- United Kingdom

- /

- Chemicals

- /

- LSE:ESNT

3 Undervalued Small Caps In The United Kingdom With Insider Buying

Reviewed by Simply Wall St

The United Kingdom market has shown resilience, with the Materials sector gaining 4.4% while the overall market remained flat over the last week and up 7.1% over the past year. In this environment of steady growth and positive earnings forecasts, identifying undervalued small-cap stocks with insider buying can present compelling opportunities for investors seeking value in a dynamic market.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 26.1x | 5.9x | 7.13% | ★★★★★☆ |

| Domino's Pizza Group | 15.4x | 1.8x | 38.04% | ★★★★★☆ |

| C&C Group | NA | 0.4x | 46.28% | ★★★★★☆ |

| GB Group | NA | 2.8x | 36.84% | ★★★★★☆ |

| Genus | 153.5x | 1.8x | 6.09% | ★★★★★☆ |

| CVS Group | 23.2x | 1.3x | 39.16% | ★★★★☆☆ |

| Essentra | 720.9x | 1.4x | 38.12% | ★★★★☆☆ |

| NWF Group | 8.7x | 0.1x | 35.03% | ★★★☆☆☆ |

| Alpha Group International | 10.1x | 4.7x | -25.42% | ★★★☆☆☆ |

| Harworth Group | 12.4x | 6.5x | -609.41% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

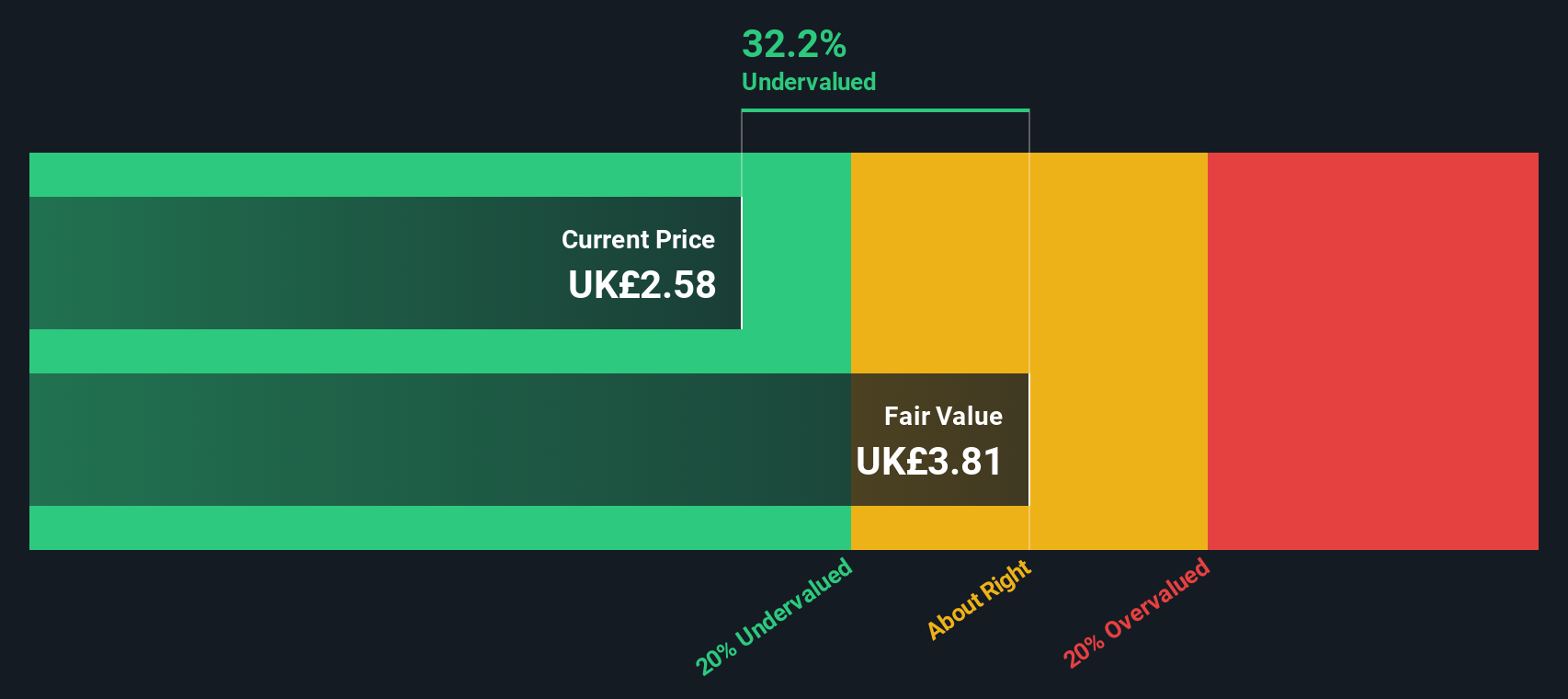

Bytes Technology Group (LSE:BYIT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bytes Technology Group is an IT solutions provider with a market cap of £1.23 billion.

Operations: Bytes Technology Group generates revenue primarily from its IT Solutions Provider segment, which reported £207.02 million in the latest period. The company's net income margin has shown a notable upward trend, reaching 22.63% recently.

PE: 26.1x

Bytes Technology Group, a small cap in the UK, has seen insider confidence with share purchases over the past six months. The company is poised for growth, with earnings forecasted to increase by 8.97% annually. Recent events include a special dividend of 8.7 pence per share and an increased final dividend of 6 pence per share announced at their AGM on July 11, 2024. They also participated in Smarter Working Live 2024 in Birmingham this September, showcasing their industry engagement and forward-thinking approach.

- Unlock comprehensive insights into our analysis of Bytes Technology Group stock in this valuation report.

Evaluate Bytes Technology Group's historical performance by accessing our past performance report.

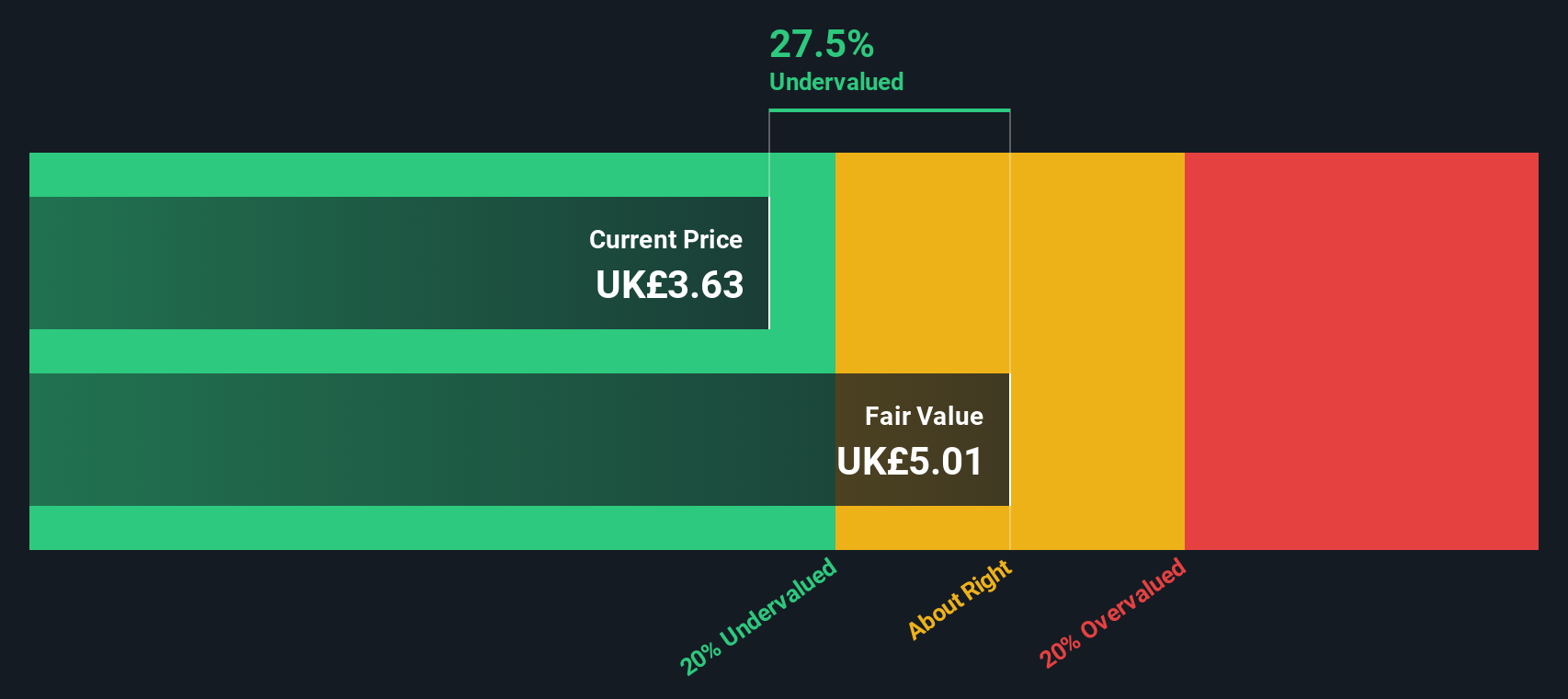

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates a network of franchise and corporate pizza stores, generating income through sales to franchisees, advertising and ecommerce, rental properties, and various fees with a market cap of approximately £1.50 billion.

Operations: The company generates revenue from sales to franchisees, corporate store income, national advertising and e-commerce income, rental income on properties, and various franchise fees. The gross profit margin has shown an upward trend over the periods analyzed, reaching 47.48% in June 2024.

PE: 15.4x

Domino's Pizza Group, a UK-based company, is currently trading at attractive valuations. Recent insider confidence is evident with notable share purchases by executives in the past six months. On August 6, 2024, Domino's announced a buyback program to repurchase up to 10% of its issued shares by August 2025. Despite reporting lower sales and net income for H1 2024 compared to last year (£326.8 million vs £332.9 million; £42.3 million vs £80.2 million), the company remains optimistic about growth in order count and like-for-like sales for the fiscal year.

- Navigate through the intricacies of Domino's Pizza Group with our comprehensive valuation report here.

Understand Domino's Pizza Group's track record by examining our Past report.

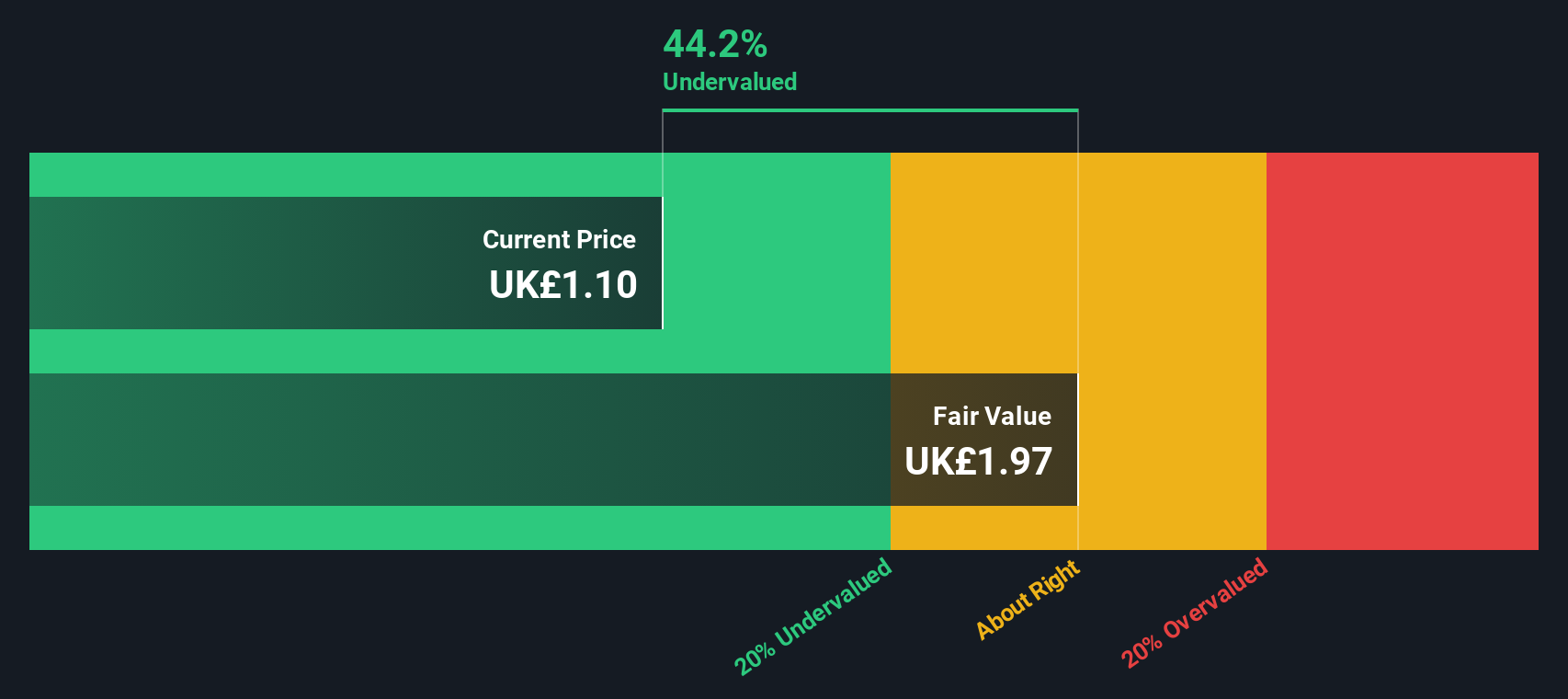

Essentra (LSE:ESNT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Essentra is a global provider of essential components and solutions, specializing in the manufacture and distribution of plastic, fiber, foam, and packaging products with a market cap of approximately £0.83 billion.

Operations: Essentra generates revenue primarily from its core business operations. Over the analyzed periods, the company has seen fluctuations in its gross profit margin, with a notable trend reaching 46.14% by September 2024. The cost of goods sold (COGS) and operating expenses are significant components impacting its financial performance.

PE: 720.9x

Essentra, a UK-based company, has shown insider confidence with significant share purchases in the past year. Recently, Rowan Baker was appointed as CFO effective November 2024. Despite a decline in H1 2024 sales to £159.7 million from £166.3 million and net income dropping to £1.3 million from £6.9 million, the board increased its interim dividend to 1.25 pence per share, reflecting their commitment to a progressive dividend policy amidst challenging financial results and reliance on external borrowing for funding.

- Delve into the full analysis valuation report here for a deeper understanding of Essentra.

Gain insights into Essentra's past trends and performance with our Past report.

Summing It All Up

- Click through to start exploring the rest of the 21 Undervalued UK Small Caps With Insider Buying now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essentra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ESNT

Essentra

Manufactures and distributes plastic injection and vinyl dip moulded, and metal components worldwide.

Excellent balance sheet and good value.