- United Kingdom

- /

- Personal Products

- /

- LSE:PZC

Lacklustre Performance Is Driving PZ Cussons plc's (LON:PZC) 30% Price Drop

PZ Cussons plc (LON:PZC) shares have had a horrible month, losing 30% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 45% share price drop.

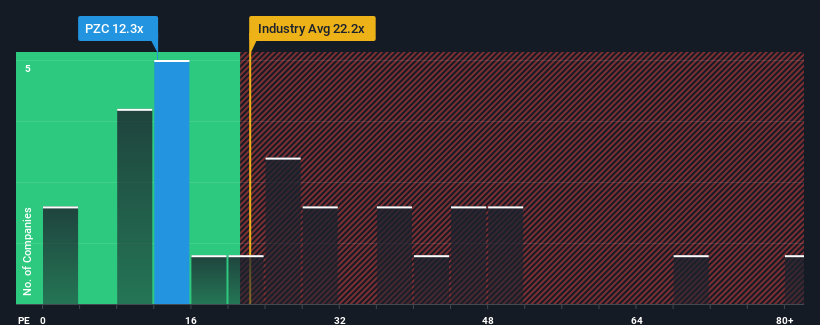

Since its price has dipped substantially, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 15x, you may consider PZ Cussons as an attractive investment with its 12.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

PZ Cussons has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for PZ Cussons

Is There Any Growth For PZ Cussons?

The only time you'd be truly comfortable seeing a P/E as low as PZ Cussons' is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. Still, the latest three year period has seen an excellent 189% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 0.8% per annum over the next three years. That's not great when the rest of the market is expected to grow by 11% per year.

With this information, we are not surprised that PZ Cussons is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On PZ Cussons' P/E

PZ Cussons' P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of PZ Cussons' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - PZ Cussons has 3 warning signs (and 1 which is significant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:PZC

PZ Cussons

Manufactures, distributes, markets, and sells baby, beauty, and hygiene products in Europe, the Asia Pacific, the Americas, and Africa.

Very undervalued with moderate growth potential.

Market Insights

Community Narratives