- United Kingdom

- /

- Biotech

- /

- LSE:GNS

3 UK Stocks That May Be Trading At Discounts Of Up To 43.6%

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. As London's bluechip index falters, investors may find opportunities in undervalued stocks that could potentially offer value despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victorian Plumbing Group (AIM:VIC) | £0.696 | £1.28 | 45.7% |

| ProCook Group (LSE:PROC) | £0.31 | £0.56 | 45.1% |

| PayPoint (LSE:PAY) | £5.12 | £9.30 | 44.9% |

| Pan African Resources (LSE:PAF) | £0.937 | £1.84 | 49% |

| PageGroup (LSE:PAGE) | £2.278 | £4.32 | 47.3% |

| Norcros (LSE:NXR) | £3.04 | £5.47 | 44.5% |

| Nichols (AIM:NICL) | £10.05 | £18.53 | 45.8% |

| Forterra (LSE:FORT) | £1.746 | £3.23 | 46% |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £2.20 | 48.1% |

| Airtel Africa (LSE:AAF) | £3.056 | £5.88 | 48% |

Let's dive into some prime choices out of the screener.

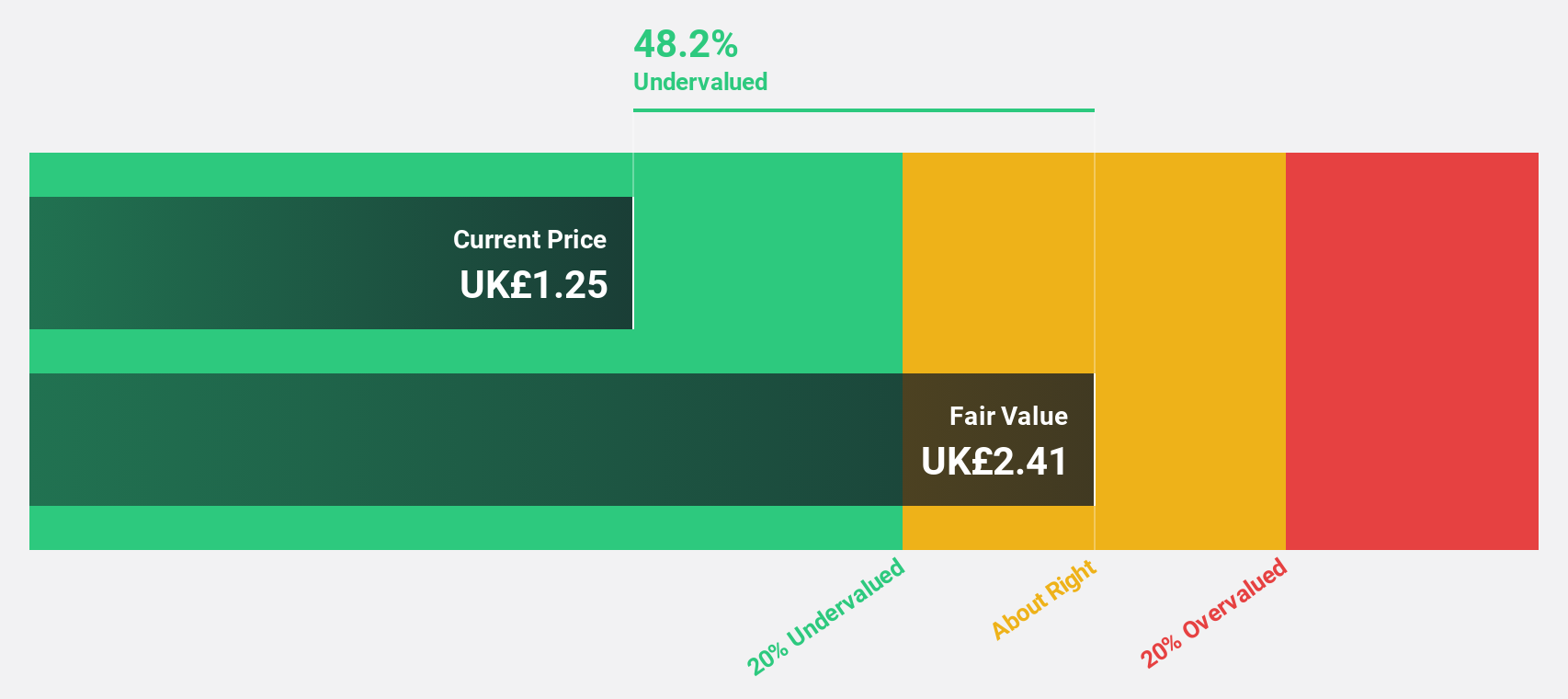

SigmaRoc (AIM:SRC)

Overview: SigmaRoc plc, with a market cap of £1.22 billion, operates through its subsidiaries to invest in and acquire projects within the quarried materials sector.

Operations: The company generates revenue of £1.02 billion from the production and sale of construction material products and services.

Estimated Discount To Fair Value: 43.6%

SigmaRoc is trading at a significant discount, approximately 43.6% below its estimated fair value of £1.95, with a current price around £1.1. Despite low interest coverage by earnings and large one-off items affecting results, the company has turned profitable this year with net income rising to £24.32 million in H1 2025 from £3.25 million last year. Earnings are projected to grow significantly over the next three years, surpassing UK market expectations.

- Our earnings growth report unveils the potential for significant increases in SigmaRoc's future results.

- Click here to discover the nuances of SigmaRoc with our detailed financial health report.

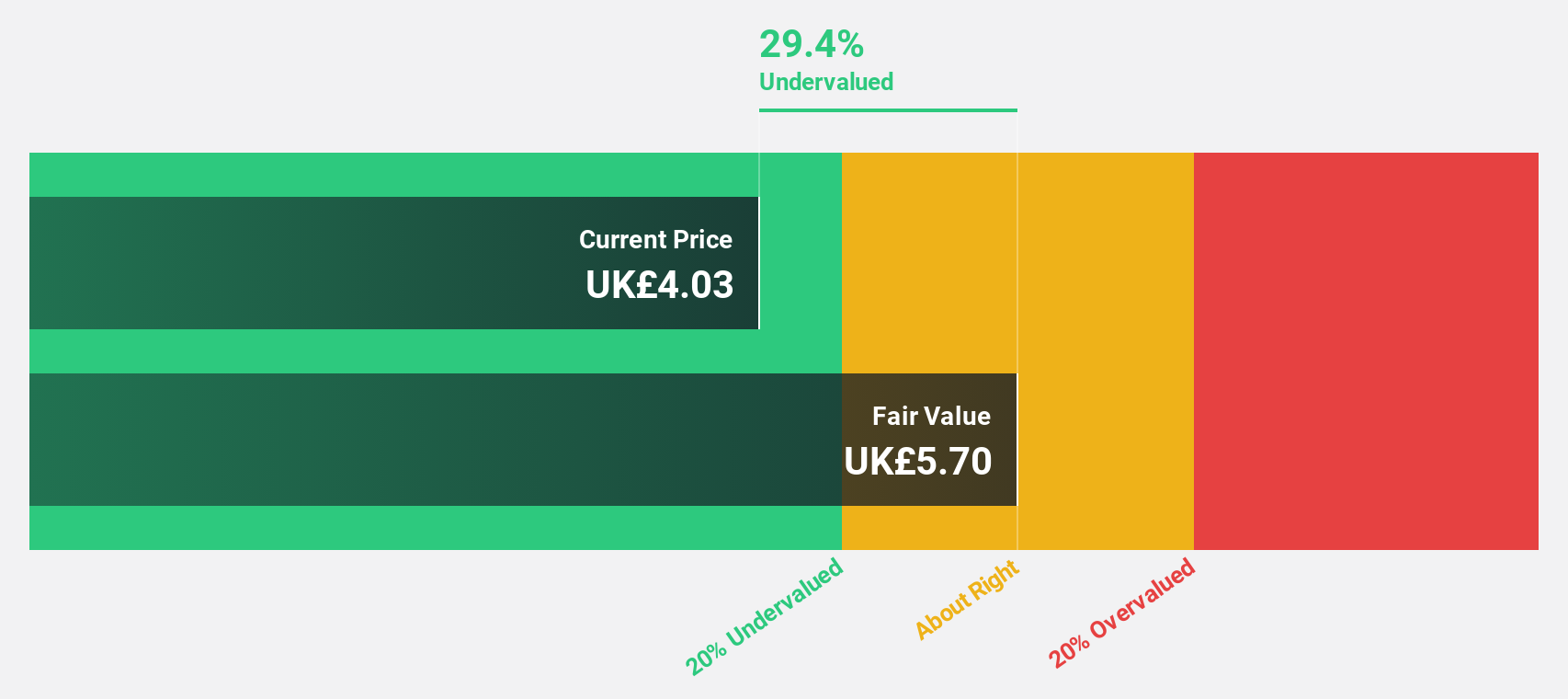

Foresight Group Holdings (LSE:FSG)

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the UK, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £520.28 million.

Operations: The company's revenue segments include £95.89 million from infrastructure, £50.52 million from private equity, and £7.58 million from Foresight Capital Management.

Estimated Discount To Fair Value: 12.7%

Foresight Group Holdings is trading at £4.56, slightly below its estimated fair value of £5.23, indicating potential undervaluation. Earnings grew by 25.8% last year and are forecast to rise significantly at 20.1% annually, outpacing the UK market's growth rate of 14.5%. Revenue is expected to grow by 10.3% per year, faster than the market average but not substantially high overall, while analysts anticipate a stock price increase of 35.7%.

- Our growth report here indicates Foresight Group Holdings may be poised for an improving outlook.

- Get an in-depth perspective on Foresight Group Holdings' balance sheet by reading our health report here.

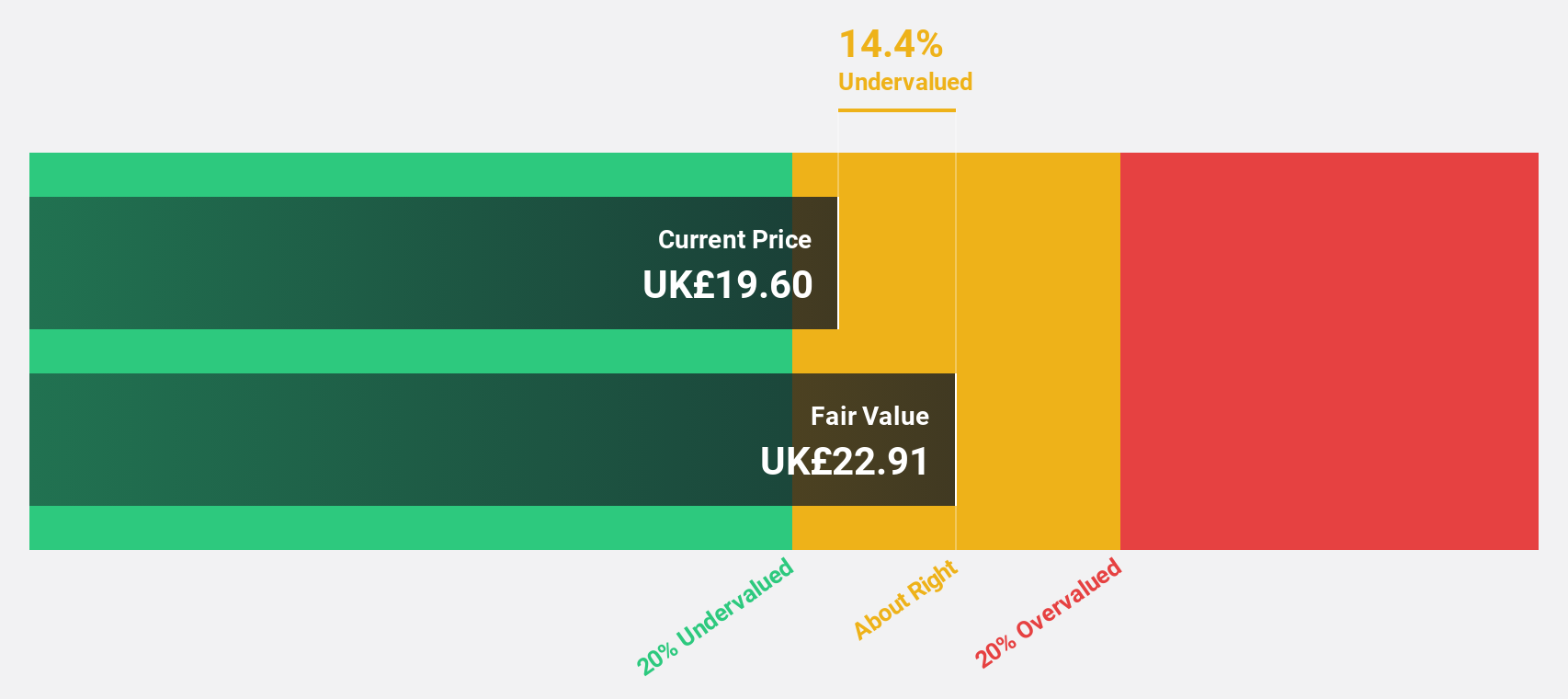

Genus (LSE:GNS)

Overview: Genus plc is a company that specializes in producing and selling animal genetics to farmers across various regions including North America, Latin America, the UK, Europe, the Middle East, Russia, Africa, and Asia with a market cap of £1.68 billion.

Operations: The company's revenue segments are comprised of Genus ABS, including Genus Asia, generating £307.70 million and Genus PIC, also including Genus Asia, contributing £362.90 million.

Estimated Discount To Fair Value: 26.1%

Genus is trading at £25.15, significantly below its estimated fair value of £34.05, suggesting it may be undervalued based on cash flows. The company's earnings grew by 144.3% over the past year and are forecast to rise at 27.5% annually, surpassing the UK market's growth rate of 14.5%. Despite a low forecasted return on equity of 11.6%, Genus's strategic alliances in China could enhance future revenue streams and provide balance sheet benefits through deleveraging opportunities.

- The growth report we've compiled suggests that Genus' future prospects could be on the up.

- Navigate through the intricacies of Genus with our comprehensive financial health report here.

Make It Happen

- Discover the full array of 52 Undervalued UK Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Produces and sells animal genetics to farmers in North America, Latin America, the United Kingdom, the rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives