- United Kingdom

- /

- Media

- /

- AIM:TIG

Market Cool On Team Internet Group plc's (LON:TIG) Revenues Pushing Shares 34% Lower

To the annoyance of some shareholders, Team Internet Group plc (LON:TIG) shares are down a considerable 34% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 25% share price drop.

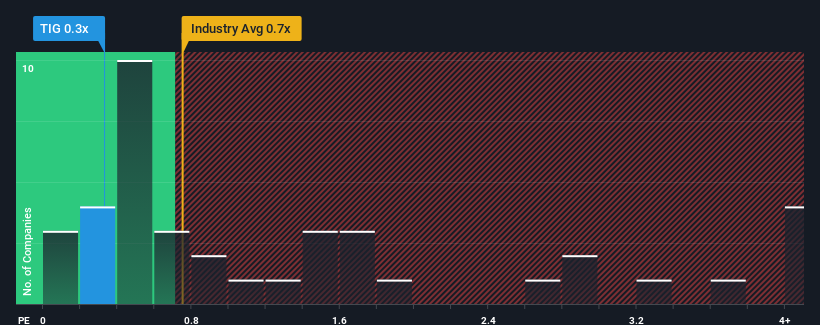

Even after such a large drop in price, it's still not a stretch to say that Team Internet Group's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Media industry in the United Kingdom, where the median P/S ratio is around 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Team Internet Group

What Does Team Internet Group's Recent Performance Look Like?

Recent revenue growth for Team Internet Group has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. Those who are bullish on Team Internet Group will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Team Internet Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Team Internet Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Team Internet Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.6% last year. Pleasingly, revenue has also lifted 181% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 5.3% during the coming year according to the five analysts following the company. That would be an excellent outcome when the industry is expected to decline by 3.5%.

With this in mind, we find it intriguing that Team Internet Group's P/S trades in-line with its industry peers. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

With its share price dropping off a cliff, the P/S for Team Internet Group looks to be in line with the rest of the Media industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We note that even though Team Internet Group trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. The market could be pricing in the event that tough industry conditions will impact future revenues. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Team Internet Group (2 shouldn't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Team Internet Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Team Internet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TIG

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives