- United Kingdom

- /

- Chemicals

- /

- LSE:JMAT

Market Participants Recognise Johnson Matthey Plc's (LON:JMAT) Earnings

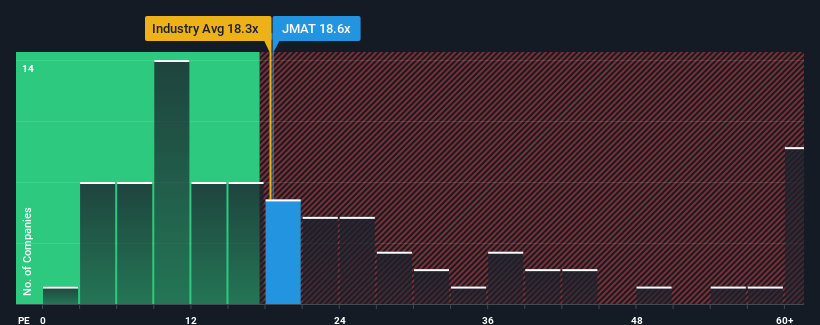

With a price-to-earnings (or "P/E") ratio of 18.6x Johnson Matthey Plc (LON:JMAT) may be sending bearish signals at the moment, given that almost half of all companies in the United Kingdom have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings that are retreating more than the market's of late, Johnson Matthey has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Johnson Matthey

How Is Johnson Matthey's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Johnson Matthey's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. Even so, admirably EPS has lifted 81% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 26% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 14% per year, which is noticeably less attractive.

In light of this, it's understandable that Johnson Matthey's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Johnson Matthey maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Johnson Matthey that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:JMAT

Johnson Matthey

Engages in the clean air, catalyst and hydrogen technology, and platinum group metals (PGM) service businesses in the United Kingdom, Germany, rest of Europe, the United States, rest of North America, China, rest of Asia, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives