- United Kingdom

- /

- Basic Materials

- /

- AIM:STCM

Steppe Cement (LON:STCM) Will Pay A Smaller Dividend Than Last Year

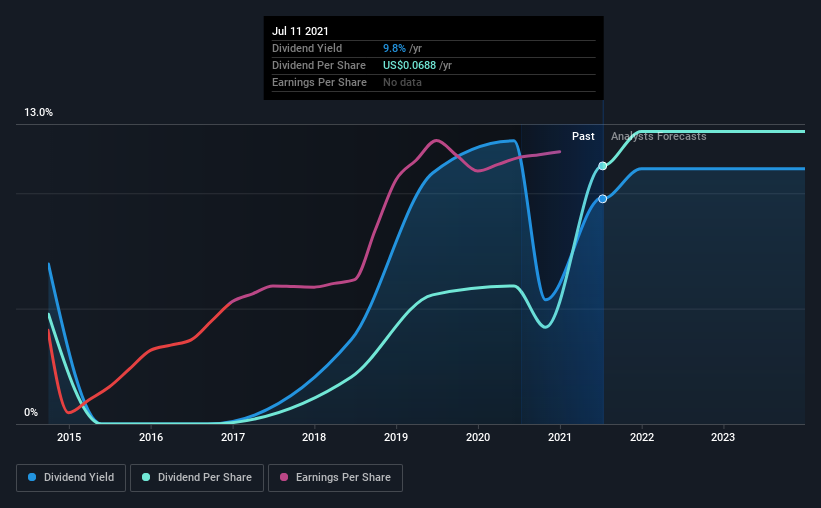

Steppe Cement Ltd. (LON:STCM) is reducing its dividend to UK£0.025 on the 30th of July. This means the annual payment is 6.9% of the current stock price, which is above the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Steppe Cement's stock price has increased by 34% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Steppe Cement

Steppe Cement's Earnings Easily Cover the Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before making this announcement, Steppe Cement's was paying out quite a large proportion of earnings and 92% of free cash flows. This is usually an indication that the focus of the company is returning cash to shareholders rather than reinvesting it for growth.

Over the next year, EPS is forecast to expand by 53.9%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 55% which brings it into quite a comfortable range.

Steppe Cement's Dividend Has Lacked Consistency

Steppe Cement has been paying dividends for a while, but the track record isn't stellar. This suggests that the dividend might not be the most reliable. The dividend has gone from US$0.029 in 2014 to the most recent annual payment of US$0.069. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. Steppe Cement has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

Steppe Cement Might Find It Hard To Grow Its Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Steppe Cement has impressed us by growing EPS at 60% per year over the past five years. Fast growing earnings are great, but this can rarely be sustained without some reinvestment into the business, which Steppe Cement hasn't been doing.

In Summary

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. Strong earnings growth means Steppe Cement has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. We don't think Steppe Cement is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 2 warning signs for Steppe Cement (1 doesn't sit too well with us!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading Steppe Cement or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:STCM

Steppe Cement

An investment holding company, engages in the production and sale of cement and clinkers in Kazakhstan.

Excellent balance sheet and good value.

Market Insights

Community Narratives