- United Kingdom

- /

- Retail REITs

- /

- LSE:HMSO

3 Top Undervalued Small Caps In The United Kingdom With Insider Activity

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently closed lower, impacted by weak trade data from China, highlighting the interconnectedness of global markets and the vulnerability of UK blue-chip companies to international economic shifts. Despite these broader market challenges, identifying undervalued small-cap stocks with insider activity can offer unique opportunities for investors looking to navigate these turbulent times.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 24.5x | 5.5x | 12.81% | ★★★★★☆ |

| Domino's Pizza Group | 15.4x | 1.8x | 30.49% | ★★★★★☆ |

| C&C Group | NA | 0.4x | 47.89% | ★★★★★☆ |

| GB Group | NA | 3.0x | 33.06% | ★★★★★☆ |

| Norcros | 7.5x | 0.5x | 2.88% | ★★★★☆☆ |

| Harworth Group | 13.9x | 7.3x | -507.38% | ★★★★☆☆ |

| Picton Property Income | NA | 7.3x | 27.15% | ★★★★☆☆ |

| CVS Group | 22.1x | 1.2x | 41.57% | ★★★★☆☆ |

| Hochschild Mining | NA | 1.6x | 43.80% | ★★★★☆☆ |

| Foxtons Group | 27.8x | 1.3x | 45.72% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

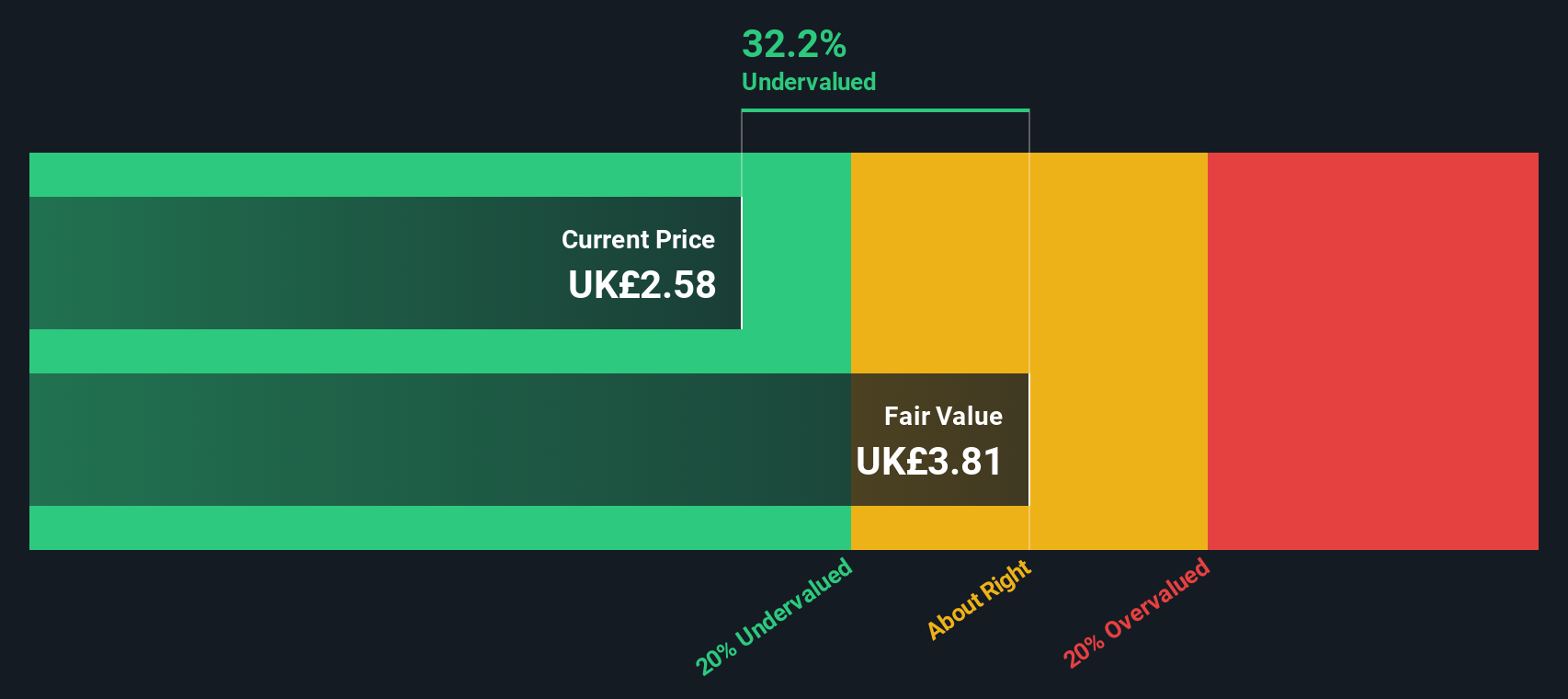

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates a network of franchise and corporate pizza stores, generating income from sales to franchisees, corporate store operations, national advertising and ecommerce, rental income on properties, and various franchise-related fees; it has a market cap of approximately £1.50 billion.

Operations: The company's revenue is primarily derived from sales to franchisees (£461 million), corporate stores income (£42.9 million), national advertising and e-commerce income (£85.5 million), rental income on leasehold and freehold property (£1.9 million), and royalties, franchise fees, and change of hands fees (£82.4 million). Gross profit margin has shown an upward trend, reaching 47.48% in the latest period ending June 30, 2024.

PE: 15.4x

Domino's Pizza Group, a small cap in the UK, has recently announced share repurchases starting August 6, 2024. The company plans to buy back up to 39.5 million shares by August 1, 2025. Despite facing a dip in H1 sales (£326.8 million) and net income (£42.3 million), insider confidence remains high with significant share purchases earlier this year for £90.1 million. Domino's expects trading momentum and growth in orders for the rest of fiscal year 2024.

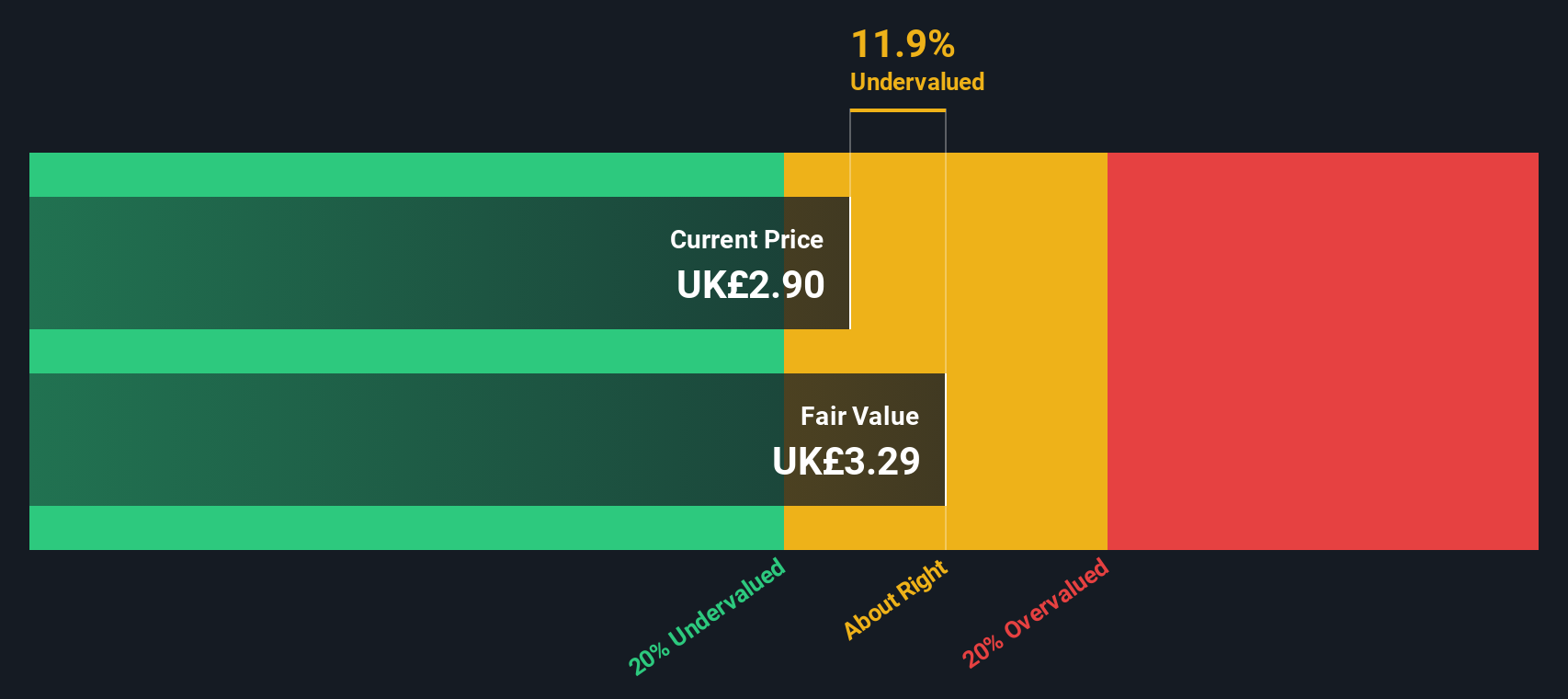

Hammerson (LSE:HMSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammerson is a property development and investment company focusing on flagship retail destinations in the UK, France, and Ireland with a market cap of £1.26 billion.

Operations: Hammerson generates revenue primarily from its flagship destinations in the UK, France, and Ireland. The company has experienced fluctuations in its net income margin, reaching as high as 1.937% and dropping to -7.897%. Operating expenses have varied but typically range between £42 million to £74 million per quarter.

PE: -33.0x

Hammerson has arranged a €175 million share of a €350 million non-recourse term loan with PIMCO Prime Real Estate, secured on Dundrum Town Centre. This move extends their average debt maturity from 2.2 to 2.9 years and maintains their LTV ratio. Despite reporting a net loss of £516.7 million for H1 2024, the company declared an interim dividend of £0.00756 per share, signaling confidence in future cash flows and stability within the UK retail sector.

- Take a closer look at Hammerson's potential here in our valuation report.

Review our historical performance report to gain insights into Hammerson's's past performance.

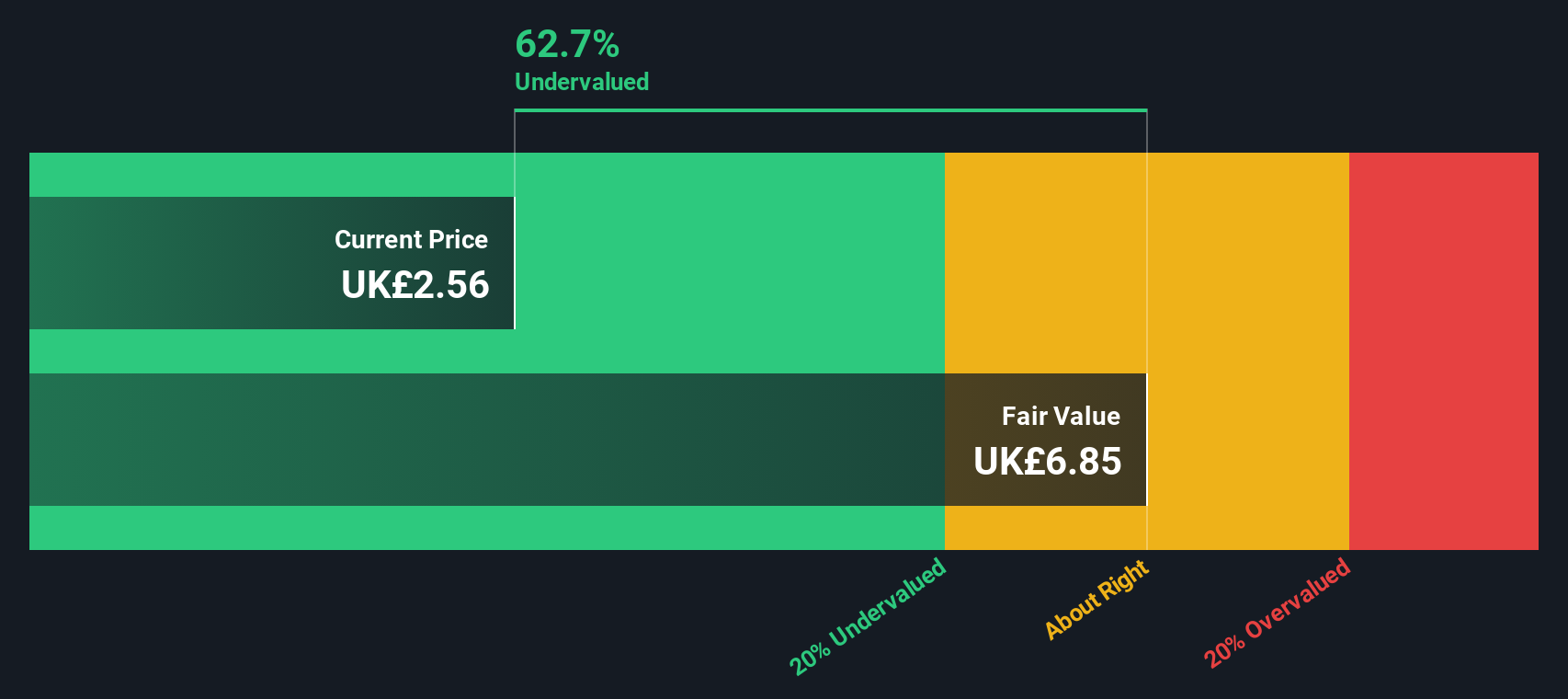

Hochschild Mining (LSE:HOC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hochschild Mining is a company engaged in the exploration, mining, processing, and sale of silver and gold with key operations in San Jose, Inmaculada, and Pallancata; it has a market capitalization of approximately £0.50 billion.

Operations: Hochschild Mining generates its revenue primarily from its San Jose, Inmaculada, and Pallancata segments. Over recent periods, the company has experienced fluctuations in its gross profit margin, with a high of 42.85% and a low of 8.08%. Operating expenses have varied significantly as well, impacting net income margins which have ranged from -50.01% to 9.48%.

PE: -20.7x

Hochschild Mining, a smaller UK-based company, has recently shown promising insider confidence with CEO Eduardo Navarro purchasing 148,000 shares for £235,320 in July 2024. This move increased their holdings by over 52%. The company's production guidance for 2024 remains steady at 343,000-360,000 gold equivalent ounces. In Q2 2024, Hochschild reported silver production of 2.6 million ounces and gold production of 66.37 thousand ounces. Earnings are forecasted to grow by nearly 54% annually despite reliance on higher-risk external borrowing for funding.

- Click here to discover the nuances of Hochschild Mining with our detailed analytical valuation report.

Gain insights into Hochschild Mining's past trends and performance with our Past report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 23 Undervalued UK Small Caps With Insider Buying here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammerson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HMSO

Hammerson

Hammerson is a cities business. An owner, operator and developer of prime urban real estate, with a portfolio value of £4.7billion (as at 30 June 2023), in some of the fastest growing cities in the UK, Ireland and France.

Fair value with moderate growth potential.