- United Kingdom

- /

- Metals and Mining

- /

- AIM:GFM

If You Had Bought Griffin Mining (LON:GFM) Shares Five Years Ago You'd Have Earned 471% Returns

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. For example, the Griffin Mining Limited (LON:GFM) share price is up a whopping 471% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 96% over the last quarter.

View our latest analysis for Griffin Mining

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Griffin Mining moved from a loss to profitability. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. So we might find other metrics can better explain the share price movements.

On the other hand, Griffin Mining's revenue is growing nicely, at a compound rate of 9.1% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

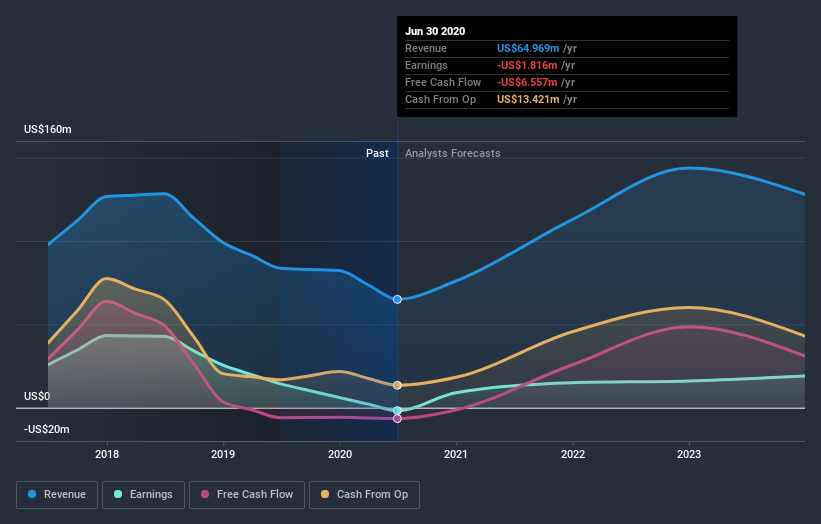

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Griffin Mining's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Griffin Mining shareholders have received a total shareholder return of 96% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 42% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Griffin Mining that you should be aware of before investing here.

We will like Griffin Mining better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Griffin Mining, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:GFM

Griffin Mining

A mining and investment company, engages in the mining, exploration, and development of mineral properties.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success