- United Kingdom

- /

- Life Sciences

- /

- LSE:ONT

Oxford Nanopore Technologies plc's (LON:ONT) Stock Retreats 25% But Revenues Haven't Escaped The Attention Of Investors

Oxford Nanopore Technologies plc (LON:ONT) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Longer-term, the stock has been solid despite a difficult 30 days, gaining 12% in the last year.

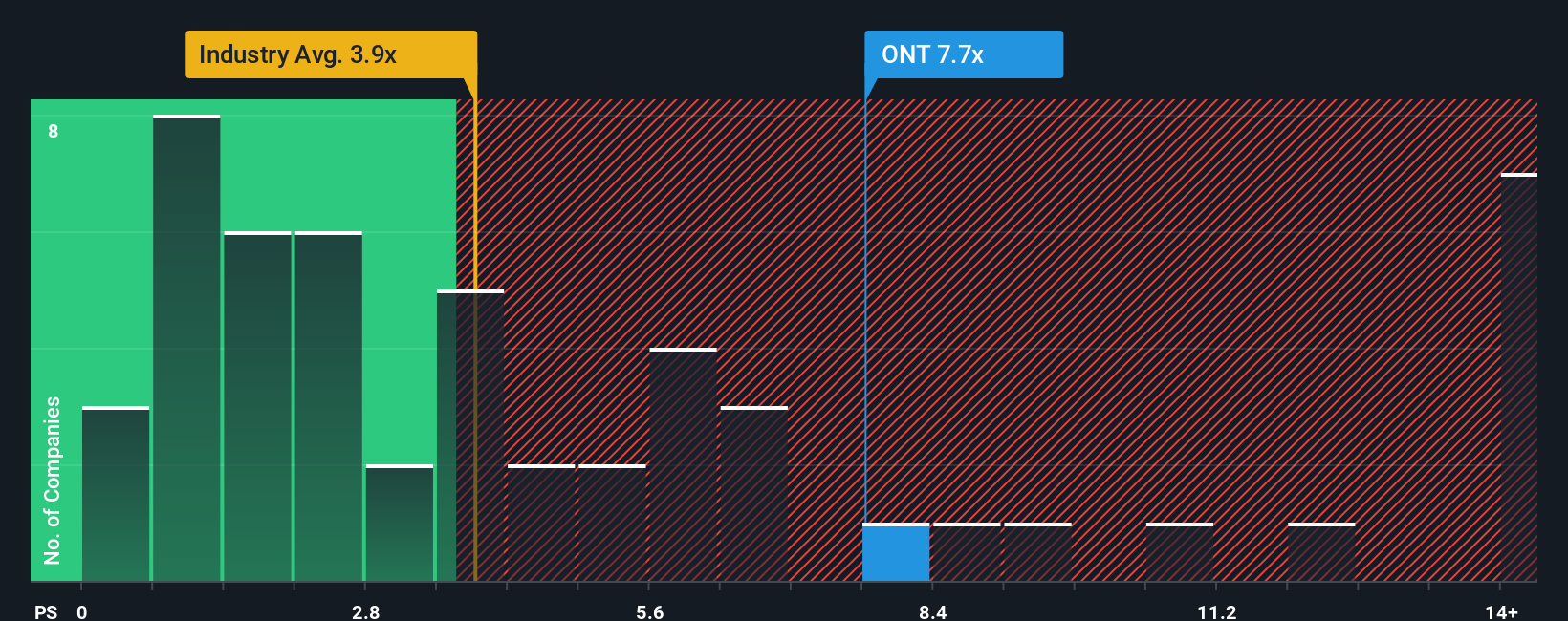

Even after such a large drop in price, Oxford Nanopore Technologies may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 7.7x, since almost half of all companies in the Life Sciences industry in the United Kingdom have P/S ratios under 4.4x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Oxford Nanopore Technologies

How Has Oxford Nanopore Technologies Performed Recently?

There hasn't been much to differentiate Oxford Nanopore Technologies' and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Oxford Nanopore Technologies will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Oxford Nanopore Technologies?

Oxford Nanopore Technologies' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 23% each year as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 11% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why Oxford Nanopore Technologies' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Oxford Nanopore Technologies' P/S?

Oxford Nanopore Technologies' shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Oxford Nanopore Technologies' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Oxford Nanopore Technologies that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ONT

Oxford Nanopore Technologies

Engages in the research, development, manufacture, and commercialization of a novel generation of deoxyribonucleic acid (DNA) or ribonucleic acid (RNA) sequencing technology that allows the real-time analysis of DNA or RNA.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives