Brickability Group Plc (LON:BRCK) has announced that it will pay a dividend of £0.0112 per share on the 20th of February. This makes the dividend yield 5.6%, which is above the industry average.

Check out our latest analysis for Brickability Group

Brickability Group's Future Dividend Projections Appear Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, Brickability Group's profits didn't cover the dividend, but the company was generating enough cash instead. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 51% which is fairly sustainable.

Brickability Group Is Still Building Its Track Record

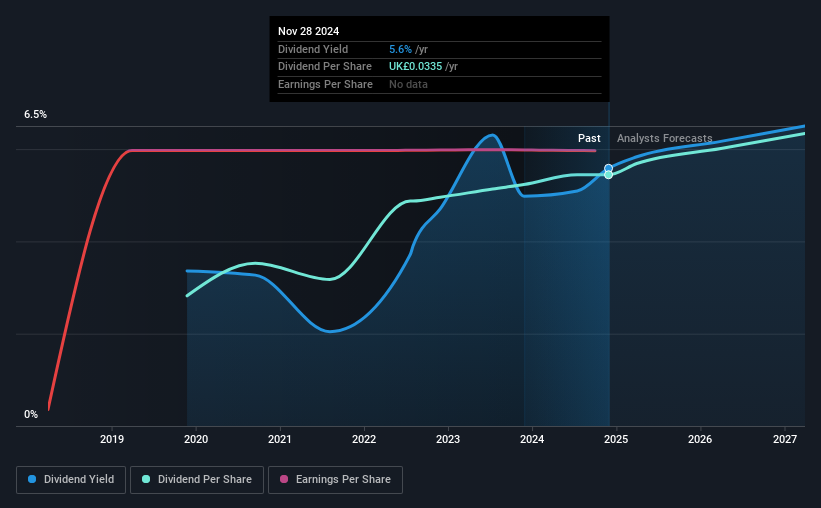

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. The annual payment during the last 5 years was £0.0174 in 2019, and the most recent fiscal year payment was £0.0335. This implies that the company grew its distributions at a yearly rate of about 14% over that duration. Brickability Group has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Dividend Growth May Be Hard To Come By

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. In the last five years, Brickability Group's earnings per share has shrunk at approximately 5.2% per annum. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think Brickability Group's payments are rock solid. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 3 warning signs for Brickability Group that you should be aware of before investing. Is Brickability Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Brickability Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:BRCK

Brickability Group

Distributes specialist products and services to the construction industry in the United Kingdom.It operates through four segments: Bricks and Building Materials; Importing; Distribution; and Contracting.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives