Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, the ROCE of Pebble Group (LON:PEBB) looks decent, right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Pebble Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = UK£9.4m ÷ (UK£99m - UK£28m) (Based on the trailing twelve months to June 2020).

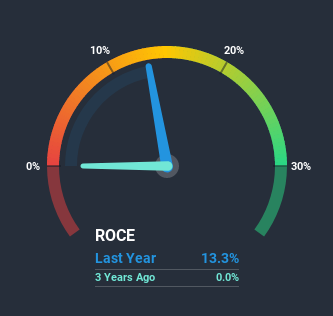

Therefore, Pebble Group has an ROCE of 13%. In absolute terms, that's a satisfactory return, but compared to the Media industry average of 9.2% it's much better.

Check out our latest analysis for Pebble Group

Above you can see how the current ROCE for Pebble Group compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

The Trend Of ROCE

The trend of ROCE doesn't stand out much, but returns on a whole are decent. The company has employed 24% more capital in the last two years, and the returns on that capital have remained stable at 13%. 13% is a pretty standard return, and it provides some comfort knowing that Pebble Group has consistently earned this amount. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

What We Can Learn From Pebble Group's ROCE

To sum it up, Pebble Group has simply been reinvesting capital steadily, at those decent rates of return. Yet over the last year the stock has declined 13%, so the decline might provide an opening. For that reason, savvy investors might want to look further into this company in case it's a prime investment.

On a final note, we've found 2 warning signs for Pebble Group that we think you should be aware of.

While Pebble Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you’re looking to trade Pebble Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:PEBB

Pebble Group

Engages in the sale of technology solutions, products, and other services to the promotional merchandise industry in the United Kingdom, Continental Europe, North America, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success