- United Kingdom

- /

- Professional Services

- /

- LSE:HAS

3 UK Stocks That May Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, highlighting concerns about global economic recovery. Despite these headwinds, there are opportunities to find stocks that may be trading below their intrinsic value, offering potential for long-term growth.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.38 | £0.76 | 49.9% |

| Triple Point Social Housing REIT (LSE:SOHO) | £0.658 | £1.30 | 49.3% |

| Topps Tiles (LSE:TPT) | £0.473 | £0.90 | 47.6% |

| Informa (LSE:INF) | £8.466 | £16.80 | 49.6% |

| Redcentric (AIM:RCN) | £1.2775 | £2.45 | 47.8% |

| Velocity Composites (AIM:VEL) | £0.435 | £0.82 | 47% |

| Tortilla Mexican Grill (AIM:MEX) | £0.515 | £1.01 | 48.9% |

| SysGroup (AIM:SYS) | £0.345 | £0.66 | 47.8% |

| Foxtons Group (LSE:FOXT) | £0.624 | £1.19 | 47.6% |

| Forterra (LSE:FORT) | £1.76 | £3.49 | 49.6% |

Let's review some notable picks from our screened stocks.

LBG Media (AIM:LBG)

Overview: LBG Media plc operates as an online media publisher in the United Kingdom, Ireland, Australia, the United States, and internationally with a market cap of £290.62 million.

Operations: LBG Media generates £67.51 million in revenue from the online media publishing industry across its various markets.

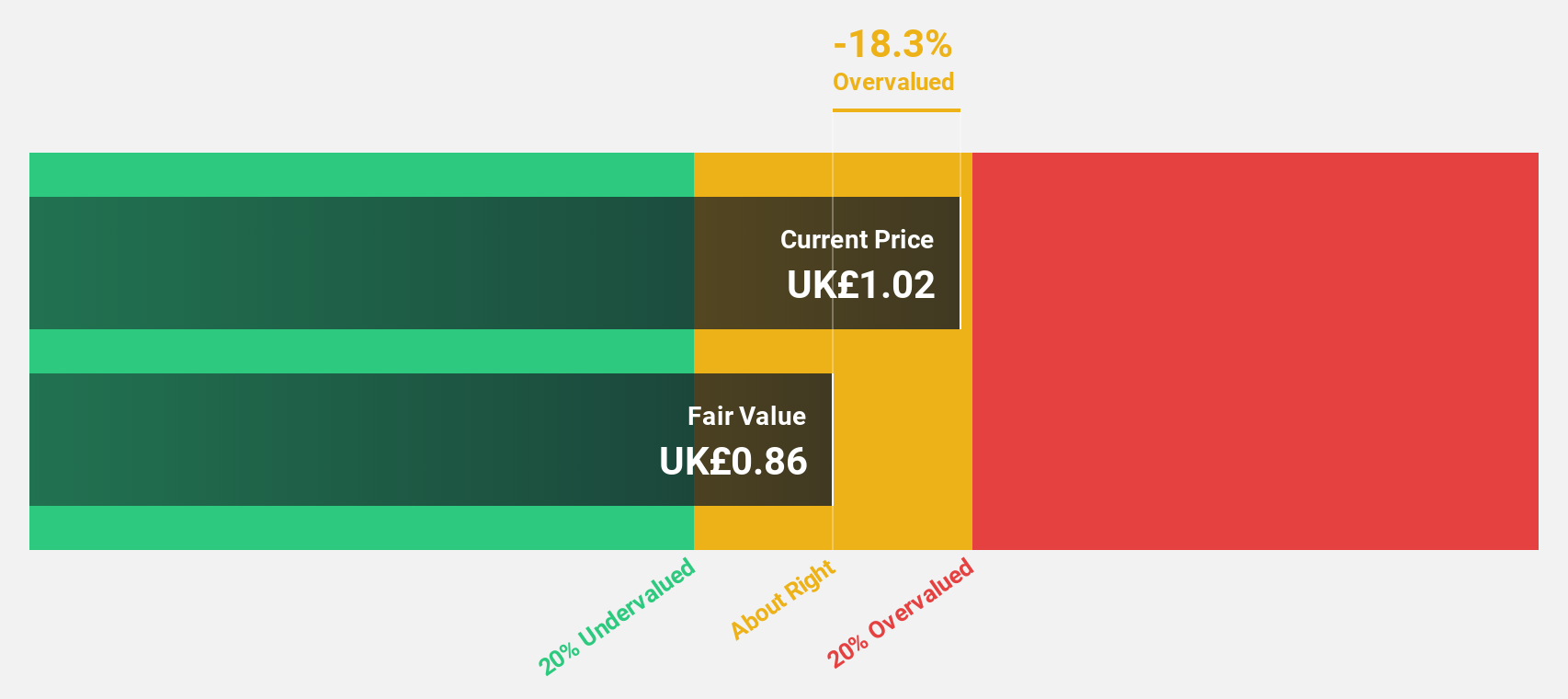

Estimated Discount To Fair Value: 15.4%

LBG Media (£1.39) is trading 15.4% below its estimated fair value (£1.64). Despite a decline in profit margins from 8.6% to 0.9% over the past year, earnings are forecast to grow significantly at 43.84% per year, outpacing the UK market's expected growth of 14.2%. Revenue is also projected to increase by 11.7% annually, though this is slower than the desired growth rate of over 20%.

- The analysis detailed in our LBG Media growth report hints at robust future financial performance.

- Take a closer look at LBG Media's balance sheet health here in our report.

Forterra (LSE:FORT)

Overview: Forterra plc manufactures and sells building products in the United Kingdom, with a market cap of £364.14 million.

Operations: Forterra's revenue segments include £67.70 million from Bespoke Products and £261.10 million from Bricks and Blocks.

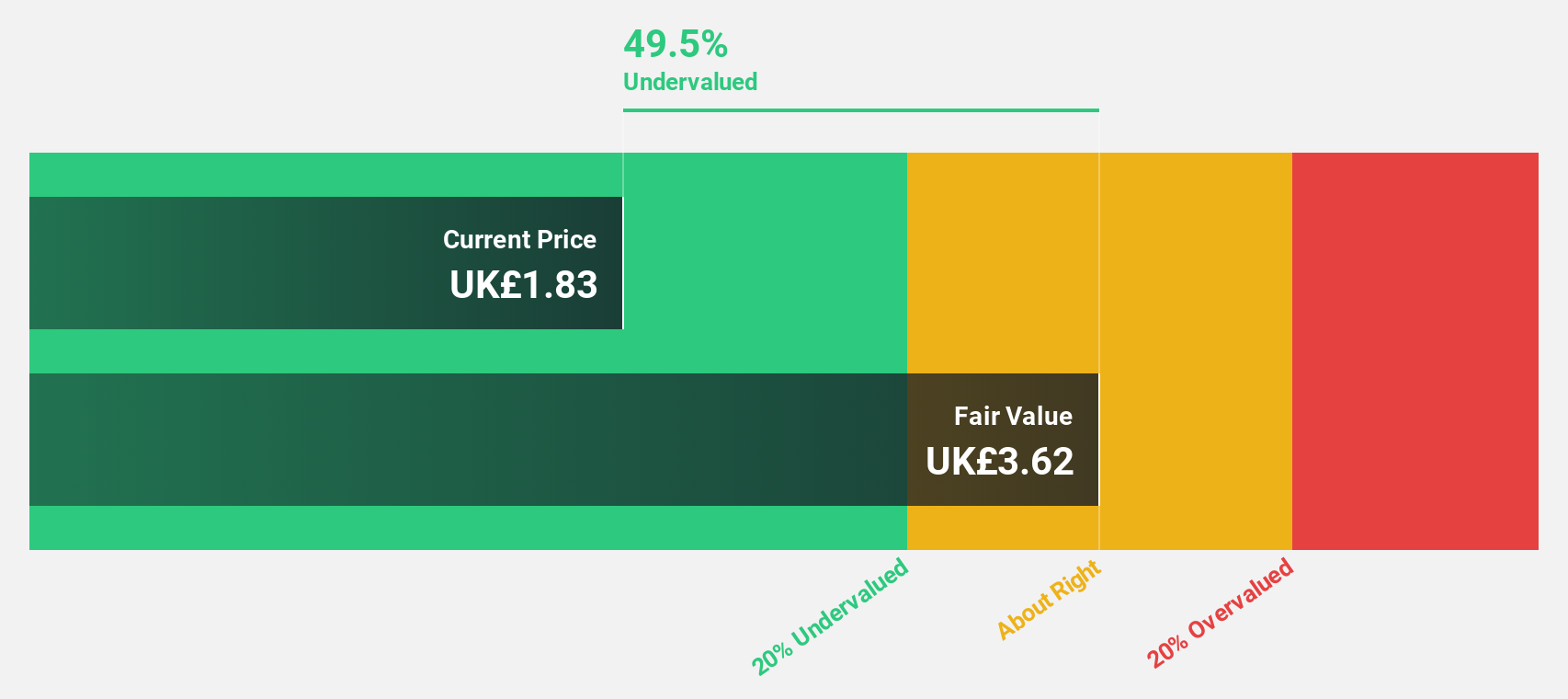

Estimated Discount To Fair Value: 49.6%

Forterra (£1.76) is trading 49.6% below its estimated fair value (£3.49). Despite a drop in profit margins from 8.9% to 2.5% over the past year, earnings are forecast to grow significantly at 42.7% per year, surpassing the UK market's expected growth of 14.2%. However, revenue growth is projected at a slower rate of 8% annually, and recent earnings show a decline with net income dropping from £13.8 million to £9 million year-over-year for H1 2024.

- The growth report we've compiled suggests that Forterra's future prospects could be on the up.

- Get an in-depth perspective on Forterra's balance sheet by reading our health report here.

Hays (LSE:HAS)

Overview: Hays plc provides recruitment services across Australia, New Zealand, Germany, the United Kingdom, Ireland, and internationally with a market cap of £1.43 billion.

Operations: The company generates £6.95 billion from its Qualified, Professional, and Skilled Recruitment segment.

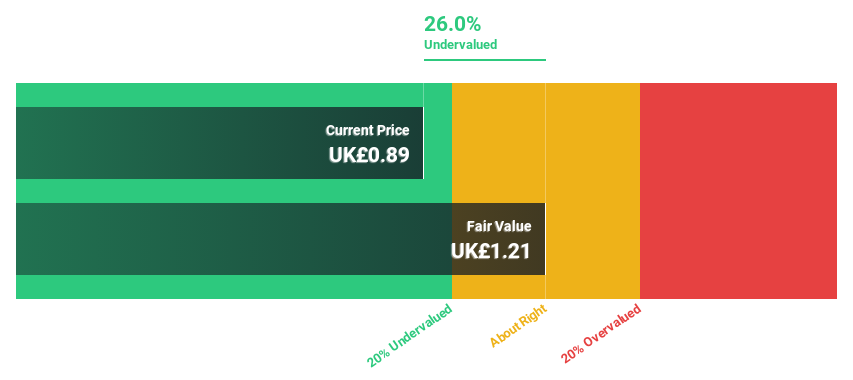

Estimated Discount To Fair Value: 24.9%

Hays plc (£0.9) is trading 24.9% below its fair value estimate (£1.2), indicating significant undervaluation based on discounted cash flows. Despite a recent net loss of £4.9 million for the year ended June 30, 2024, and a revenue decline from £7,583.3 million to £6,949.1 million year-over-year, earnings are forecast to grow at an impressive rate of 62.57% annually over the next three years as the company is expected to become profitable again.

- In light of our recent growth report, it seems possible that Hays' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Hays.

Summing It All Up

- Click this link to deep-dive into the 53 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hays might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HAS

Hays

Engages in the provision of recruitment services in Australia, New Zealand, Germany, the United Kingdom, Ireland, and internationally.

Very undervalued with excellent balance sheet.