- United Kingdom

- /

- Chemicals

- /

- AIM:HDD

Shareholders May Find It Hard To Justify Increasing Hardide plc's (LON:HDD) CEO Compensation For Now

The underwhelming share price performance of Hardide plc (LON:HDD) in the past three years would have disappointed many shareholders. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 15 March 2021. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for Hardide

Comparing Hardide plc's CEO Compensation With the industry

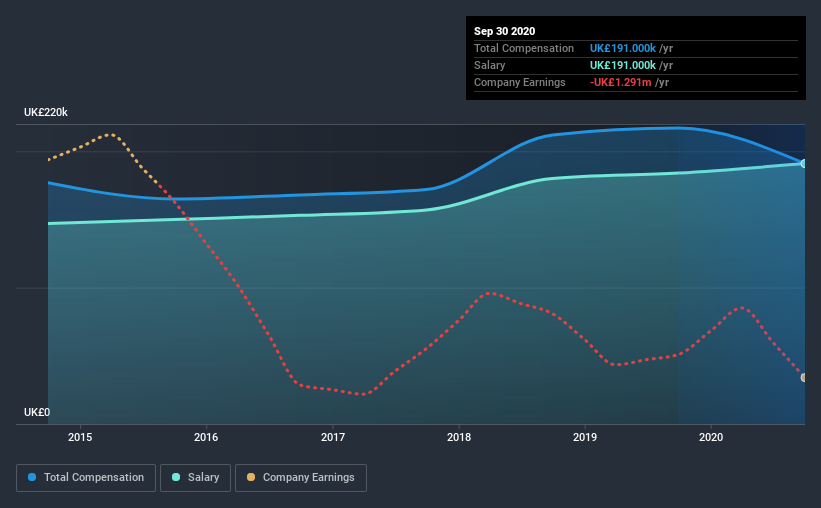

Our data indicates that Hardide plc has a market capitalization of UK£17m, and total annual CEO compensation was reported as UK£191k for the year to September 2020. We note that's a decrease of 12% compared to last year. It is worth noting that the CEO compensation consists entirely of the salary, worth UK£191k.

On comparing similar-sized companies in the industry with market capitalizations below UK£145m, we found that the median total CEO compensation was UK£218k. From this we gather that Philip Kirkham is paid around the median for CEOs in the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£191k | UK£184k | 100% |

| Other | - | UK£33k | - |

| Total Compensation | UK£191k | UK£217k | 100% |

Speaking on an industry level, nearly 65% of total compensation represents salary, while the remainder of 35% is other remuneration. On a company level, Hardide prefers to reward its CEO through a salary, opting not to pay Philip Kirkham through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Hardide plc's Growth

Hardide plc has seen its earnings per share (EPS) increase by 2.5% a year over the past three years. It saw its revenue drop 5.9% over the last year.

We would argue that the lack of revenue growth in the last year is less than ideal, but it is good to see a modest EPS growth at least. It's hard to reach a conclusion about business performance right now. This may be one to watch. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Hardide plc Been A Good Investment?

Few Hardide plc shareholders would feel satisfied with the return of -54% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Hardide pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 5 warning signs for Hardide (1 can't be ignored!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Hardide, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hardide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:HDD

Hardide

Engages in the provision of advanced tungsten carbide/tungsten metal matrix composite coatings in the United Kingdom, Europe, North America, and internationally.

High growth potential and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026