- United Kingdom

- /

- Metals and Mining

- /

- AIM:AAZ

Should You Buy Anglo Asian Mining PLC (LON:AAZ) For Its Upcoming Dividend In 3 Days?

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Anglo Asian Mining PLC (LON:AAZ) is about to go ex-dividend in just 3 days. You will need to purchase shares before the 3rd of October to receive the dividend, which will be paid on the 31st of October.

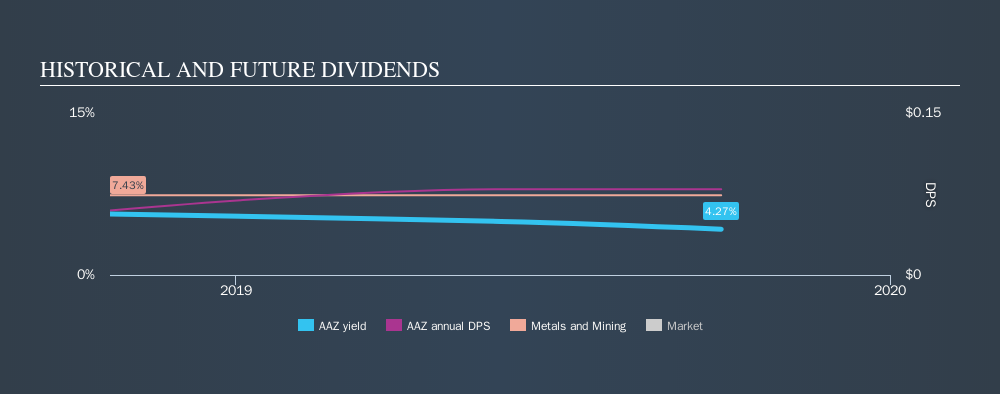

Anglo Asian Mining's next dividend payment will be UK£0.04 per share, on the back of last year when the company paid a total of UK£0.08 to shareholders. Last year's total dividend payments show that Anglo Asian Mining has a trailing yield of 4.3% on the current share price of £1.52. If you buy this business for its dividend, you should have an idea of whether Anglo Asian Mining's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Anglo Asian Mining

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately Anglo Asian Mining's payout ratio is modest, at just 48% of profit. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 15% of its free cash flow as dividends last year, which is conservatively low.

It's positive to see that Anglo Asian Mining's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's comforting to see Anglo Asian Mining's earnings have been skyrocketing, up 120% per annum for the past five years. Earnings per share have been growing very quickly, and the company is paying out a relatively low percentage of its profit and cash flow. This is a very favourable combination that can often lead to the dividend multiplying over the long term, if earnings grow and the company pays out a higher percentage of its earnings.

Given that Anglo Asian Mining has only been paying a dividend for a year, there's not much of a past history to draw insight from.

The Bottom Line

Should investors buy Anglo Asian Mining for the upcoming dividend? We love that Anglo Asian Mining is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. These characteristics suggest the company is reinvesting in growing its business, while the conservative payout ratio also implies a reduced risk of the dividend being cut in the future. There's a lot to like about Anglo Asian Mining, and we would prioritise taking a closer look at it.

Wondering what the future holds for Anglo Asian Mining? See what the two analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:AAZ

Anglo Asian Mining

Owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026