- United Kingdom

- /

- Pharma

- /

- LSE:AZN

AstraZeneca (LSE:AZN): Evaluating Valuation Strength After a 36% Total Shareholder Return

Reviewed by Simply Wall St

See our latest analysis for AstraZeneca.

AstraZeneca’s strong 11.2% one-month share price return stands out, especially as the company has now delivered a total shareholder return of nearly 36% over the past year. The upward momentum suggests that investors are increasingly optimistic about its growth prospects and are reassessing the company’s valuation in light of recent developments.

Given AstraZeneca’s performance, it is a good opportunity to see what other healthcare leaders are doing. Discover fresh ideas with our See the full list for free..

With shares reaching new highs, the question now is whether AstraZeneca remains undervalued given its performance, or if all future growth has already been factored into its price. Is there still a buying opportunity, or have markets already priced in the next chapter?

Most Popular Narrative: 4.2% Undervalued

AstraZeneca’s fair value, according to the most followed narrative, is slightly above its latest close price. Investors are weighing new growth initiatives against rising competition and changing policy, which are reshaping the company’s outlook.

The company's robust and diversified late-stage pipeline, particularly in oncology, rare diseases, and cardiovascular/metabolic therapies, is set to deliver multiple blockbuster launches over the next several years. Management estimates these new medicines could generate $10+ billion in peak risk-adjusted revenue and directly support both long-term high-margin revenue growth and future earnings expansion.

Curious what bold projections justify today’s bullish stance? Hint: underlying the narrative are ambitious profit and revenue growth targets supported by confidence in margin expansion. Want to see which strategic plays anchor the future forecasts? Uncover the standout numbers and pivotal assumptions shaping this valuation outlook.

Result: Fair Value of $145.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, impending patent expirations and growing regulatory pressures could challenge AstraZeneca’s growth story if key medicines face stiff competition or if pricing reforms emerge.

Find out about the key risks to this AstraZeneca narrative.

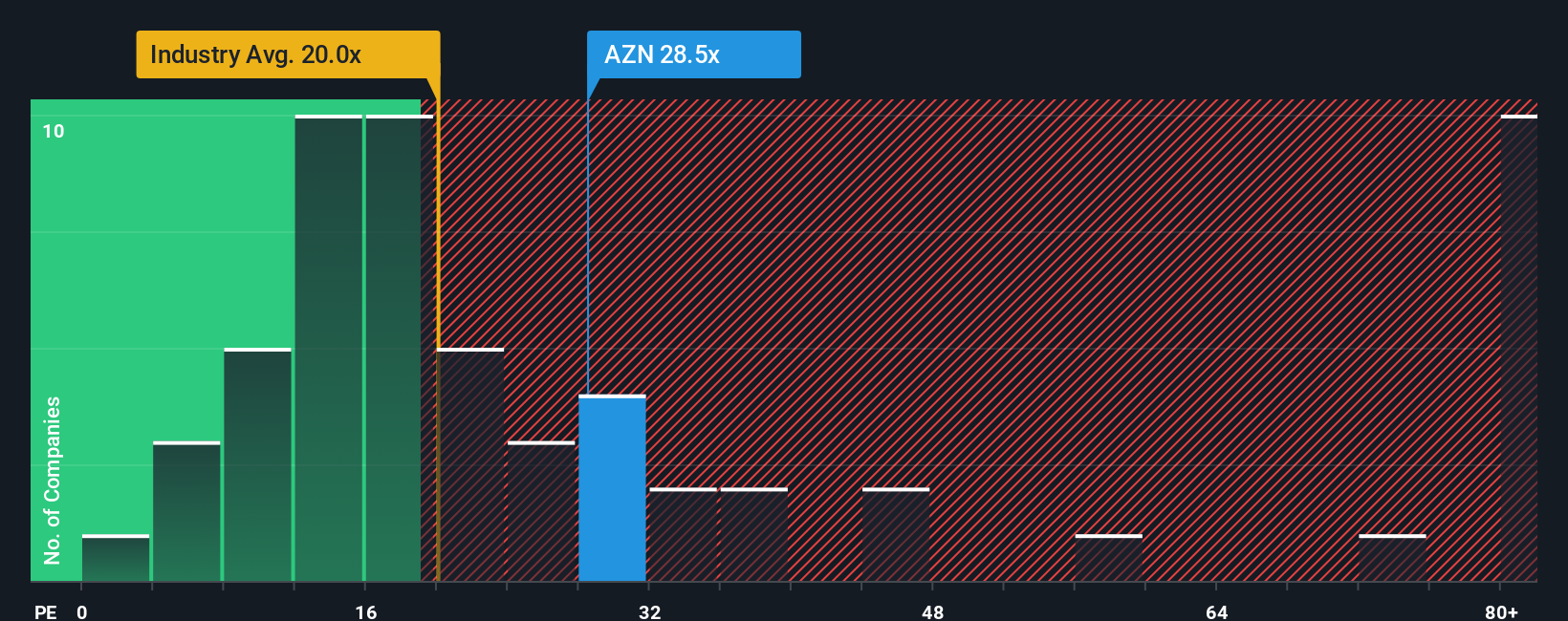

Another View: Multiples Tell a Different Story

While the fair value approach points to AstraZeneca being undervalued, a look at its price-to-earnings ratio gives pause. At 30.1 times earnings, the shares are far more expensive than both industry peers (23.8x) and the sector average (13.2x). This suggests investors are willing to pay a premium. Even compared to the fair ratio of 31.5x, the current price is high, which raises the risk of disappointment if growth slows. Is this premium justified, or could expectations be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AstraZeneca Narrative

If you think this perspective doesn't capture the full story or you prefer to dive into the numbers yourself, you can easily build your own narrative in just a few minutes. Do it your way.

A great starting point for your AstraZeneca research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Opportunities are everywhere for investors who act fast. Expand your horizons with potential-packed stocks you might otherwise miss, handpicked for their unique growth, income, or technology potential.

- Spot the most promising up-and-comers by scanning these 3584 penny stocks with strong financials. These stocks combine strong financials with big growth ambitions.

- Capture tomorrow’s technology leaders by reviewing these 26 AI penny stocks. These companies are already making waves in artificial intelligence and automation.

- Boost your portfolio’s income with these 14 dividend stocks with yields > 3%. These securities offer reliable yields above 3% and have a proven track record of shareholder returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives