- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

3 Top Growth Stocks With High Insider Ownership On UK Exchange

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has remained flat, but it is up 6.7% over the past year with earnings expected to grow by 15% per annum over the next few years. In this context, growth companies with high insider ownership can be particularly attractive as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.1% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 21.2% |

| Belluscura (AIM:BELL) | 36.3% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| RUA Life Sciences (AIM:RUA) | 13.3% | 98.2% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Let's review some notable picks from our screened stocks.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £803.93 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

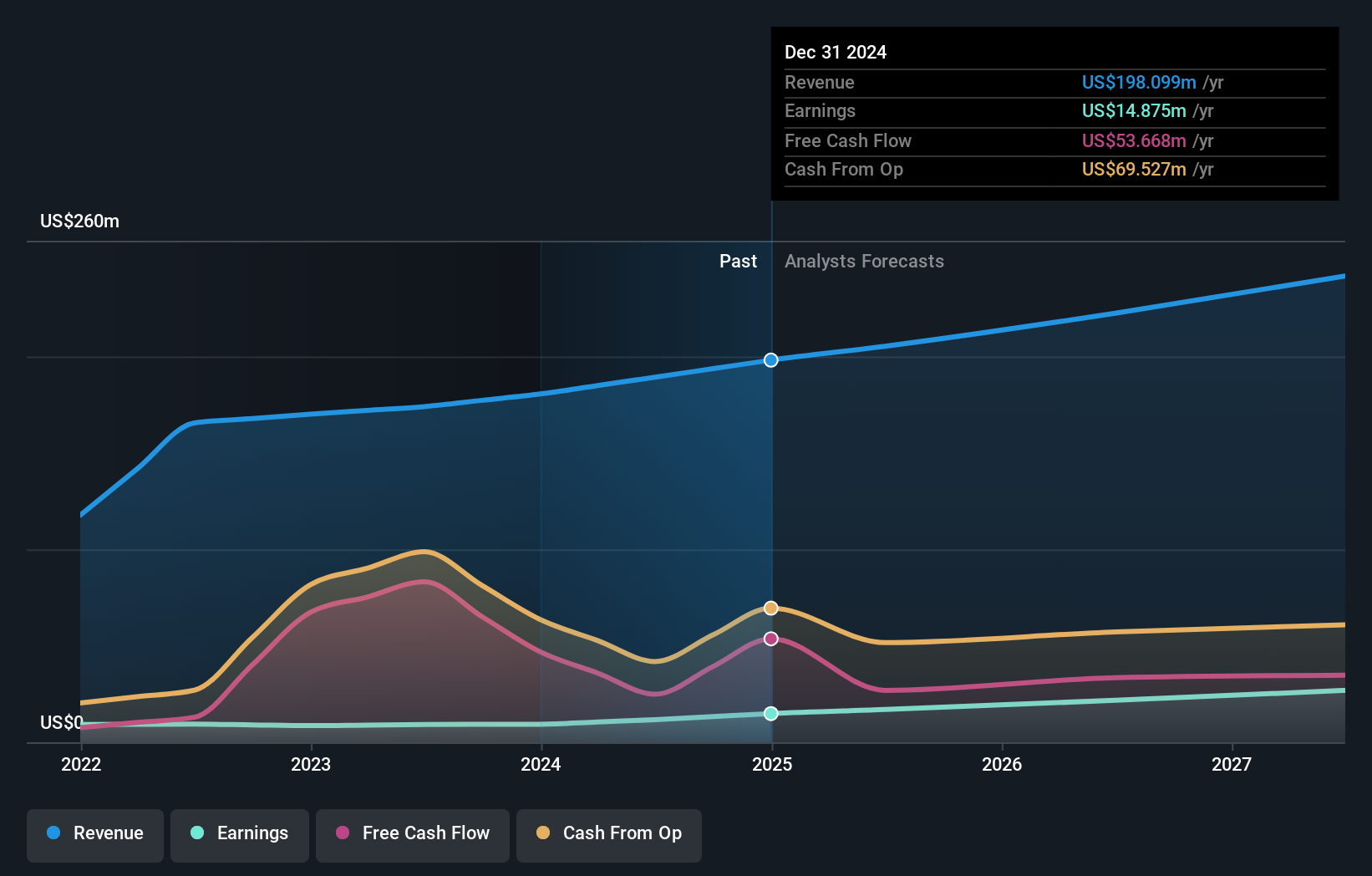

Operations: Craneware generates $189.27 million in revenue from its healthcare software segment in the United States.

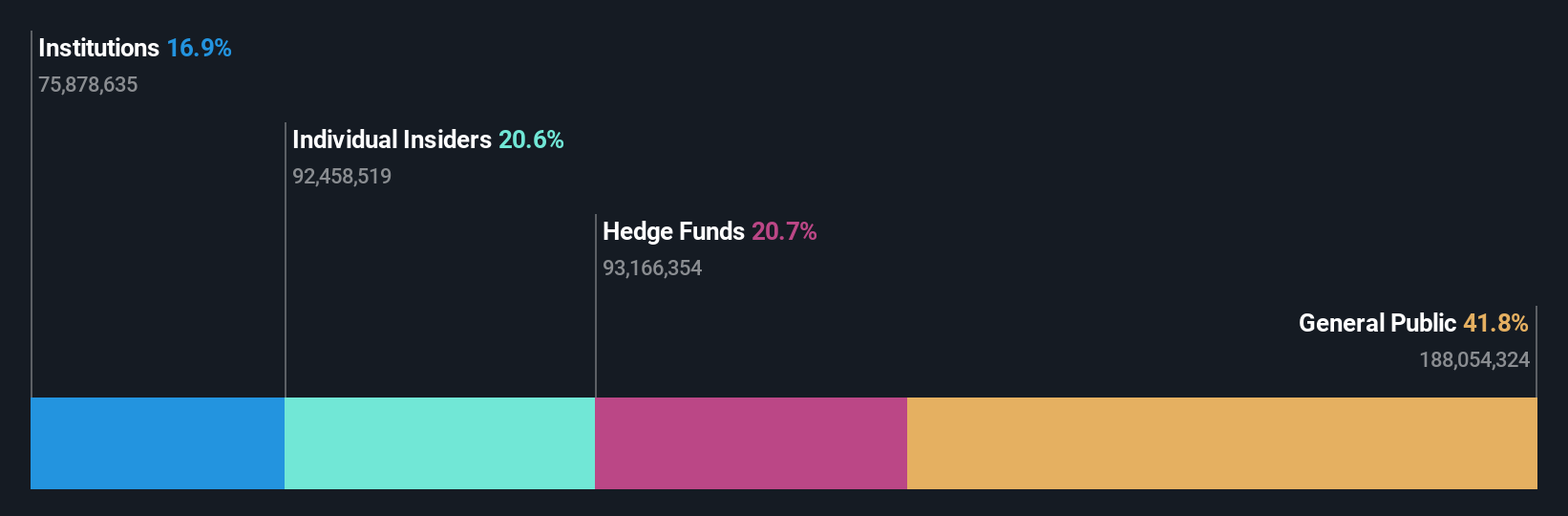

Insider Ownership: 16.5%

Craneware, a growth company with high insider ownership, is expected to see earnings grow at 25.6% annually, outpacing the UK market's 14.5%. Despite significant insider selling recently, the company has been actively repurchasing shares and seeking strategic acquisitions to bolster its portfolio. Recent collaborations with Microsoft aim to enhance their healthcare solutions using advanced AI and cloud technologies. For FY2024, Craneware reported sales of US$189.27 million and net income of US$11.7 million.

- Take a closer look at Craneware's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Craneware shares in the market.

Evoke (LSE:EVOK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Evoke plc, with a market cap of £274.20 million, offers online betting and gaming products and solutions in the United Kingdom, Ireland, Italy, Spain, and internationally.

Operations: Evoke's revenue segments include £514 million from Retail, £661.20 million from UK&I Online, and £516.10 million from International markets.

Insider Ownership: 20.5%

Evoke, with substantial insider buying over the past three months, is trading at 88.6% below its estimated fair value and is forecast to become profitable within three years. Despite recent volatility and a net loss of £143.2 million for H1 2024, the company expects significant profitability improvement in H2 2024 due to successful product launches and effective promotions. Revenue growth aligns with medium-term guidance of 5-9%, surpassing the UK market's average growth rate.

- Dive into the specifics of Evoke here with our thorough growth forecast report.

- Our valuation report unveils the possibility Evoke's shares may be trading at a discount.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, with a market cap of £1.78 billion, provides workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

Operations: The company's revenue segments include $1.29 billion from the Americas, $1.69 billion from Europe, the Middle East and Africa (EMEA), $341.30 million from the Asia Pacific, and $400.56 million from Worka.

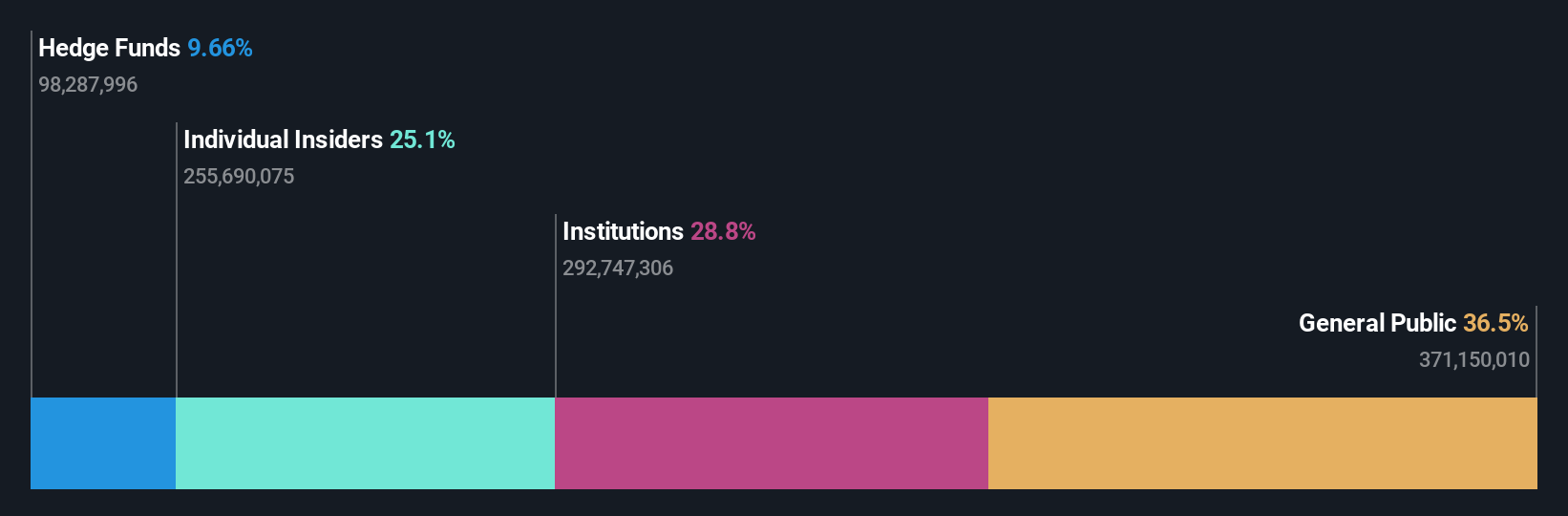

Insider Ownership: 25.2%

International Workplace Group (IWG) has seen modest insider buying recently and is trading below analyst price targets, suggesting potential undervaluation. Despite a 50% share price drop over five years, the company reported a net income of $16 million for H1 2024, reversing a previous loss. Activist investor Buckley Capital Management recommends a share buyback and US listing to unlock value. IWG's revenue is forecast to grow faster than the UK market at 8.9% per year.

- Get an in-depth perspective on International Workplace Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that International Workplace Group is priced lower than what may be justified by its financials.

Next Steps

- Discover the full array of 66 Fast Growing UK Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Reasonable growth potential with proven track record.