- United Kingdom

- /

- Specialty Stores

- /

- LSE:AO.

Discover 3 UK Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting the global interconnectedness of economies. In such a volatile environment, growth stocks with high insider ownership can be particularly appealing as they often indicate confidence in the company's future prospects by those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Tortilla Mexican Grill (AIM:MEX) | 21.8% | 116.2% |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| QinetiQ Group (LSE:QQ.) | 13.3% | 67.7% |

| Metals Exploration (AIM:MTL) | 10.4% | 85.9% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| LSL Property Services (LSE:LSL) | 10.4% | 21.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Foresight Group Holdings (LSE:FSG) | 34.7% | 20.1% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

Let's dive into some prime choices out of the screener.

AO World (LSE:AO.)

Simply Wall St Growth Rating: ★★★★☆☆

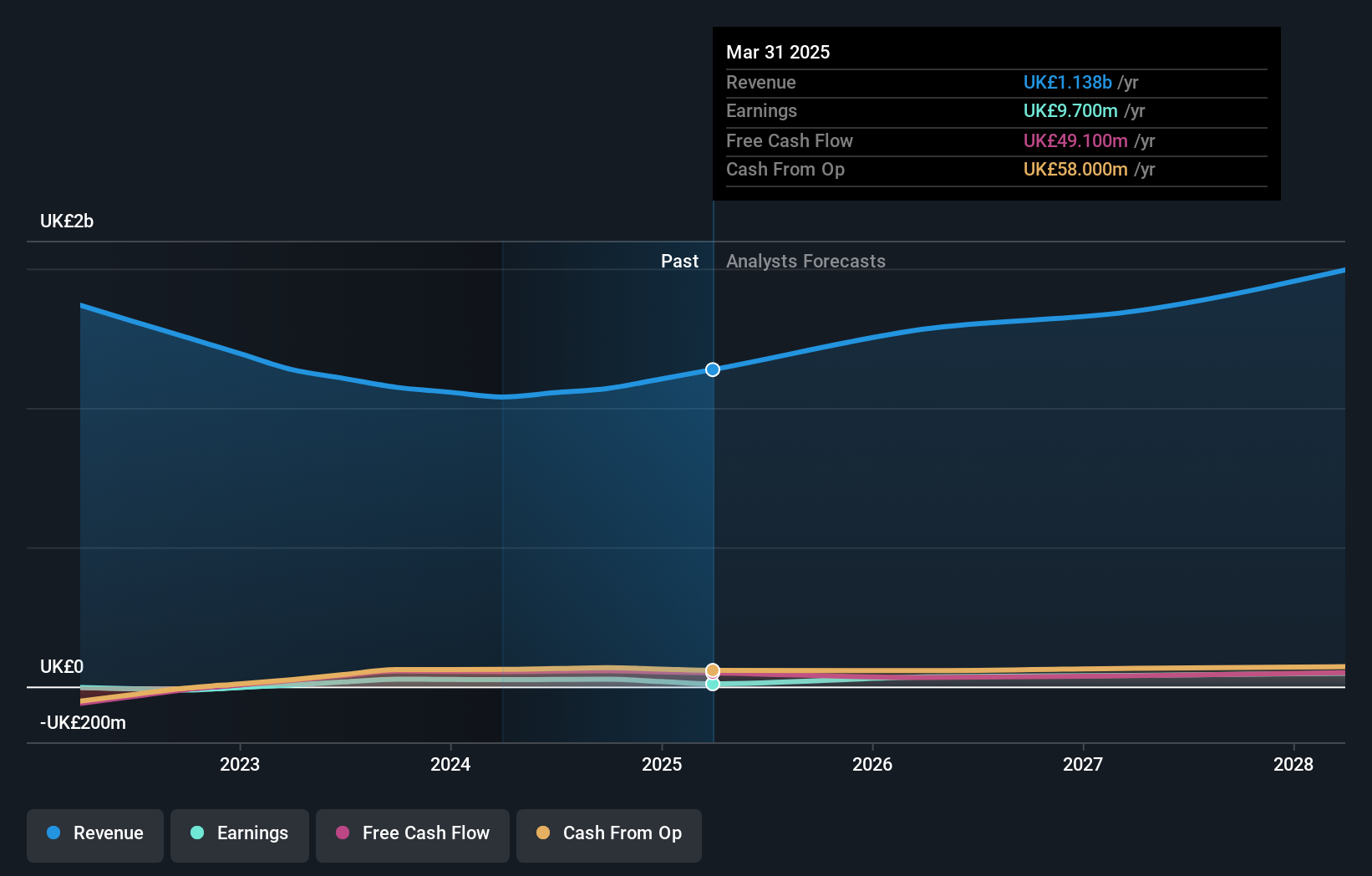

Overview: AO World plc, along with its subsidiaries, operates as an online retailer of domestic appliances and ancillary services in the United Kingdom and Germany, with a market cap of £586.34 million.

Operations: The company's revenue primarily comes from its online retailing of domestic appliances and ancillary services, amounting to £1.14 billion.

Insider Ownership: 20.2%

Earnings Growth Forecast: 36% p.a.

AO World has seen substantial insider buying over the past three months, indicating confidence in its growth trajectory. Despite a recent decline in profit margins from 2.4% to 0.9%, earnings are forecasted to grow significantly at 36% annually, outpacing the UK market's 14.6%. Trading below fair value by 23.9%, AO's revenue is projected to increase by 8.3% annually, faster than the market average of 4.2%.

- Dive into the specifics of AO World here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, AO World's share price might be too optimistic.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across several countries including Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile with a market cap of £1.86 billion.

Operations: The company's revenue segments include $320.31 million from San Jose, $186.58 million from Mara Rosa, and $568.64 million from Inmaculada.

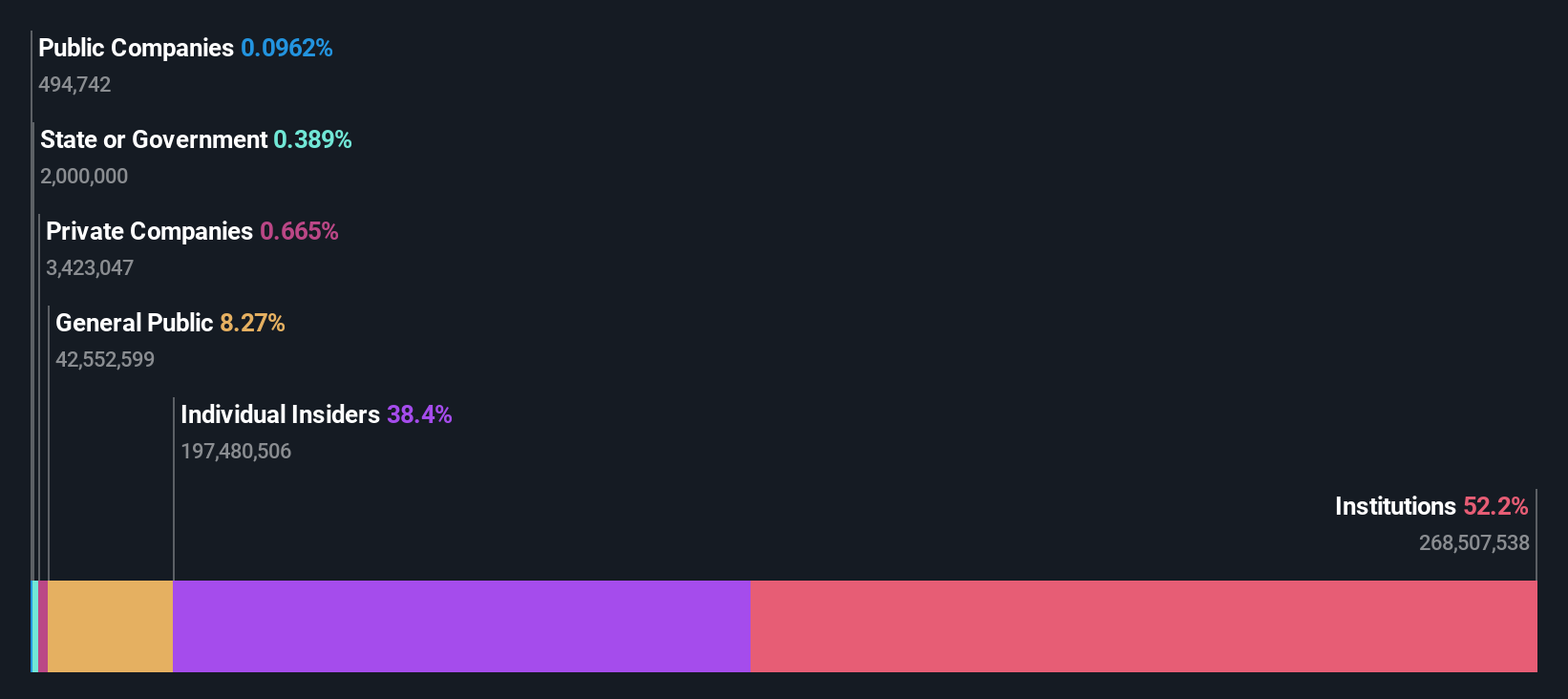

Insider Ownership: 38.4%

Earnings Growth Forecast: 26.2% p.a.

Hochschild Mining, with substantial insider ownership, is trading at a significant discount to its estimated fair value. Despite recent volatility and reduced production guidance, the company's earnings grew substantially last year and are forecasted to grow significantly at 26.18% annually, outpacing the UK market's growth rate. However, revenue growth is expected to be slower than desired for high-growth companies but still exceeds the broader market's pace.

- Unlock comprehensive insights into our analysis of Hochschild Mining stock in this growth report.

- In light of our recent valuation report, it seems possible that Hochschild Mining is trading behind its estimated value.

Playtech (LSE:PTEC)

Simply Wall St Growth Rating: ★★★★☆☆

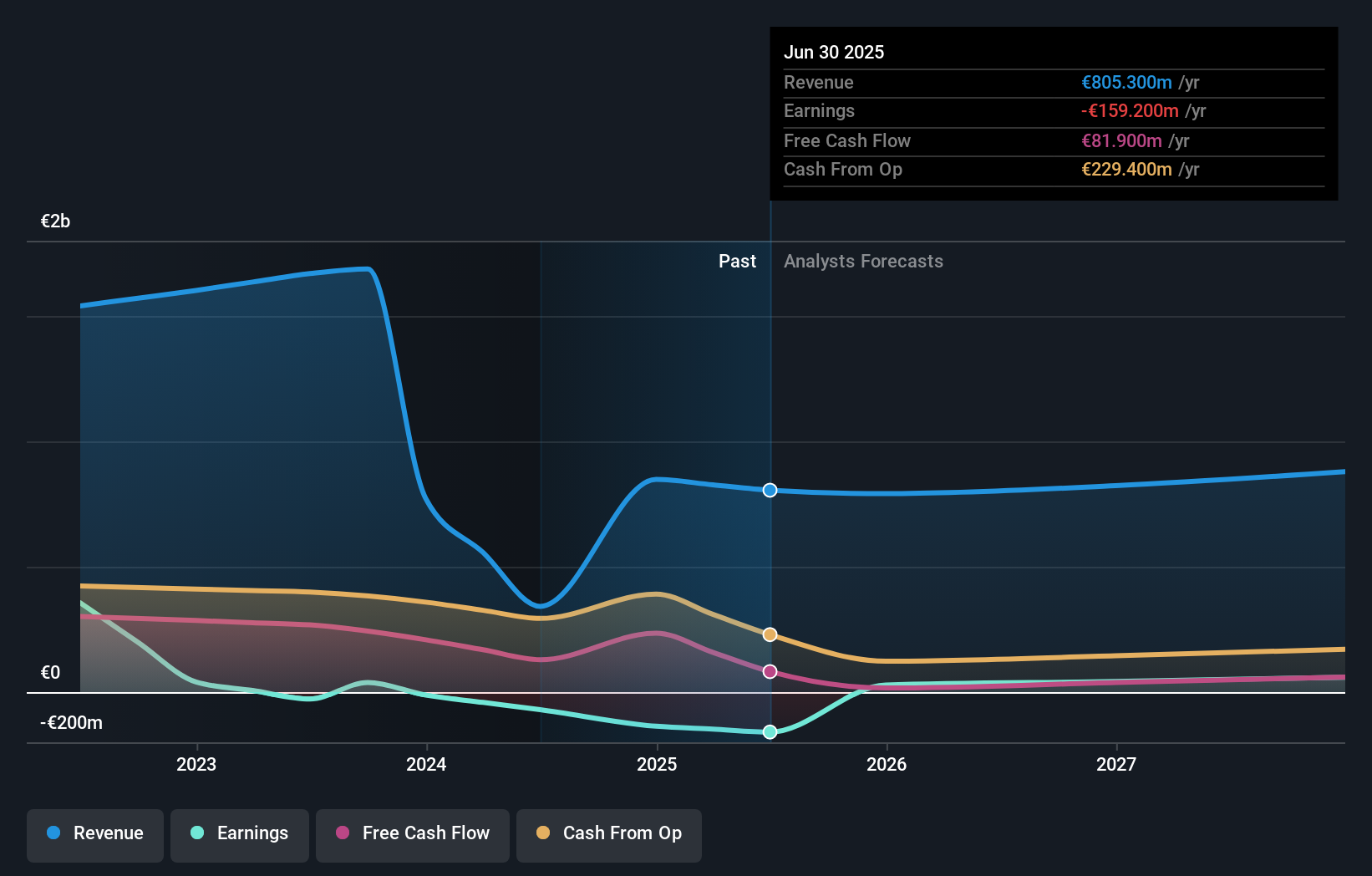

Overview: Playtech plc is a technology company providing gambling software, services, content, and platform technologies across Italy, Mexico, the UK, Europe, Latin America, and internationally with a market cap of £729.75 million.

Operations: Playtech's revenue segments include B2B services generating €719.70 million, HAPPYBET contributing €17.10 million, and Sun Bingo along with other B2C operations adding €72.20 million.

Insider Ownership: 13.6%

Earnings Growth Forecast: 62.6% p.a.

Playtech, with high insider ownership, is trading at 39.1% below its estimated fair value. The company has initiated a share buyback program worth £43.7 million and is actively seeking strategic acquisitions to enhance its B2B technology offerings. Despite recent earnings volatility, Playtech's profit growth forecast of 62.56% annually surpasses the UK market average, although revenue growth at 5.4% per year lags behind typical high-growth benchmarks yet remains above the broader market rate.

- Click to explore a detailed breakdown of our findings in Playtech's earnings growth report.

- The valuation report we've compiled suggests that Playtech's current price could be quite moderate.

Turning Ideas Into Actions

- Dive into all 58 of the Fast Growing UK Companies With High Insider Ownership we have identified here.

- Contemplating Other Strategies? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AO.

AO World

Engages in the online retailing of domestic appliances and ancillary services in the United Kingdom and Germany.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives