- United Kingdom

- /

- REITS

- /

- LSE:BLND

Christopher Grigg Is The Executive Director of British Land Company Plc (LON:BLND) And They Just Sold 28% Of Their Shares

We wouldn't blame British Land Company Plc (LON:BLND) shareholders if they were a little worried about the fact that Christopher Grigg, the Executive Director recently netted about UK£1.9m selling shares at an average price of UK£4.74. That sale reduced their total holding by 28% which is hardly insignificant, but far from the worst we've seen.

View our latest analysis for British Land

The Last 12 Months Of Insider Transactions At British Land

In fact, the recent sale by Christopher Grigg was the biggest sale of British Land shares made by an insider individual in the last twelve months, according to our records. So what is clear is that an insider saw fit to sell at around the current price of UK£4.70. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

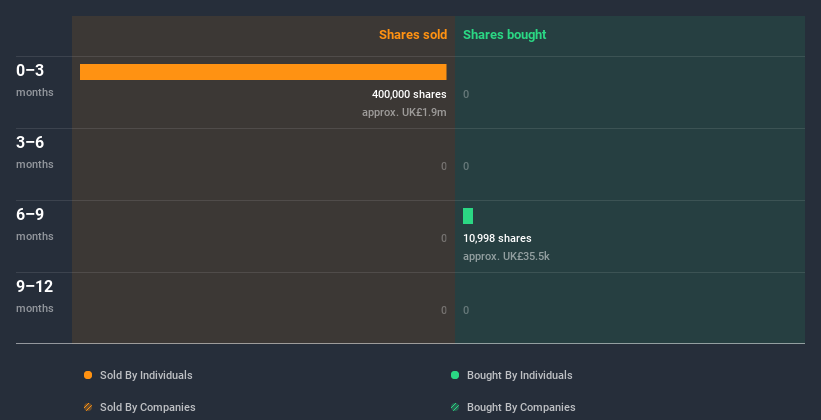

Happily, we note that in the last year insiders paid UK£35k for 11.00k shares. But insiders sold 400.00k shares worth UK£1.9m. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Does British Land Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. It appears that British Land insiders own 0.2% of the company, worth about UK£10.0m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Do The British Land Insider Transactions Indicate?

An insider hasn't bought British Land stock in the last three months, but there was some selling. And our longer term analysis of insider transactions didn't bring confidence, either. When you consider that most companies have higher levels of insider ownership, we're a little wary. So we're not rushing to buy, to say the least. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing British Land. To that end, you should learn about the 4 warning signs we've spotted with British Land (including 1 which is concerning).

Of course British Land may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade British Land, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if British Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:BLND

British Land

British Land is a UK commercial property company focused on real estate sectors with the strongest operational fundamentals: London campuses, retail parks, and London urban logistics.

Fair value with moderate growth potential.