Brave Bison Group plc (LON:BBSN) Surges 33% Yet Its Low P/E Is No Reason For Excitement

Brave Bison Group plc (LON:BBSN) shares have continued their recent momentum with a 33% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 4.0% isn't as attractive.

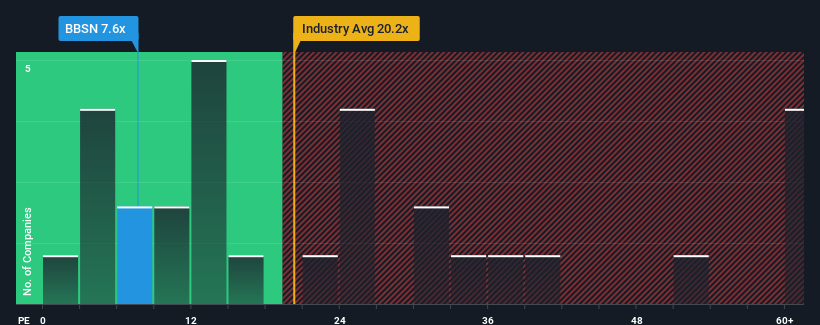

Although its price has surged higher, Brave Bison Group's price-to-earnings (or "P/E") ratio of 7.6x might still make it look like a strong buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 17x and even P/E's above 29x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's exceedingly strong of late, Brave Bison Group has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Brave Bison Group

What Are Growth Metrics Telling Us About The Low P/E?

Brave Bison Group's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 426% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 17% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Brave Bison Group is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Shares in Brave Bison Group are going to need a lot more upward momentum to get the company's P/E out of its slump. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Brave Bison Group revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Brave Bison Group is showing 2 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Brave Bison Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:BBSN

Brave Bison Group

Provides digital advertising and technology services in the United Kingdom, Europe, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives