- United Kingdom

- /

- Media

- /

- LSE:INF

Top High Growth Tech Stocks in the United Kingdom for August 2024

Reviewed by Simply Wall St

In the last week, the United Kingdom market has been flat with a notable 3.0% drop in the Energy sector, yet it remains up 12% over the past year and earnings are expected to grow by 14% annually in the coming years. In this context, identifying high-growth tech stocks that can capitalize on these favorable conditions is crucial for investors seeking robust returns.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Filtronic | 21.64% | 33.46% | ★★★★★★ |

| YouGov | 14.30% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 32.33% | 94.46% | ★★★★★★ |

| STV Group | 13.43% | 47.09% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Seeing Machines | 24.07% | 93.93% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our UK High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Nexxen International (AIM:NEXN)

Simply Wall St Growth Rating: ★★★★☆☆

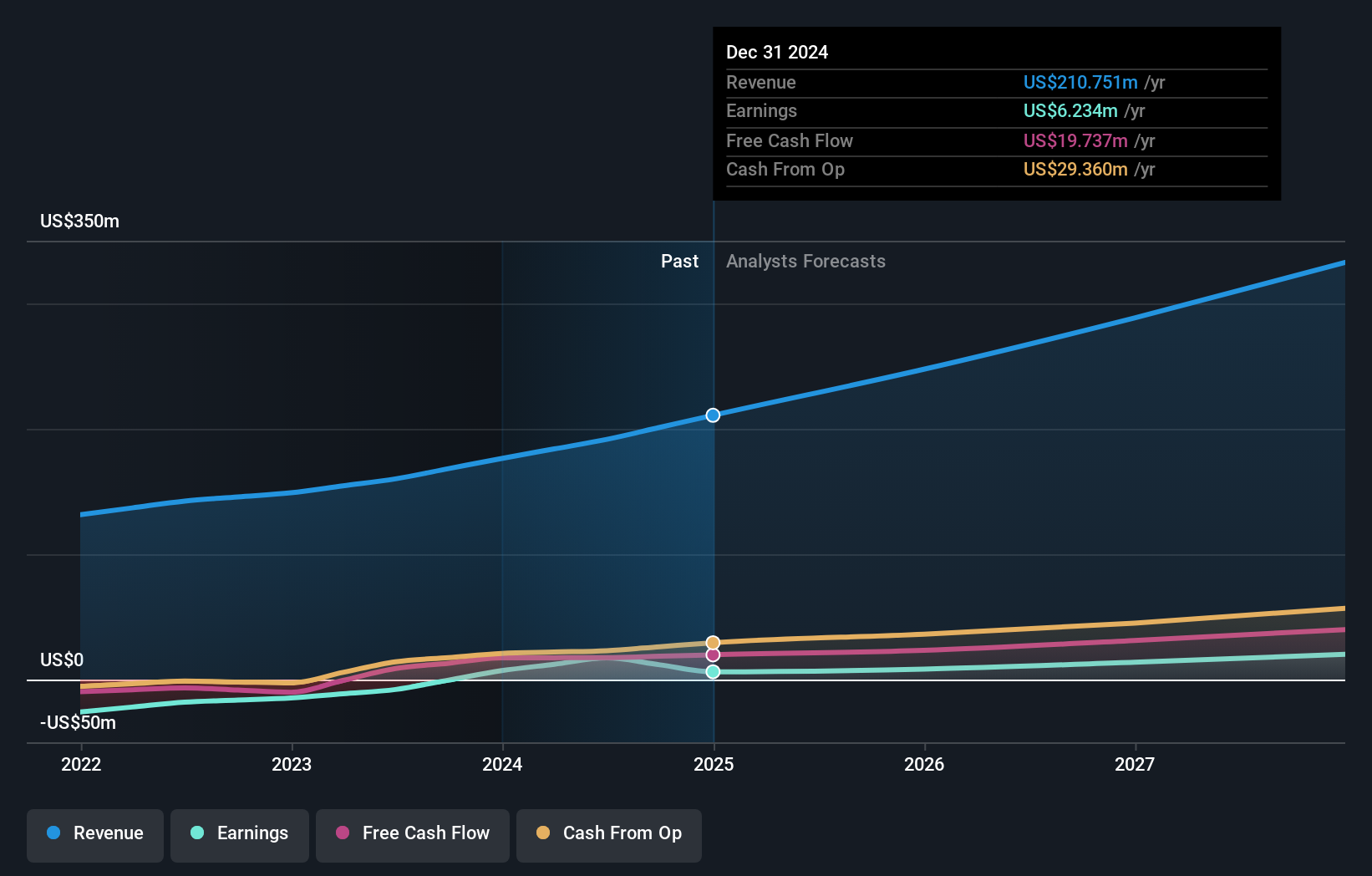

Overview: Nexxen International Ltd. offers a comprehensive software platform for advertisers to connect with publishers in Israel, and has a market cap of £414.56 million.

Operations: Nexxen International Ltd. generates revenue primarily through its marketing services, amounting to $339.02 million. The company operates an end-to-end software platform facilitating connections between advertisers and publishers in Israel.

Nexxen International has demonstrated significant advancements, particularly in its strategic data partnerships and programmatic advertising capabilities. Recent earnings reveal a notable turnaround, with Q2 sales reaching $88.58 million (up from $84.25 million) and net income hitting $2.92 million compared to a net loss of $5.61 million last year. The company's collaboration with The Trade Desk offers exclusive ACR data segments, enhancing cross-channel targeting efficiency for advertisers, while its partnership with Vevo expands programmatic reach across CTV platforms. Investment in R&D remains robust; Nexxen's expenditure has consistently supported innovation in automated content recognition and advanced advertising solutions, contributing to an expected annual earnings growth rate of 71.87%. With revenue forecasted to grow at 8.8% per year—outpacing the UK market average of 3.7%—Nexxen's strategic moves position it favorably within the tech landscape despite recent insider selling activities over the past three months.

- Click here and access our complete health analysis report to understand the dynamics of Nexxen International.

Understand Nexxen International's track record by examining our Past report.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

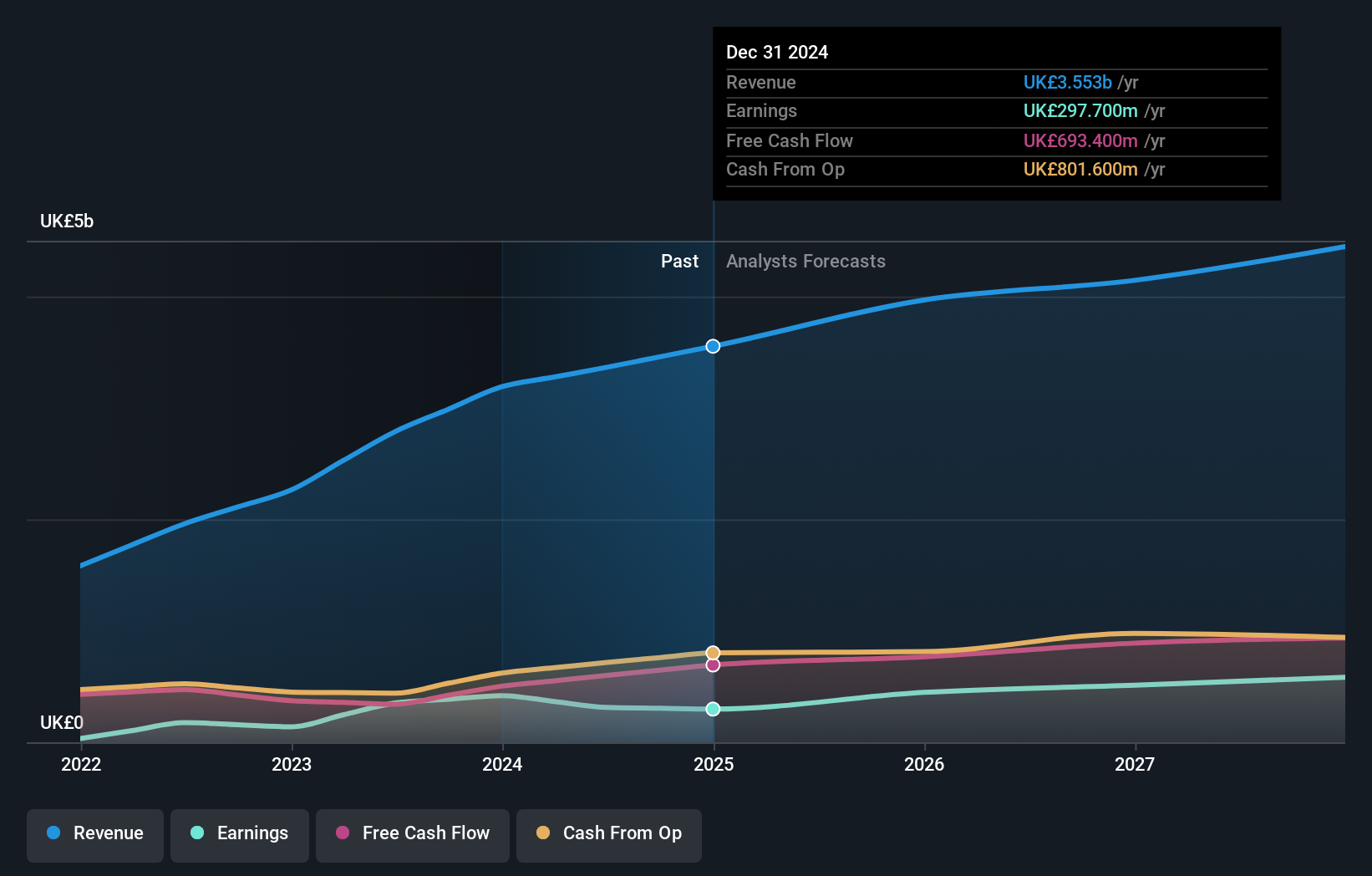

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £10.94 billion.

Operations: Informa generates revenue primarily through its four segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company focuses on international events, digital services, and academic research across multiple regions including the UK, Continental Europe, the US, and China.

Informa's revenue growth, projected at 6.7% annually, surpasses the UK market average of 3.7%. Despite a notable one-off loss of £213.5M impacting recent financials, earnings are forecasted to rise by an impressive 21.5% per year over the next three years. The company has repurchased 41.67 million shares in H1 2024 for £338.9M, reflecting strategic confidence in its future prospects and enhancing shareholder value through reduced share count and potential EPS improvement.

- Navigate through the intricacies of Informa with our comprehensive health report here.

Gain insights into Informa's historical performance by reviewing our past performance report.

Trustpilot Group (LSE:TRST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Trustpilot Group plc operates an online review platform for businesses and consumers across the United Kingdom, North America, Europe, and internationally, with a market cap of £838.73 million.

Operations: Trustpilot Group plc generates revenue primarily from its Internet Information Providers segment, amounting to $176.36 million. The company focuses on developing and hosting an online review platform that serves businesses and consumers globally.

Trustpilot Group, with its recent profitability, is forecasted to grow revenue at 16.2% annually, outpacing the UK market's 3.7%. Earnings are projected to rise by an impressive 32%, significantly higher than the UK's average of 14.3%. The company's strategic focus on R&D, with expenses reaching £12M last year, underscores its commitment to innovation and maintaining competitive edge in the interactive media and services industry. Recent M&A activities hint at potential shifts in shareholder dynamics without impacting Trustpilot directly.

Key Takeaways

- Navigate through the entire inventory of 48 UK High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally.

Reasonable growth potential with adequate balance sheet.