- United Kingdom

- /

- Metals and Mining

- /

- AIM:AAZ

Anglo Asian Mining PLC's (LON:AAZ) 36% Price Boost Is Out Of Tune With Revenues

Anglo Asian Mining PLC (LON:AAZ) shareholders have had their patience rewarded with a 36% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

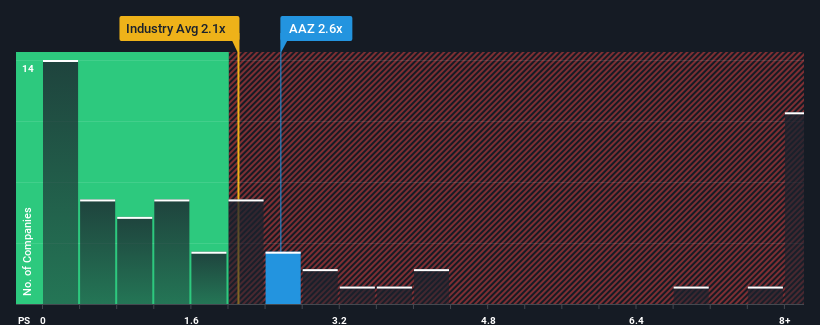

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Anglo Asian Mining's P/S ratio of 2.6x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in the United Kingdom is also close to 2.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Anglo Asian Mining

How Anglo Asian Mining Has Been Performing

For example, consider that Anglo Asian Mining's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Anglo Asian Mining, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Anglo Asian Mining?

The only time you'd be comfortable seeing a P/S like Anglo Asian Mining's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 46%. As a result, revenue from three years ago have also fallen 55% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 1.1% shows it's an unpleasant look.

With this information, we find it concerning that Anglo Asian Mining is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On Anglo Asian Mining's P/S

Anglo Asian Mining's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We find it unexpected that Anglo Asian Mining trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Having said that, be aware Anglo Asian Mining is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

If these risks are making you reconsider your opinion on Anglo Asian Mining, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AAZ

Anglo Asian Mining

Owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives