- United Kingdom

- /

- Chemicals

- /

- LSE:VCT

Victrex (LSE:VCT) Faces High P/E Ratio and Dividend Challenges Despite 15% Volume Growth

Reviewed by Simply Wall St

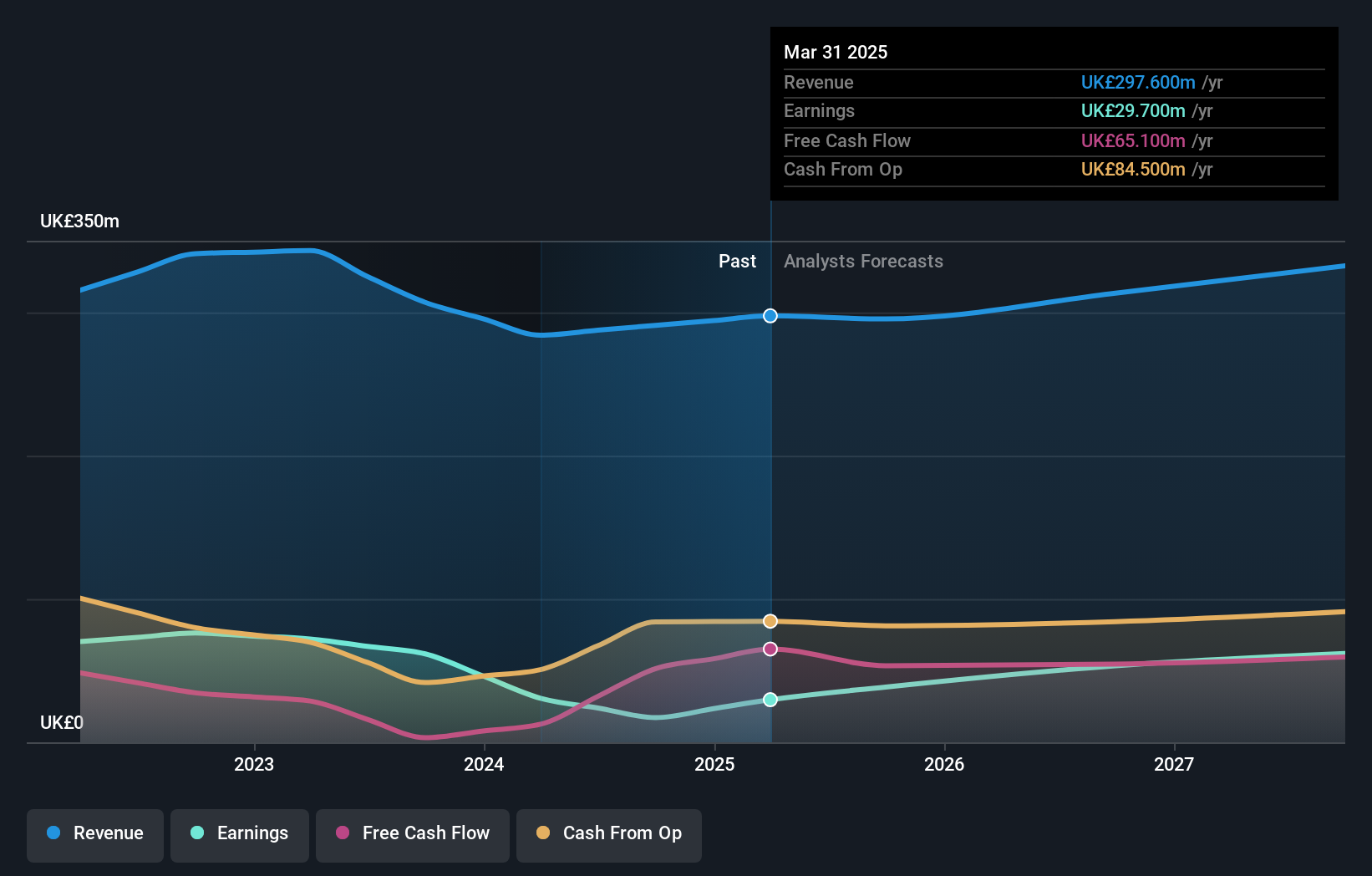

Victrex (LSE:VCT) recently affirmed a final dividend of 46.14 pence per share at its upcoming AGM in February 2025, despite reporting a significant drop in net income for the fiscal year ending September 2024. The company's earnings reveal a challenging year with sales declining to GBP 291 million and net income plummeting to GBP 17.2 million, reflecting pressures from medical destocking and a high effective tax rate. In the following discussion, we will explore Victrex's strategic positioning, recent operational developments, and the financial metrics that underscore both the opportunities and vulnerabilities facing the company.

Click to explore a detailed breakdown of our findings on Victrex.

Key Assets Propelling Victrex Forward

Victrex has demonstrated a strong market position with a notable 15% volume increase in the second half of the year, reflecting a recovery in demand, particularly in the Sustainable Solutions segment. This aligns with the company's forecasted annual profit growth of 32.6%, significantly surpassing the UK market's average. The resilience in their pricing strategy, as highlighted by CFO Ian Melling, underscores their ability to maintain value-based pricing, contributing to stable revenue streams. Additionally, the company's operational efficiency is evident through reduced overheads and strong cash conversion, which supports their ability to maintain dividends. Trading at 19.6% below its estimated fair value, Victrex's financial health is further bolstered by a satisfactory net debt to equity ratio of 2.4% and well-covered interest payments.

Vulnerabilities Impacting Victrex

However, the company faces challenges, notably a high Price-To-Earnings Ratio of 55.4x, which exceeds both peer and industry averages. This financial strain is compounded by a low Return on Equity of 3.4%, which is below the acceptable threshold. The impact of medical destocking has also significantly affected revenue and profitability, as noted by CEO Jakob Sigurdsson, highlighting a vulnerability in this segment. Additionally, a higher effective tax rate of 32.5% has further squeezed net income. The company's dividend payments have been volatile, with a high payout ratio of 301.1%, indicating unsustainable dividend practices. Despite these weaknesses, the company continues to propose a final dividend of 46.14 pence per share, maintaining shareholder returns.

Future Prospects for Victrex in the Market

Looking ahead, Victrex is poised to capitalize on several growth opportunities. The anticipated increase in mega-programme revenues, particularly in E-mobility and Medical sectors, presents a significant growth avenue. The recent operationalization of their China facilities opens new market opportunities, aligning with their 'China for China' strategy. This expansion could significantly enhance their market share in Asia. Moreover, the company's alignment with global megatrends such as CO2 reduction and energy efficiency positions them well to drive demand for their sustainable and high-performance applications.

Key Risks and Challenges That Could Impact Victrex's Success

Despite these opportunities, Victrex faces several external threats. Economic uncertainties and mixed trading conditions continue to pose risks to demand and revenue stability. Currency fluctuations and potential tariffs, particularly in key markets like the U.S., could adversely affect profitability. Additionally, competitive pricing pressures could lead to margin compression, especially if raw material costs decrease and competitors lower prices. These challenges necessitate careful navigation to sustain growth and market position.

Conclusion

Victrex's impressive 15% volume increase and strong pricing strategy underscore its capability to leverage demand recovery, particularly in the Sustainable Solutions segment, driving a forecasted profit growth of 32.6%. However, the company's high Price-To-Earnings Ratio of 55.4x, despite trading 19.6% below its estimated fair value, suggests market skepticism about its current earnings relative to its price, compounded by a low Return on Equity and high dividend payout ratio. While the operationalization of China facilities and alignment with global megatrends offer promising growth avenues, economic uncertainties and competitive pressures pose significant risks. The company must navigate these challenges carefully to sustain its market position and capitalize on emerging opportunities.

Seize The Opportunity

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:VCT

Victrex

Through its subsidiaries, engages in the manufacture and sale of polymer solutions worldwide.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives