- United Kingdom

- /

- Capital Markets

- /

- AIM:MAFL

3 Promising UK Penny Stocks With At Least £0 Market Cap

Reviewed by Simply Wall St

The UK market has been experiencing fluctuations, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market challenges, certain smaller or newer companies—often referred to as penny stocks—continue to offer unique opportunities for investors seeking potential growth. While the term 'penny stock' might seem outdated, it still signifies a category of investments that can provide both affordability and growth potential when backed by solid financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.97 | £479.09M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.30 | £866.67M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.25 | £160.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.30 | £82.01M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.34 | £332.18M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.476 | £227.64M | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ebiquity (AIM:EBQ)

Simply Wall St Financial Health Rating: ★★★★★☆

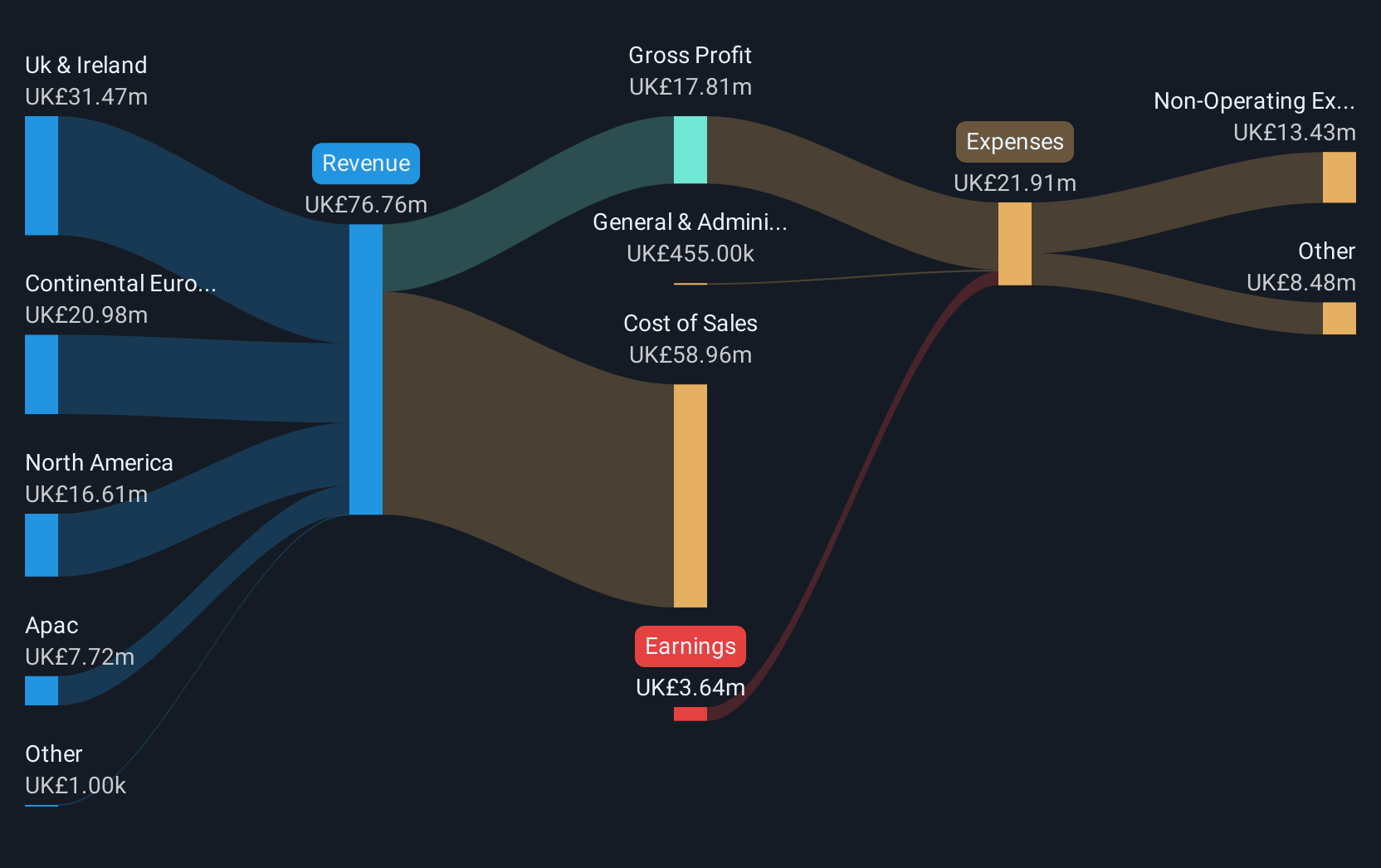

Overview: Ebiquity plc, operating with a market cap of £30.81 million, offers media consultancy and investment analysis services across the United Kingdom, Ireland, North America, Continental Europe, and the Asia Pacific.

Operations: The company generates revenue from several regions, including £31.58 million from the UK & Ireland, £19.95 million from Continental Europe, £17.19 million from North America, and £8.57 million from the Asia Pacific.

Market Cap: £30.81M

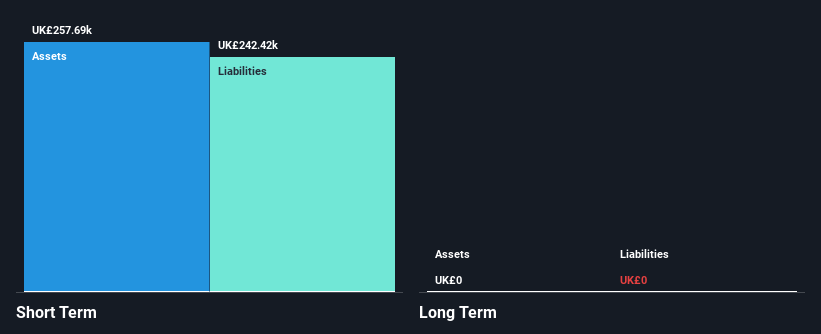

Ebiquity plc, with a market cap of £30.81 million, is currently unprofitable but shows potential for growth. The company forecasts earnings growth of over 100% annually and trades at a significant discount to its estimated fair value. Despite negative return on equity and increased debt levels over the past five years, Ebiquity maintains a satisfactory net debt to equity ratio of 38.3%. Its short-term assets exceed both short-term and long-term liabilities, ensuring financial stability. Recent leadership changes aim to drive profitable growth by transforming the business into a tech-enabled entity under new CEO Ruben Schreurs' guidance.

- Click here and access our complete financial health analysis report to understand the dynamics of Ebiquity.

- Assess Ebiquity's future earnings estimates with our detailed growth reports.

Katoro Gold (AIM:KAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Katoro Gold plc, with a market cap of £798,210, is involved in the exploration and development of mineral resources across the United Kingdom, Cyprus, South Africa, and Tanzania.

Operations: There are no reported revenue segments for the company.

Market Cap: £798.21k

Katoro Gold plc, with a market cap of £798,210, is pre-revenue and focuses on mineral exploration. Its short-term assets exceed liabilities, indicating some financial stability despite high volatility. The company recently expanded its Pearl Lithium Project in Ontario from 880 to 1,475 hectares through strategic collaboration with 31 Explore Ltd., enhancing its potential for lithium discovery. While Katoro has no long-term liabilities and has raised additional capital to extend its cash runway to five months, it remains unprofitable with a negative return on equity. Recent executive changes include the appointment of Patrick Cullen as CEO.

- Unlock comprehensive insights into our analysis of Katoro Gold stock in this financial health report.

- Evaluate Katoro Gold's historical performance by accessing our past performance report.

Mineral & Financial Investments (AIM:MAFL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mineral & Financial Investments Limited is an investment company that focuses on natural resources, minerals, metals, and oil and gas projects in the Cayman Islands, with a market cap of £7.94 million.

Operations: The company generates revenue of £2.57 million from its investments in natural resources, minerals, metals, and oil and gas projects.

Market Cap: £7.94M

Mineral & Financial Investments Limited, with a market cap of £7.94 million, shows potential in the penny stock segment through its focus on natural resources. The company reported revenue of £2.57 million for the year ended June 30, 2024, with net income rising to £2.01 million from £1.55 million previously, indicating profitability despite being pre-revenue by some measures. Its earnings growth over the past year outpaced both its historical average and industry peers, while maintaining high-quality earnings and improving profit margins. Additionally, it trades significantly below estimated fair value and has reduced debt levels over time.

- Take a closer look at Mineral & Financial Investments' potential here in our financial health report.

- Learn about Mineral & Financial Investments' historical performance here.

Seize The Opportunity

- Unlock our comprehensive list of 443 UK Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MAFL

Mineral & Financial Investments

An investment company, invests in natural resources, minerals, metals, and oil and gas projects in the Cayman Islands.

Outstanding track record and good value.

Market Insights

Community Narratives