- United Kingdom

- /

- Oil and Gas

- /

- AIM:YCA

Discover These 3 Undiscovered Gems in the United Kingdom

Reviewed by Simply Wall St

The United Kingdom market has shown positive momentum, rising 1.2% over the last week and 8.7% over the past year, with earnings forecast to grow by 14% annually. In this favorable environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding; here are three undiscovered gems that stand out in the current landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Cohort (AIM:CHRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohort plc offers a range of products and services in defense, security, and related markets across multiple regions including the UK, Germany, Portugal, Africa, the Americas, and Asia Pacific with a market cap of £364.69 million.

Operations: Cohort plc generates revenue primarily from its Sensors and Effectors segment (£120.49 million) and Communications and Intelligence segment (£83.38 million).

Cohort has shown impressive growth, with earnings increasing 34.9% over the past year, surpassing the Aerospace & Defense industry’s 14.8%. The company’s debt to equity ratio improved from 32.5% to 29.2% in five years, and its interest payments are well covered by EBIT at a ratio of 17.5x. Recently, Cohort reported net income of £15.32 million for FY2024 compared to £11.36 million last year and announced a €33 million contract with NATO's NCI Agency for its subsidiary EID.

- Click here and access our complete health analysis report to understand the dynamics of Cohort.

Review our historical performance report to gain insights into Cohort's's past performance.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc operates in the uranium sector with a market cap of £1.25 billion.

Operations: Yellow Cake plc generates revenue primarily from holding U3O8 for long-term capital appreciation, amounting to $735.02 million.

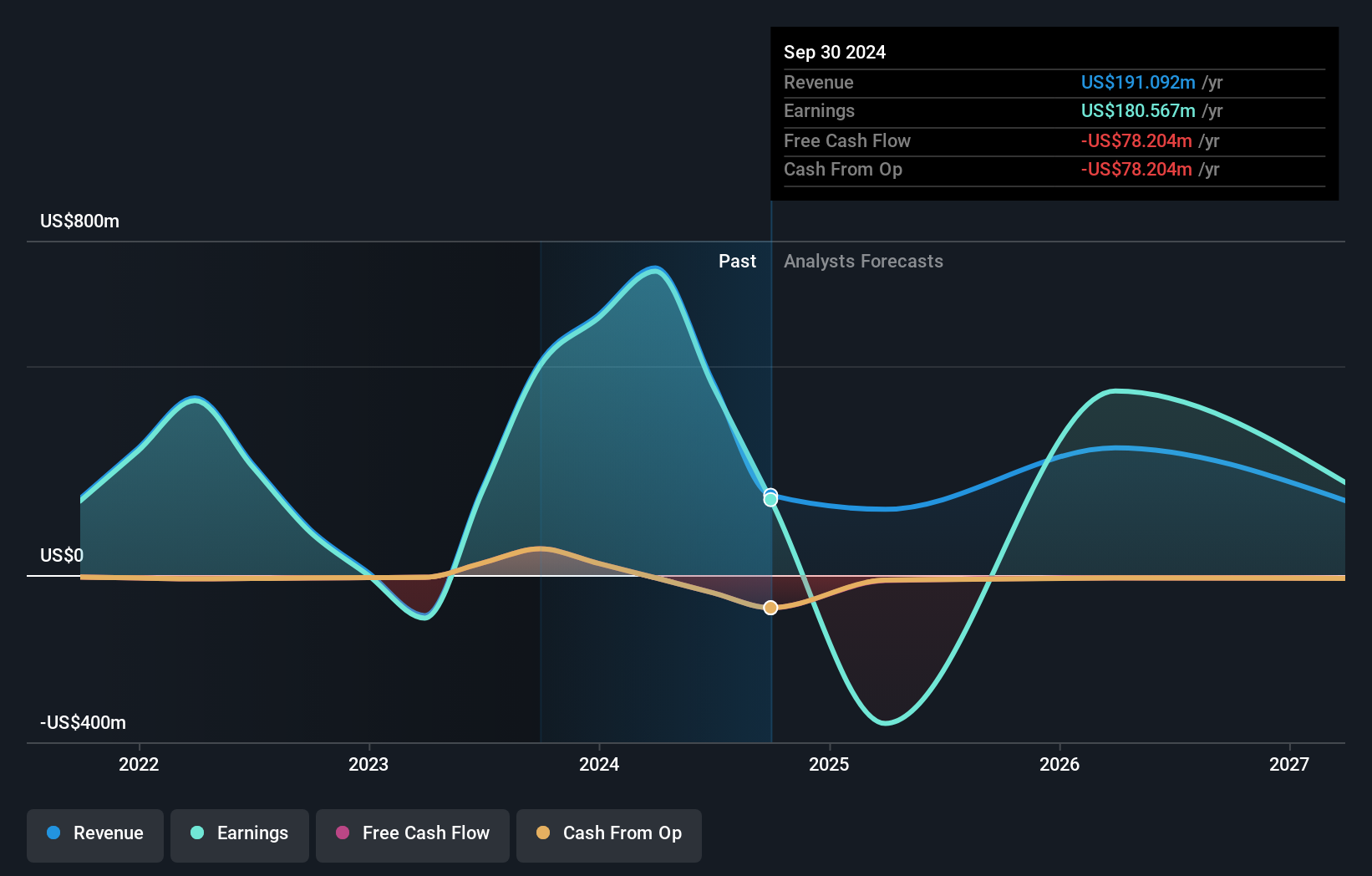

Yellow Cake has turned profitable this year, reporting net income of US$727.01 million for the full year ended March 31, 2024, compared to a net loss of US$102.94 million the previous year. The company’s price-to-earnings ratio stands at an attractive 2.3x against the UK market average of 17x. With no debt for the past five years and high levels of non-cash earnings, Yellow Cake presents a compelling case despite forecasted earnings declines over the next three years.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc, a holding company with a market cap of £1.05 billion, operates as a home and community builder in Ireland.

Operations: Cairn Homes generates revenue primarily from building and property development, amounting to €813.40 million. The company's net profit margin is 10.5%.

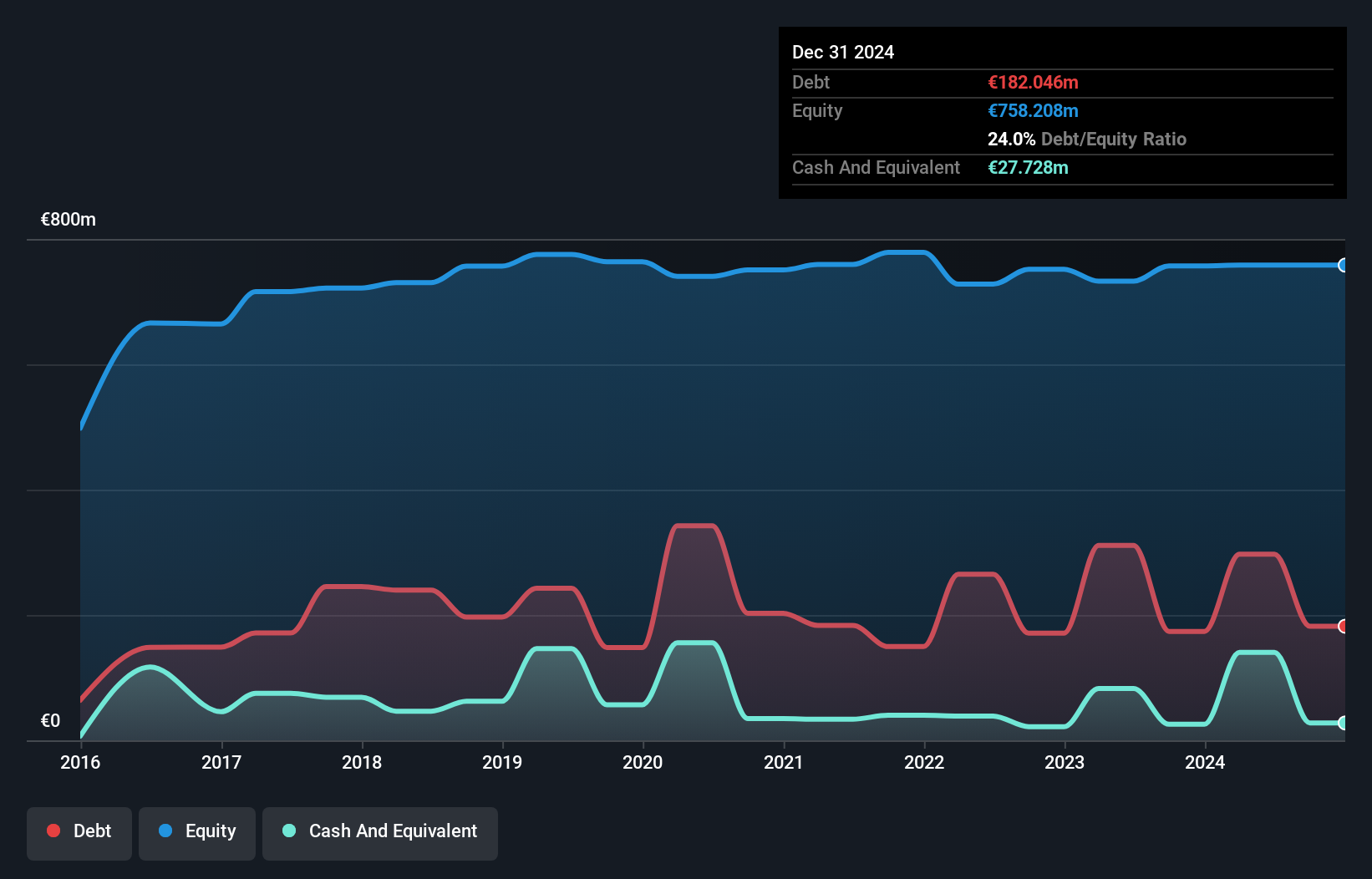

Cairn Homes, a notable player in the UK housing market, has been making waves with its impressive financial performance. The firm reported half-year sales of €366.13 million, up from €219.54 million last year, and net income surged to €46.89 million from €20.7 million. Its earnings per share also rose to €0.072 from €0.03 previously, reflecting strong profitability growth of 49%. Cairn's debt-to-equity ratio increased to 39% over five years while maintaining a satisfactory net debt level of 20%. The company repurchased 17,743,924 shares for €27.2 million this year and announced an interim dividend of 3.8 cents per share payable on October 4th.

- Unlock comprehensive insights into our analysis of Cairn Homes stock in this health report.

Gain insights into Cairn Homes' historical performance by reviewing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 81 UK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YCA

Flawless balance sheet and good value.