- United Kingdom

- /

- Pharma

- /

- LSE:AZN

Is AstraZeneca Fairly Priced After a 38% Gain and New Therapies Momentum in 2025?

Reviewed by Bailey Pemberton

- Wondering if AstraZeneca is a good buy at today’s price? You’re not alone, especially with headlines buzzing and the stock drawing new investor attention.

- The share price recently climbed 8.0% in the last month, bringing the year-to-date return to a striking 27.6% and a full-year gain of 38.3%. This signals momentum and shifting investor sentiment.

- There has been plenty of talk lately about AstraZeneca’s momentum in developing next-generation therapies, as well as industry changes such as regulatory greenlights for key treatments and new partnership announcements. These stories are fueling optimism and speculation about what is driving the latest surge in the share price.

- When we stack up AstraZeneca’s numbers, the company lands a 3 out of 6 on our quick valuation score, reflecting areas where the price looks attractive and others that might warrant caution. There is more than one way to value a company like this, so let’s dig into some popular approaches. This will show why a broader perspective matters most for long-term investors.

Approach 1: AstraZeneca Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by taking all future expected cash flows, projecting them forward, and discounting them back to today’s value. This allows investors to determine what a stock should be worth based on how much cash it is likely to generate in the future.

For AstraZeneca, the latest reported Free Cash Flow stands at $10.24 billion. Analysts expect this figure to climb significantly over the coming years and project it to reach $18.30 billion by the end of 2029. While analyst forecasts only extend out five years, Simply Wall St extrapolates projections as far as ten years beyond that point to provide a fuller view of AstraZeneca’s long-term earning power.

After discounting these projected cash flows using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share is $224.43. This value suggests AstraZeneca stock is currently trading at a 39.6% discount to its intrinsic value, which makes it look significantly undervalued at today’s price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AstraZeneca is undervalued by 39.6%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

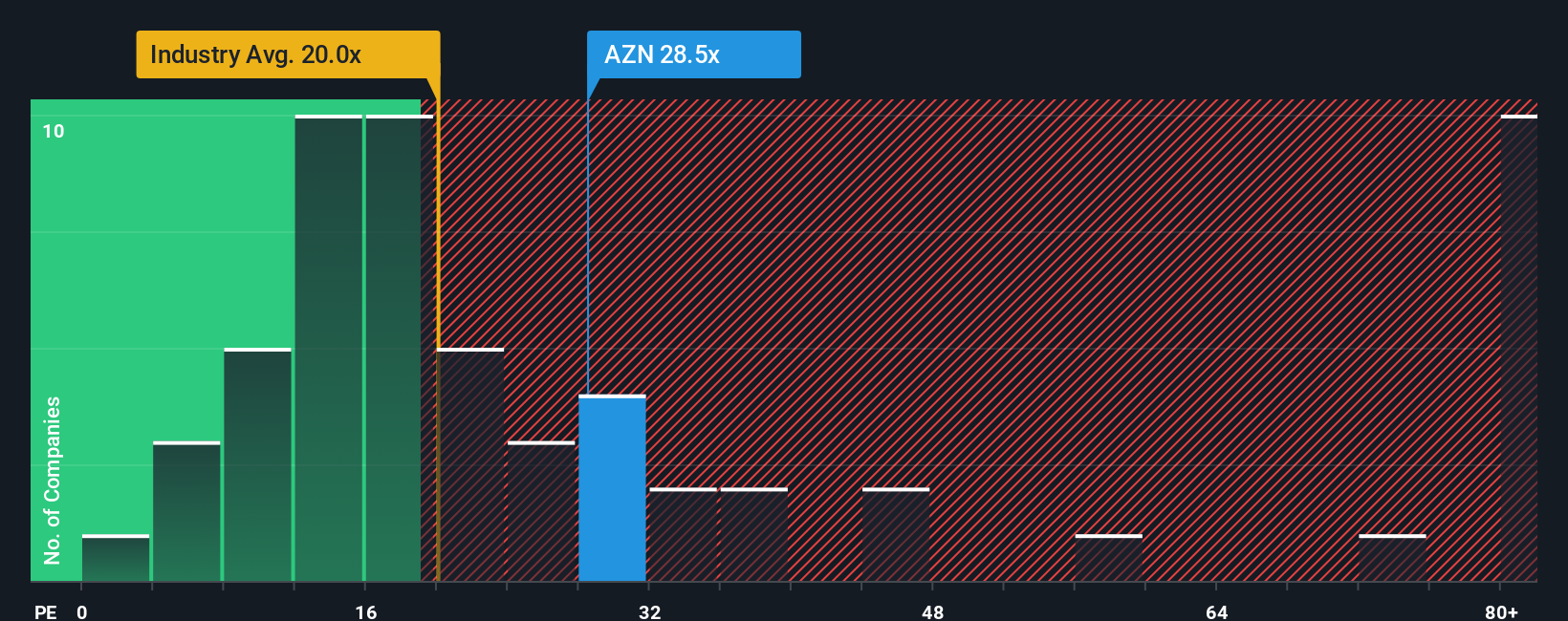

Approach 2: AstraZeneca Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies like AstraZeneca, as it directly relates the current share price to the company’s underlying earnings. This makes it a straightforward way for investors to assess how much they are paying for one pound of AstraZeneca’s profits today.

It is important to remember, though, that a "normal" PE ratio varies depending on future growth prospects and the risks a company faces. Generally, companies expected to grow faster than average or that have stable, predictable earnings can justify higher PE multiples. In contrast, slower growth or higher risk tends to warrant a lower ratio.

AstraZeneca currently trades at a PE of 29.4x. This is above both the Pharmaceuticals industry average of 23.8x and the average among its peers, which sits at 13.0x. At first glance, this might seem expensive, but context matters.

Simply Wall St’s Fair Ratio calculation refines this comparison. Unlike a basic industry or peer average, the Fair Ratio incorporates AstraZeneca’s own growth outlook, earnings quality, profit margins, market capitalization, and sector risks. For AstraZeneca, the Fair PE Ratio is 31.4x, reflecting its solid growth prospects and competitive position.

Comparing these numbers, AstraZeneca's current PE of 29.4x is very close to its Fair Ratio. This suggests the market’s valuation is well-aligned with the company’s fundamentals and future prospects, rather than being driven purely by hype or short-term sentiment.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1420 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AstraZeneca Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective about a company, connecting what you believe about AstraZeneca’s future with the numbers, such as your estimates for revenue growth, margins, and fair value.

Narratives let you link AstraZeneca’s big picture, such as strong oncology momentum or patent risk, to a specific financial forecast and price target. This lets you see exactly how your view stacks up. This approach is more dynamic and insightful than relying on a single number because it brings your assumptions to life and helps you make confident decisions on when to buy or sell.

On Simply Wall St’s Community page, millions of investors use Narratives to document their reasoning, compare fair value to price, and quickly update their views as new earnings or news headlines emerge. With Narratives, you are empowered to learn from other investors’ scenarios and spot what really matters as the facts change.

For example, one AstraZeneca Narrative might focus on the company’s blockbuster pipeline and global expansion, targeting a bullish price of £180.93. Another might emphasize margin pressure and patent challenges, considering a more cautious fair value of £108.24. This helps you find a stance that best matches your convictions.

Do you think there's more to the story for AstraZeneca? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives