- United Kingdom

- /

- Chemicals

- /

- LSE:SYNT

Investors Aren't Entirely Convinced By Synthomer plc's (LON:SYNT) Revenues

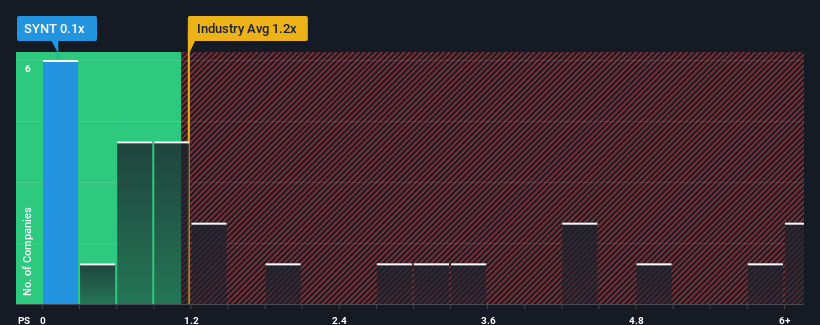

Synthomer plc's (LON:SYNT) price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Chemicals industry in the United Kingdom, where around half of the companies have P/S ratios above 1.2x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Synthomer

What Does Synthomer's P/S Mean For Shareholders?

Synthomer's negative revenue growth of late has neither been better nor worse than most other companies. One possibility is that the P/S ratio is low because investors think the company's revenue may begin to slide even faster. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Synthomer.How Is Synthomer's Revenue Growth Trending?

Synthomer's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.2%. As a result, revenue from three years ago have also fallen 7.7% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 2.3% as estimated by the nine analysts watching the company. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 14%, that would be a solid result.

With this in consideration, we find it intriguing that Synthomer's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Synthomer's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Synthomer's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for Synthomer that we have uncovered.

If these risks are making you reconsider your opinion on Synthomer, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SYNT

Synthomer

Manufactures and supplies specialised polymers and ingredients for coatings, construction, adhesives, and health and protection sectors.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives