- United Kingdom

- /

- Pharma

- /

- LSE:AZN

AstraZeneca (LSE:AZN): Assessing Valuation Following Recent Share Price Pause

Reviewed by Simply Wall St

AstraZeneca (LSE:AZN) shares have seen a shift in momentum recently, as investors weigh the company’s steady growth over the past year alongside a modest pullback this week. The pharmaceutical group’s performance continues to draw attention, especially following strong annual results.

See our latest analysis for AstraZeneca.

After a run of strong results, AstraZeneca’s share price has cooled a little with a 2.1% decline over the past week. The longer-term picture remains compelling, as investors have seen a 29.8% year-to-date share price return, while the 1-year total shareholder return stands at 30.7%. The recent dip appears to be a pause in momentum, with steady growth and consistent performance continuing to drive optimism in the broader outlook.

If AstraZeneca’s steady climb has you exploring what else is possible in healthcare, take the next step and see the full list of industry players with See the full list for free.

With shares pulling back slightly after strong gains, investors are left debating whether AstraZeneca’s current price reflects all its future potential or if there could be hidden value yet to be unlocked. Is this a buying opportunity, or is the market already pricing in the company’s expected growth?

Most Popular Narrative: 5.8% Undervalued

Compared to its last close at £138, the most widely-followed narrative points to a fair value of £146.44, suggesting room for further upside. Investors are weighing this seemingly modest undervaluation against the company’s powerful long-term roadmap and execution challenges.

The company's robust and diversified late-stage pipeline, particularly in oncology, rare diseases, and cardiovascular/metabolic therapies, is set to deliver multiple blockbuster launches over the next several years. Management estimates these new medicines could generate $10+ billion in peak risk-adjusted revenue, directly supporting both long-term high-margin revenue growth and future earnings expansion.

Want to know the secret behind that seemingly generous fair value? It hinges on game-changing product launches and ambitious financial targets that hint at a major revenue transformation. Which bold pipeline bets and financial leaps drive analyst conviction? Jump in to uncover the full financial story behind this price target.

Result: Fair Value of £146.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming patent expiries and mounting regulatory pressures could quickly shift AstraZeneca’s growth story. These factors may challenge even the most optimistic forecasts.

Find out about the key risks to this AstraZeneca narrative.

Another View: Gauging Valuation Through Market Ratios

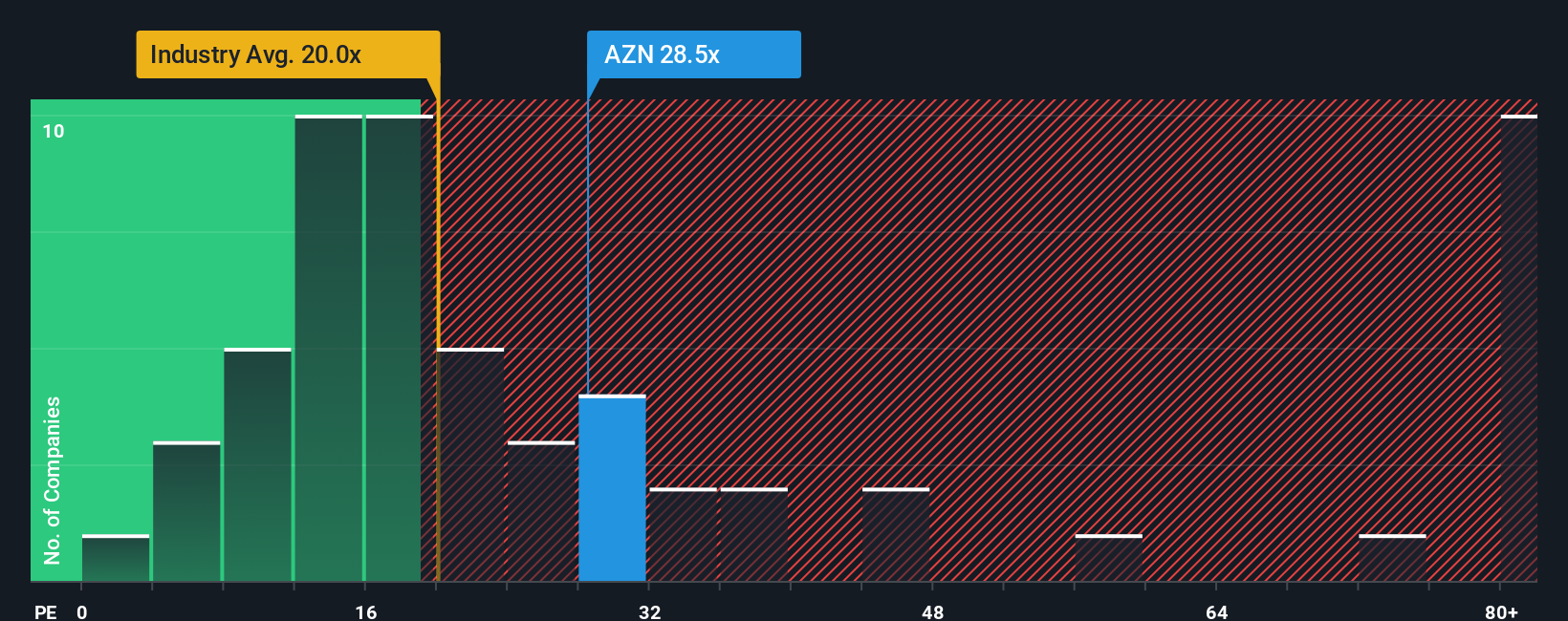

While the fair value estimate suggests AstraZeneca is undervalued, a closer look at its price-to-earnings ratio (30.2x) reveals the shares are currently more expensive than both peers (13.2x) and the broader European pharmaceuticals industry (24.9x). However, the ratio is very close to its fair ratio (31.6x). This raises the question of whether the market anticipates further potential, or if this premium introduces additional risk in the future.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AstraZeneca Narrative

If these conclusions do not quite align with your views, dive into the data and shape your own take on AstraZeneca in just a few minutes with Do it your way.

A great starting point for your AstraZeneca research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t watch opportunities pass you by. Use the Simply Wall Street Screener to quickly spot stocks that match your goals, before the crowd gets there first.

- Tap into steady income by reviewing these 14 dividend stocks with yields > 3% offering 3%+ yields for income-focused portfolios.

- Get ahead of the innovation curve with these 25 AI penny stocks paving the way in artificial intelligence breakthroughs.

- Secure your money with these 930 undervalued stocks based on cash flows that trade below fair value, providing more upside potential and a cushion for volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026