- United Kingdom

- /

- Oil and Gas

- /

- LSE:SEPL

Undiscovered Gems in the United Kingdom to Watch This August 2024

Reviewed by Simply Wall St

The United Kingdom's market has faced some turbulence recently, with the FTSE 100 closing lower due to weak trade data from China and broader global economic uncertainties. Despite these challenges, there are still promising opportunities within the small-cap sector that could offer significant potential for growth. In this article, we will explore three undiscovered gems in the United Kingdom that investors should watch this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Goodwin | 59.96% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc offers foreign exchange risk management and alternative banking solutions across the UK, Europe, Canada, and internationally, with a market cap of £1.07 billion.

Operations: Alpha Group International plc generates revenue primarily from its Alpha Pay (£64.30 million), Institutional (£61.29 million), and Corporate London (£45.42 million) segments, among others.

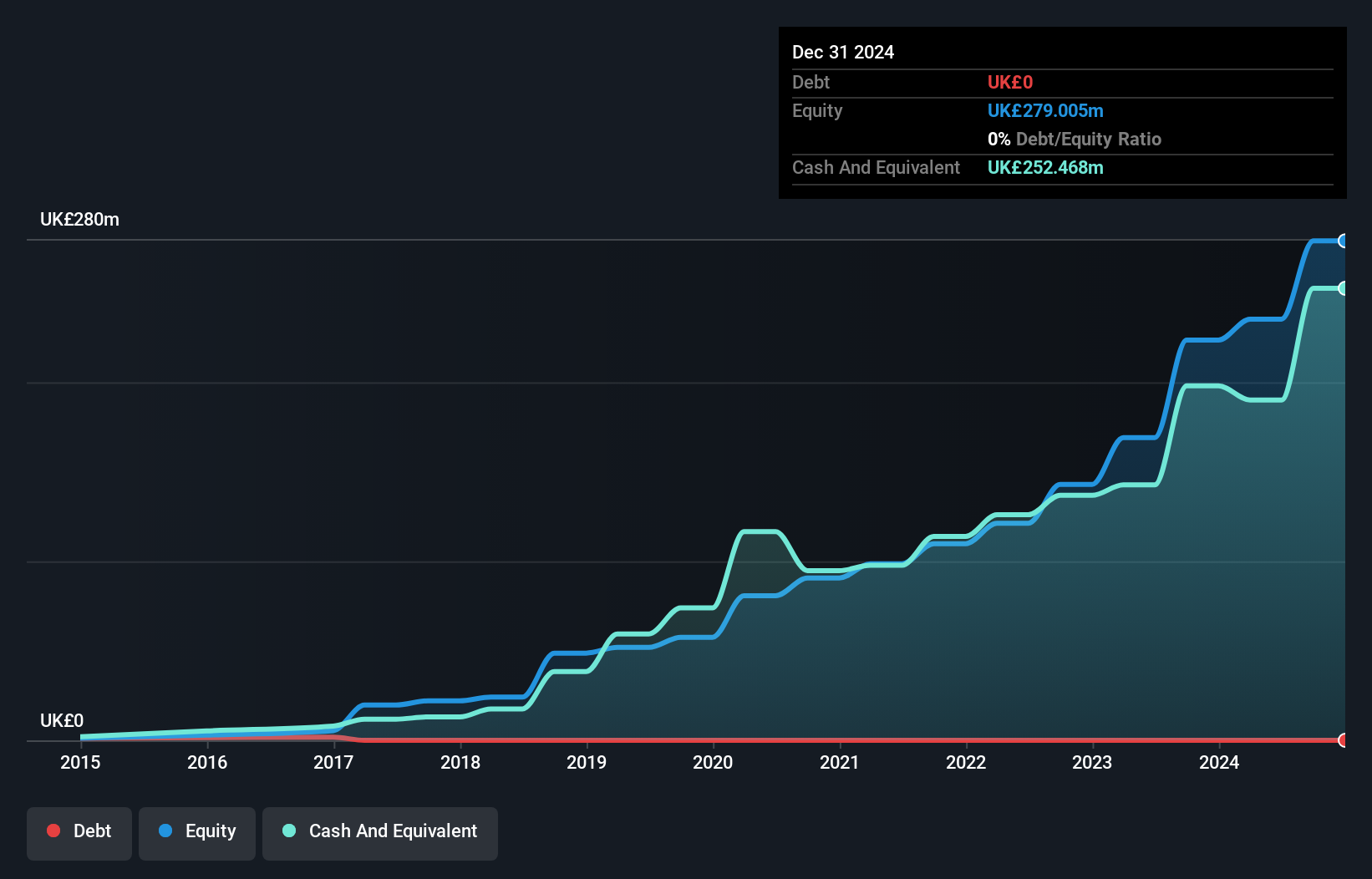

Alpha Group International, recently added to the FTSE 250 and FTSE 350 indices, has shown impressive earnings growth of 130% over the past year, significantly outpacing the Capital Markets industry at 1.2%. With a price-to-earnings ratio of 12x compared to the UK market's 16.4x, it trades at good value. The company repurchased shares in June under a shareholder mandate and remains debt-free for five years while forecasting an annual earnings growth rate of 8.25%.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.12 billion.

Operations: Seplat Energy generates revenue primarily from oil ($815.03 million) and gas ($120.87 million) segments.

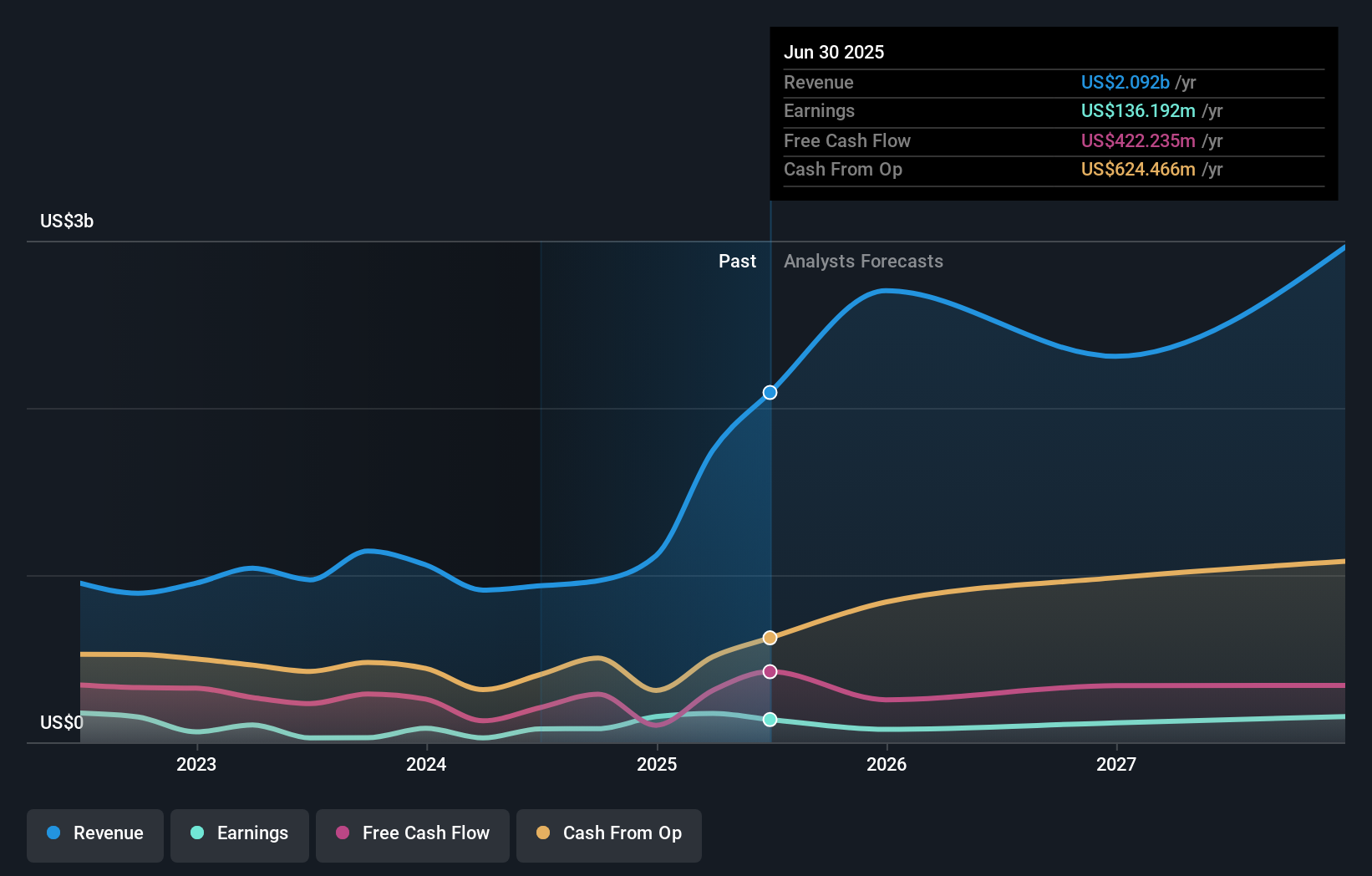

Seplat Energy has shown impressive earnings growth of 207.6% over the past year, significantly outpacing the Oil and Gas industry average. Despite a net debt to equity ratio rising from 20.6% to 41.5% over five years, it remains satisfactory by industry standards. The company reported Q2 sales of US$241.82 million, up from US$216.03 million last year, with net income at US$39.72 million compared to a loss of US$14.63 million previously

- Get an in-depth perspective on Seplat Energy's performance by reading our health report here.

Examine Seplat Energy's past performance report to understand how it has performed in the past.

Senior (LSE:SNR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Senior plc designs, manufactures, and sells high-technology components and systems for the aerospace, defense, land vehicle, and power and energy markets globally, with a market cap of £675.37 million.

Operations: Senior plc generates revenue primarily from its Aerospace segment (£651.10 million) and Flexonics segment (£333 million), with central costs of -£1.50 million.

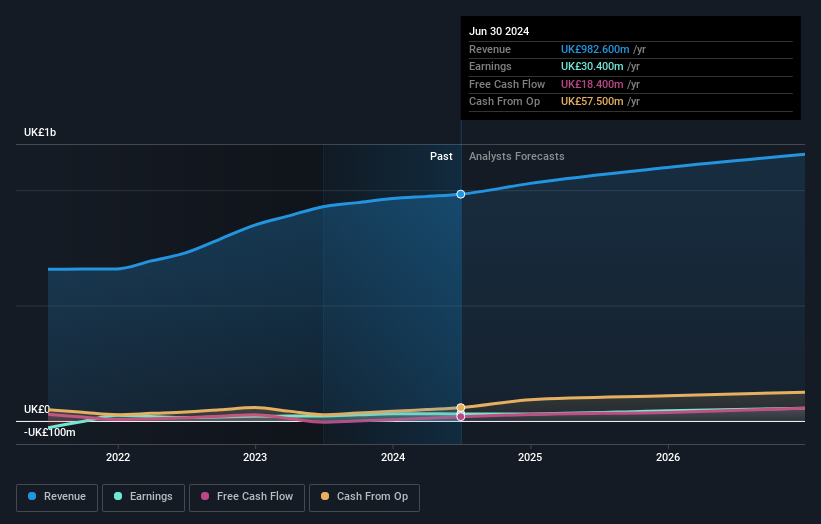

Senior plc, a notable player in the Aerospace & Defense sector, has demonstrated strong performance with earnings growth of 40.1% over the past year, significantly outpacing industry growth of 14.8%. Trading at 67.8% below its estimated fair value, it offers good relative value compared to peers. Despite a debt to equity ratio increase from 35.5% to 42.4% over five years, its net debt to equity ratio remains satisfactory at 34.4%.

- Take a closer look at Senior's potential here in our health report.

Gain insights into Senior's past trends and performance with our Past report.

Where To Now?

- Unlock our comprehensive list of 79 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SEPL

Seplat Energy

Engages in the oil and gas exploration and production, and gas processing activities in Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England.

Established dividend payer with proven track record.