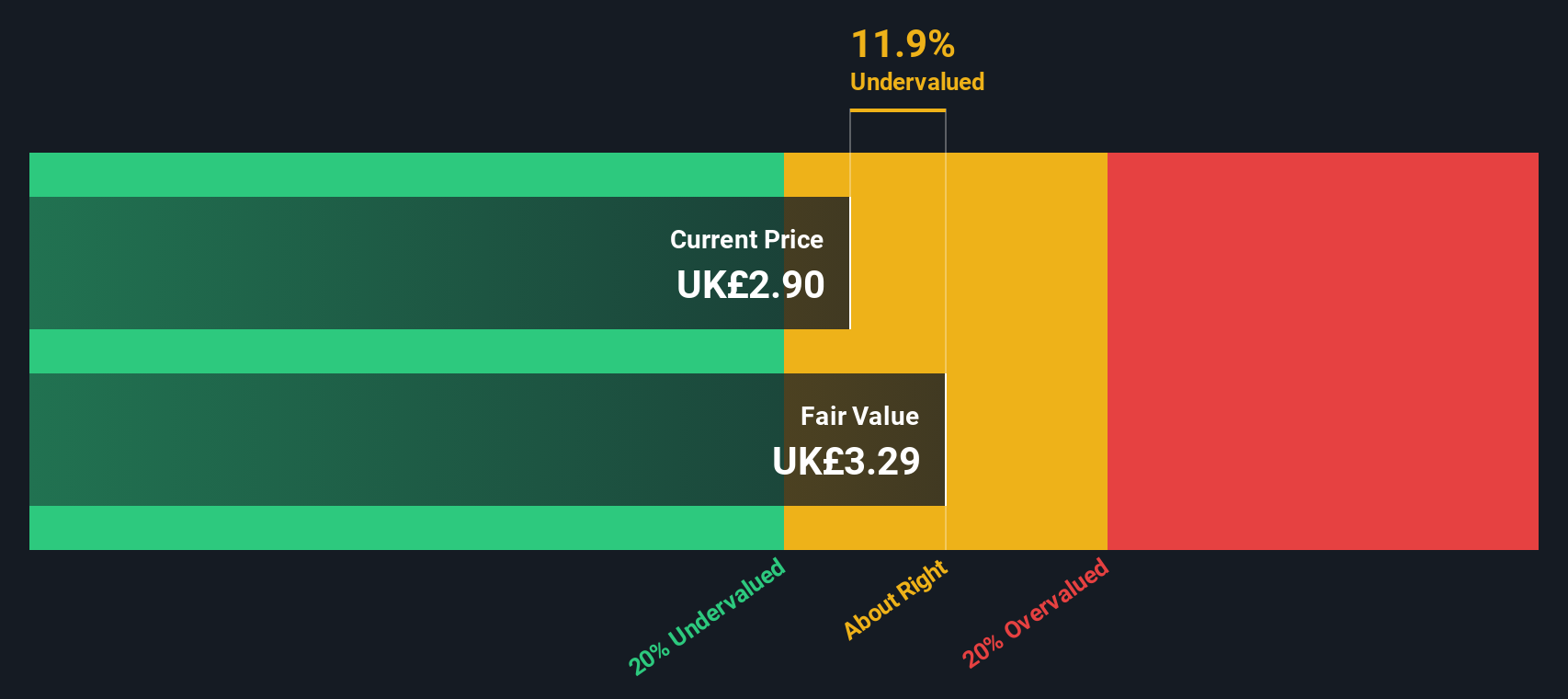

Hammerson (LSE:HMSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammerson is a real estate investment company focused on managing and developing flagship retail destinations in the UK, France, and Ireland, with a market cap of approximately £1.35 billion.

Operations: Flagship Destinations in the UK, France, and Ireland are key revenue streams. The gross profit margin has shown a downward trend from 87.44% in March 2014 to 75.34% by December 2024.

PE: -27.7x

Hammerson, a small European company, has caught attention with insider confidence shown through recent share purchases. Despite reporting a net loss of £526.3 million for 2024 compared to the previous year's £51.4 million, their earnings are forecasted to grow at an impressive 47% annually. The company relies entirely on external borrowing for funding, which poses some risk but hasn't deterred insiders from investing more in shares. A proposed final dividend of 8.07 pence per share further indicates potential future stability and growth prospects amidst current challenges.

- Take a closer look at Hammerson's potential here in our valuation report.

Evaluate Hammerson's historical performance by accessing our past performance report.

Seize The Opportunity

- Embark on your investment journey to our 55 Undervalued European Small Caps With Insider Buying selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JDG

Judges Scientific

Designs, manufactures, and sells scientific instruments and services.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives