- United Kingdom

- /

- Biotech

- /

- AIM:TRX

Tissue Regenix Group plc's (LON:TRX) Shares Bounce 25% But Its Business Still Trails The Industry

Tissue Regenix Group plc (LON:TRX) shareholders have had their patience rewarded with a 25% share price jump in the last month. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

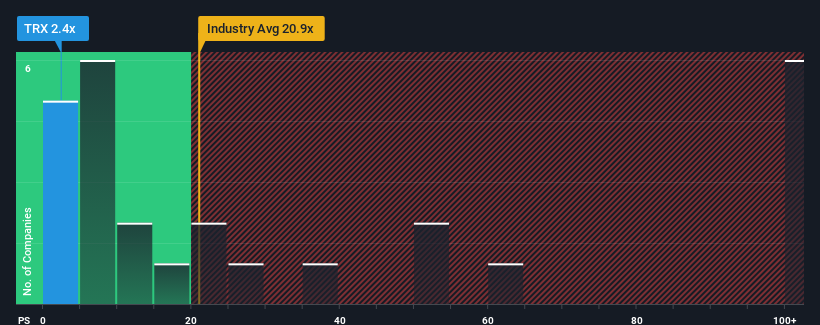

Even after such a large jump in price, Tissue Regenix Group may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.4x, since almost half of all companies in the Biotechs industry in the United Kingdom have P/S ratios greater than 20.9x and even P/S higher than 123x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Tissue Regenix Group

How Has Tissue Regenix Group Performed Recently?

With revenue growth that's inferior to most other companies of late, Tissue Regenix Group has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Tissue Regenix Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Tissue Regenix Group?

In order to justify its P/S ratio, Tissue Regenix Group would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 65% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 20% as estimated by the two analysts watching the company. With the industry predicted to deliver 199% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Tissue Regenix Group's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Tissue Regenix Group's recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Tissue Regenix Group maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Tissue Regenix Group you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tissue Regenix Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TRX

Tissue Regenix Group

A medical technology company, develops and commercializes platform technologies for bone graft substitutes, skin, and soft tissue biologics markets in the United States and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives