- United Kingdom

- /

- Retail REITs

- /

- LSE:SUPR

3 UK Stocks That Could Be Trading Up To 40.7% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

The recent performance of the FTSE 100, influenced by weak trade data from China and falling commodity prices, has highlighted vulnerabilities in the UK market. In such a climate, identifying undervalued stocks that could be trading significantly below their intrinsic value becomes crucial for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TBC Bank Group (LSE:TBCG) | £30.15 | £57.68 | 47.7% |

| Liontrust Asset Management (LSE:LIO) | £6.51 | £12.43 | 47.6% |

| Marks Electrical Group (AIM:MRK) | £0.645 | £1.27 | 49.2% |

| Topps Tiles (LSE:TPT) | £0.47 | £0.9 | 47.6% |

| Gaming Realms (AIM:GMR) | £0.4005 | £0.76 | 47.3% |

| C&C Group (LSE:CCR) | £1.562 | £2.99 | 47.8% |

| AstraZeneca (LSE:AZN) | £130.76 | £248.13 | 47.3% |

| Mercia Asset Management (AIM:MERC) | £0.35 | £0.67 | 47.9% |

| Franchise Brands (AIM:FRAN) | £1.82 | £3.60 | 49.5% |

| Forterra (LSE:FORT) | £1.786 | £3.50 | 49% |

Let's explore several standout options from the results in the screener.

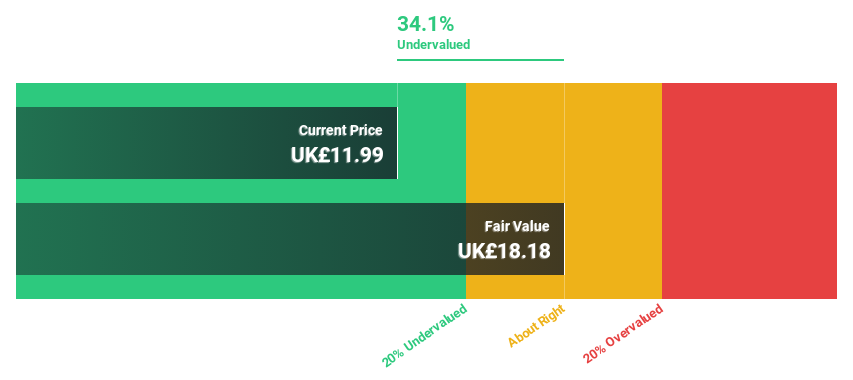

Smith & Nephew (LSE:SN.)

Overview: Smith & Nephew plc, with a market cap of £10.21 billion, develops, manufactures, markets, and sells medical devices and services in the United Kingdom and internationally.

Operations: Smith & Nephew generates revenue from three primary segments: Orthopaedics ($2.26 billion), Sports Medicine & ENT ($1.77 billion), and Advanced Wound Management (AWM) ($1.61 billion).

Estimated Discount To Fair Value: 32.8%

Smith & Nephew is trading at £11.71, significantly below its estimated fair value of £17.41, indicating it may be undervalued based on cash flows. Despite a high level of debt and a dividend yield of 2.42% not well-covered by earnings or free cash flows, the company's earnings are forecast to grow 22.68% annually, outpacing the UK market's growth rate. Recent strategic partnerships and product clearances further bolster its potential for future revenue enhancement.

- Our comprehensive growth report raises the possibility that Smith & Nephew is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Smith & Nephew.

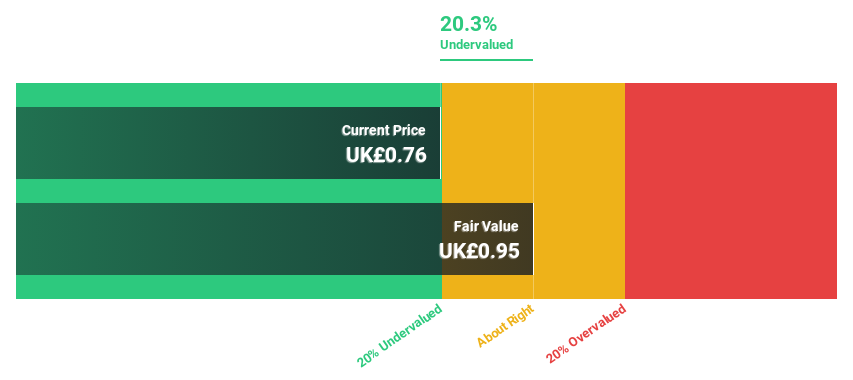

Supermarket Income REIT (LSE:SUPR)

Overview: Supermarket Income REIT plc (LSE: SUPR) is a real estate investment trust focused on investing in grocery properties that are integral to the UK's food supply chain, with a market cap of approximately £947.14 million.

Operations: Supermarket Income REIT's revenue primarily comes from its real estate investment segment, generating £106.29 million.

Estimated Discount To Fair Value: 22.1%

Supermarket Income REIT, trading at £0.76, is significantly undervalued with a fair value estimate of £0.98. Earnings are expected to grow 90.24% annually over the next three years, outperforming the UK market's 14.3%. Despite recent refinancing of £170 million in debt and a pro-forma LTV of 37%, its debt remains poorly covered by operating cash flow. The company has declared four quarterly dividends totaling 6.06 pence per share for the financial year ended June 2024.

- The analysis detailed in our Supermarket Income REIT growth report hints at robust future financial performance.

- Dive into the specifics of Supermarket Income REIT here with our thorough financial health report.

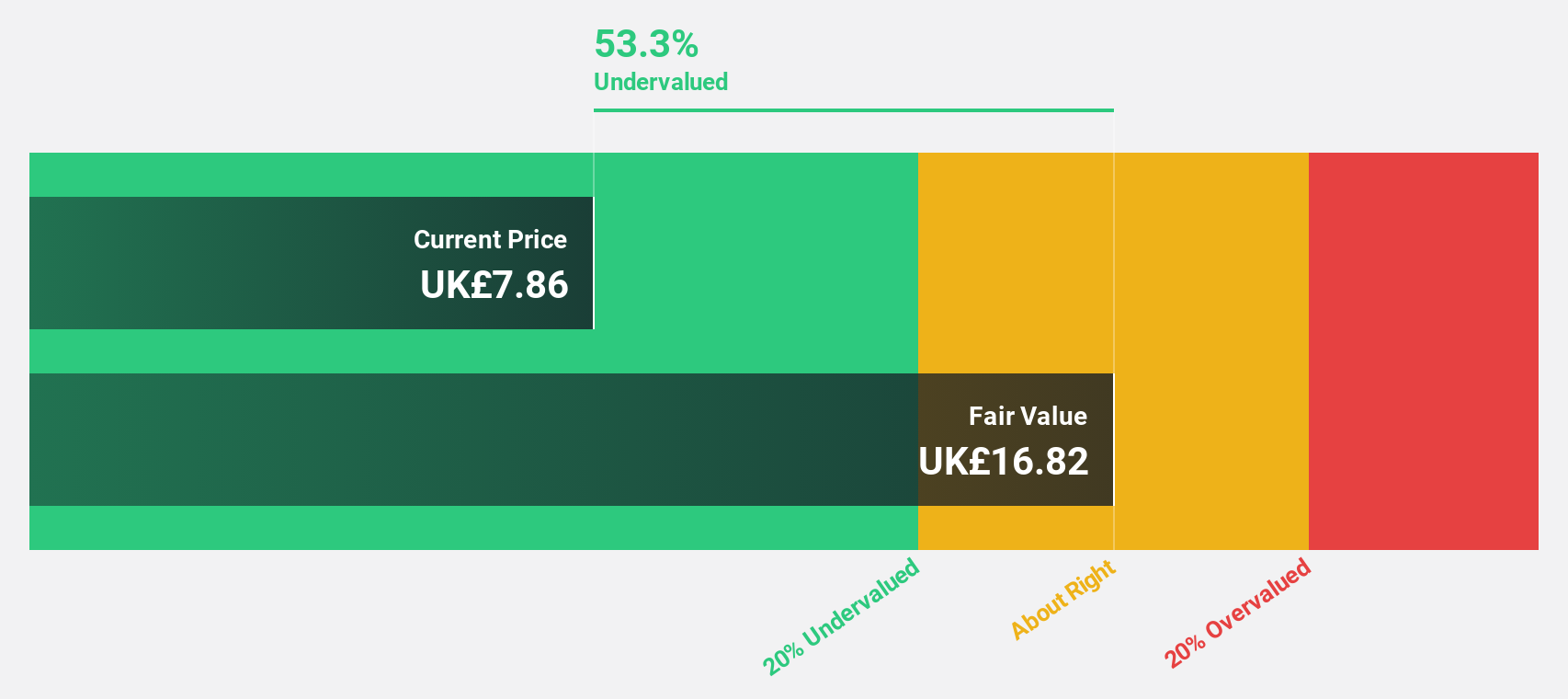

Victrex (LSE:VCT)

Overview: Victrex plc, with a market cap of £893.94 million, manufactures and sells polymer solutions globally through its subsidiaries.

Operations: Victrex's revenue segments include £59.10 million from Medical and £229.80 million from Sustainable Solutions.

Estimated Discount To Fair Value: 40.7%

Victrex is trading at £10.28, significantly below its estimated fair value of £17.34, indicating it may be undervalued based on cash flows. Despite a dividend yield of 5.79%, coverage by earnings and free cash flow remains weak. Profit margins have declined from 21% to 10.8% over the past year, but earnings are forecast to grow by 36.66% annually, outpacing the UK market's growth rate of 14.3%. Recent interim management statements will provide further insights into financial performance and future outlooks on July 4, 2024.

- Our expertly prepared growth report on Victrex implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Victrex's balance sheet health report.

Make It Happen

- Click here to access our complete index of 61 Undervalued UK Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SUPR

Supermarket Income REIT

Supermarket Income REIT plc (LSE: SUPR) is a real estate investment trust dedicated to investing in grocery properties which are an essential part of the UK's feed the nation infrastructure.

Reasonable growth potential average dividend payer.