Trustpilot Group plc (LON:TRST) Not Flying Under The Radar

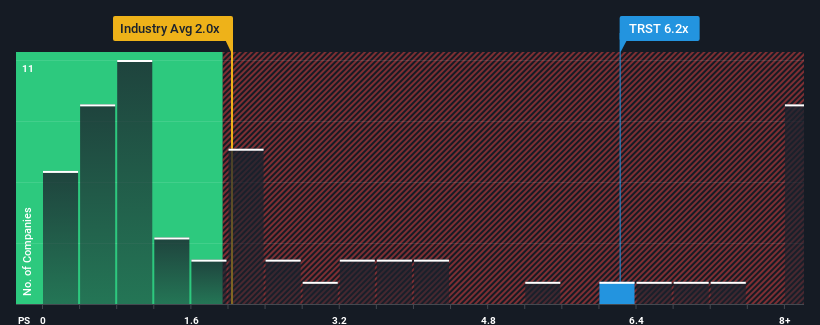

When close to half the companies in the Interactive Media and Services industry in the United Kingdom have price-to-sales ratios (or "P/S") below 2.2x, you may consider Trustpilot Group plc (LON:TRST) as a stock to avoid entirely with its 6.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Trustpilot Group

What Does Trustpilot Group's Recent Performance Look Like?

Recent times have been advantageous for Trustpilot Group as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Trustpilot Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Trustpilot Group's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The latest three year period has also seen an excellent 73% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 18% per annum as estimated by the seven analysts watching the company. That's shaping up to be materially higher than the 8.9% per annum growth forecast for the broader industry.

In light of this, it's understandable that Trustpilot Group's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Trustpilot Group's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Trustpilot Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Interactive Media and Services industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Trustpilot Group with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Trustpilot Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:TRST

Trustpilot Group

Engages in the development and hosting of an online review platform for businesses and consumers in the United Kingdom, North America, Europe, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success