- United Kingdom

- /

- Pharma

- /

- LSE:AZN

Assessing AstraZeneca’s Value After Recent Pipeline Developments and Strategic Partnerships

Reviewed by Bailey Pemberton

- Curious if AstraZeneca is actually a bargain, or if the share price is already factoring in all the good news? Many investors wonder whether now is the right moment to get in or take profits, and we’re about to break it down together.

- Despite some short-term wobbles, with the stock down 0.5% in the last week and -1.4% for the month, AstraZeneca’s stock has still returned 17.3% year-to-date and 65.0% over the last five years.

- Recent headlines have emphasized AstraZeneca’s ongoing pipeline developments and partnerships, fueling speculation about the company’s growth trajectory. At the same time, renewed interest in its strategic initiatives and approvals keeps the market’s attention focused on its long-term potential.

- When it comes to valuation, AstraZeneca scores a 3 out of 6 on our value checks. This indicates that it may only be undervalued on half of the key metrics. Next, we’ll dive into how those valuations are measured and reveal a smarter way to see the bigger picture by the end of this article.

Approach 1: AstraZeneca Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the true value of a company by projecting its future cash flows and discounting them back to today's value. This approach takes into account the expected growth of a company's free cash flow and how much those future dollars are worth in present terms.

For AstraZeneca, the latest trailing twelve months Free Cash Flow stands at $8.7 billion. Analysts project continued growth, expecting cash flows to nearly double over the decade and reach a projected $27.8 billion by 2035. Analyst forecasts provide firm estimates for the next five years, while Simply Wall St extends the outlook using reasonable growth assumptions for the years that follow.

Based on these projections and discounting them to today's dollars using the 2 Stage Free Cash Flow to Equity model, AstraZeneca's estimated intrinsic value comes to $248.46 per share. With the DCF model indicating the stock is trading at a 49.8% discount to this calculated fair value, AstraZeneca appears to be significantly undervalued at current price levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AstraZeneca is undervalued by 49.8%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

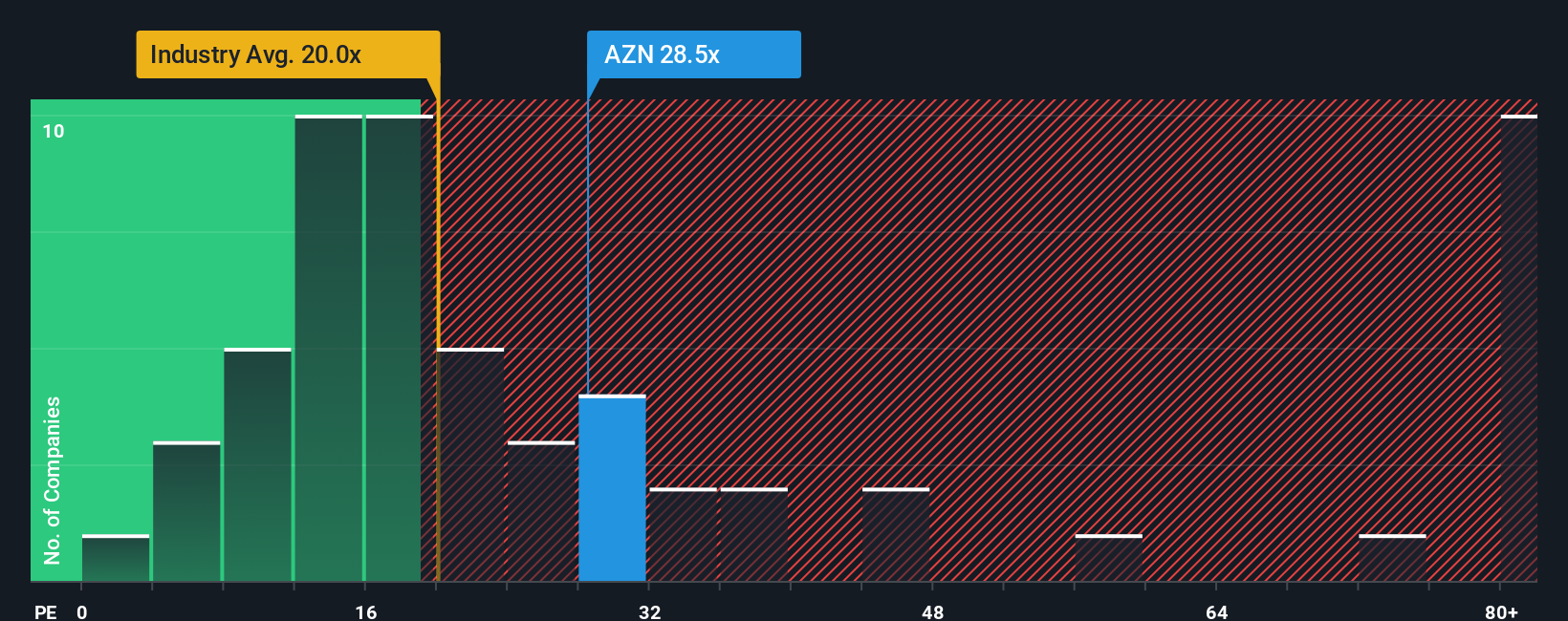

Approach 2: AstraZeneca Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation measure for profitable companies like AstraZeneca because it tells investors how much they are paying today for each pound of current earnings. When a business is generating consistent profits, the PE ratio provides a straightforward way to compare its market price to peers and broader industry standards.

Growth potential and business risks play a big role in what PE ratio is considered “normal” or fair. Companies expected to grow faster than average, or those with better profit margins and lower risks, can justify a higher PE. On the other hand, if growth prospects are muted or risks are elevated, a lower PE might be warranted.

Currently, AstraZeneca trades at a PE of 30.6x. This is above both the Pharmaceuticals industry average of 24.4x and the average of its peers, which sits at 13.4x. At first glance, this suggests a premium valuation. However, Simply Wall St’s proprietary “Fair Ratio” metric, which factors in AstraZeneca's expected earnings growth, industry position, market cap, profit margins, and risks, comes in at 32.0x. This Fair Ratio goes well beyond basic averages by considering a broader set of meaningful drivers. Instead of just comparing AstraZeneca to its industry or peers, this approach judges its valuation based on the fundamentals that matter most for its future prospects.

With AstraZeneca’s Fair Ratio (32.0x) so close to its actual PE (30.6x), the market seems to be pricing the company about right based on its underlying strengths and forward potential.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AstraZeneca Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story behind AstraZeneca as an investment. It’s where you connect the numbers to your perspective by outlining what you believe about the company’s future revenue, earnings, and profit margins, and use that to arrive at your own Fair Value.

Narratives help you link AstraZeneca’s business story to a financial forecast and ultimately, to a price estimate that fits your outlook. On Simply Wall St’s Community page, millions of investors use Narratives to quickly build, update, and share their own assessments, making this process both easy and accessible.

By comparing your Narrative’s Fair Value to the current market price, you can decide if AstraZeneca is a buy, hold, or sell for you. Since Narratives update automatically when new data or news comes in, your analysis is always relevant and up to date.

For example, some users see AstraZeneca’s robust growth pipeline and set a Fair Value as high as £180.93 per share, while others are more cautious, focusing on patent risks and competition, and set it as low as £108.24. This means you can anchor decisions to your understanding of the business today, not just analyst averages.

Do you think there's more to the story for AstraZeneca? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives