- United Kingdom

- /

- Media

- /

- AIM:NEXN

High Growth Tech Stocks to Watch in the United Kingdom August 2024

Reviewed by Simply Wall St

Amidst the backdrop of a faltering FTSE 100 and weak trade data from China, the United Kingdom's tech sector continues to present intriguing opportunities for investors. In light of these economic challenges, identifying high-growth tech stocks that can navigate market volatility and capitalize on digital transformation trends becomes crucial.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Filtronic | 21.64% | 33.46% | ★★★★★★ |

| YouGov | 14.30% | 29.79% | ★★★★★☆ |

| STV Group | 13.43% | 47.09% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Seeing Machines | 24.07% | 93.93% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Nexxen International (AIM:NEXN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nexxen International Ltd. offers a comprehensive software platform for advertisers to connect with publishers, with a market cap of £388.40 million.

Operations: Nexxen International Ltd. generates revenue primarily through its marketing services, which amounted to $334.69 million. The company operates an end-to-end software platform facilitating connections between advertisers and publishers in Israel.

Nexxen International's strategic data partnerships and programmatic expansion highlight its innovative edge in the tech landscape. Recent collaborations with The Trade Desk and Vevo enhance cross-channel targeting capabilities and boost programmatic monetization, respectively. Despite an 8% annual revenue growth forecast, Nexxen's earnings are expected to surge by 116.2% annually, indicating robust future profitability prospects. With R&D expenses contributing significantly to its advancements, Nexxen's focus on AI-driven solutions positions it strongly within the competitive media sector.

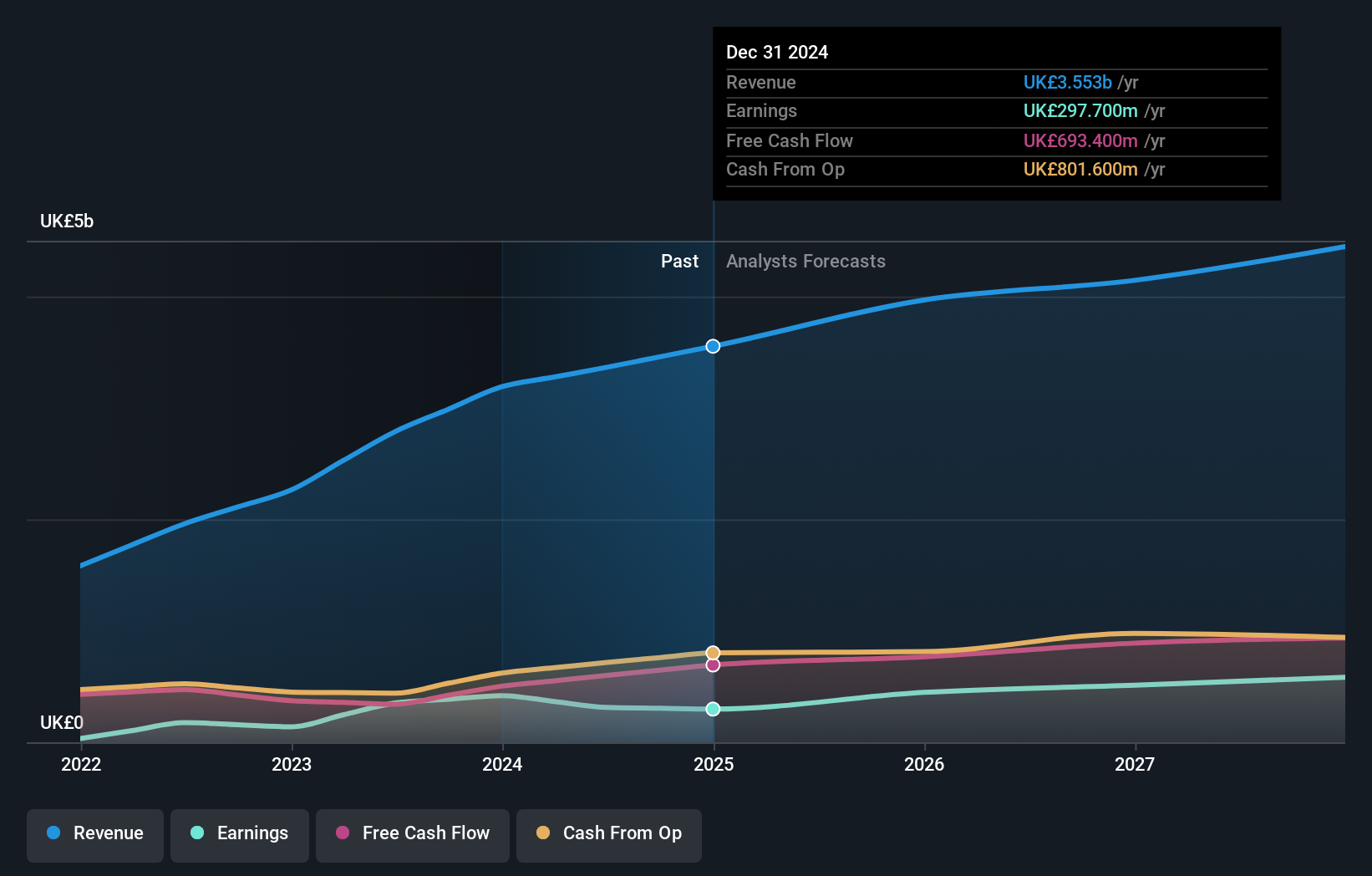

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc is an international company specializing in events, digital services, and academic research with operations spanning the United Kingdom, Continental Europe, the United States, China, and other global markets; it has a market cap of £10.85 billion.

Operations: Informa plc generates revenue primarily from its four segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company's diverse operations include events, digital services, and academic research across various global markets including the UK, Europe, the US, and China.

Informa's recent initiatives, including the repurchase of 41.67 million shares for £338.9 million, underscore its commitment to shareholder value. Despite a net income drop to £147.3 million in H1 2024 from £253.5 million a year ago, its earnings are projected to grow at 21.5% annually, outpacing the UK market average of 14.3%. The company's R&D expenses have played a crucial role in driving innovation and maintaining competitive advantage within the tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Informa.

Explore historical data to track Informa's performance over time in our Past section.

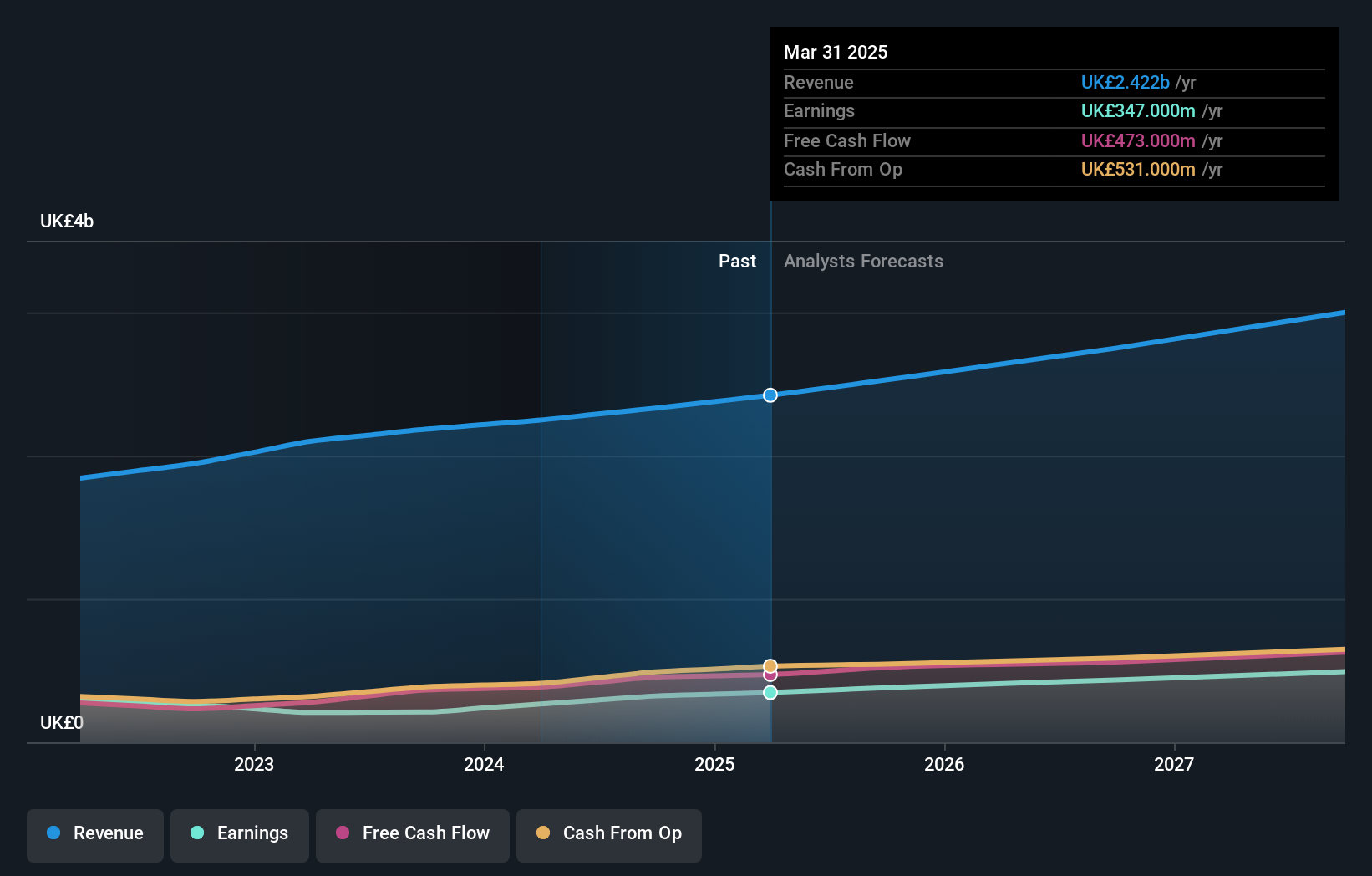

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, with a market cap of £10.23 billion, provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally.

Operations: Sage Group generates revenue primarily from its operations in North America (£1.01 billion), Europe (£595 million), and the United Kingdom & Ireland (£488 million). The company focuses on delivering technology solutions and services tailored for small and medium-sized businesses across these regions.

Sage Group's recent revenue growth of 9% to £585 million in Q3 2024, driven by its Sage Business Cloud portfolio, underscores the company's robust position in the tech sector. The strategic partnership with VoPay enhances Sage’s payroll functionalities, addressing critical pain points for SMBs and streamlining financial operations through automated direct deposits and advanced reporting. With R&D expenses at £92 million, representing a significant investment in innovation, Sage is well-positioned to leverage new technologies for continued growth.

- Navigate through the intricacies of Sage Group with our comprehensive health report here.

Examine Sage Group's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Navigate through the entire inventory of 48 UK High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexxen International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NEXN

Nexxen International

Provides end-to-end software platform that enables advertisers to reach publishers Israel.

Reasonable growth potential with adequate balance sheet.