- United Kingdom

- /

- Oil and Gas

- /

- AIM:YCA

Discovering September 2024's Undiscovered Gems in the United Kingdom

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has remained flat, but it has risen 7.1% over the past 12 months with earnings forecast to grow by 14% annually. In this promising environment, identifying stocks with strong potential can be key to capitalizing on future growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, with a market cap of £447.80 million, produces and sells cosmetics through its subsidiaries.

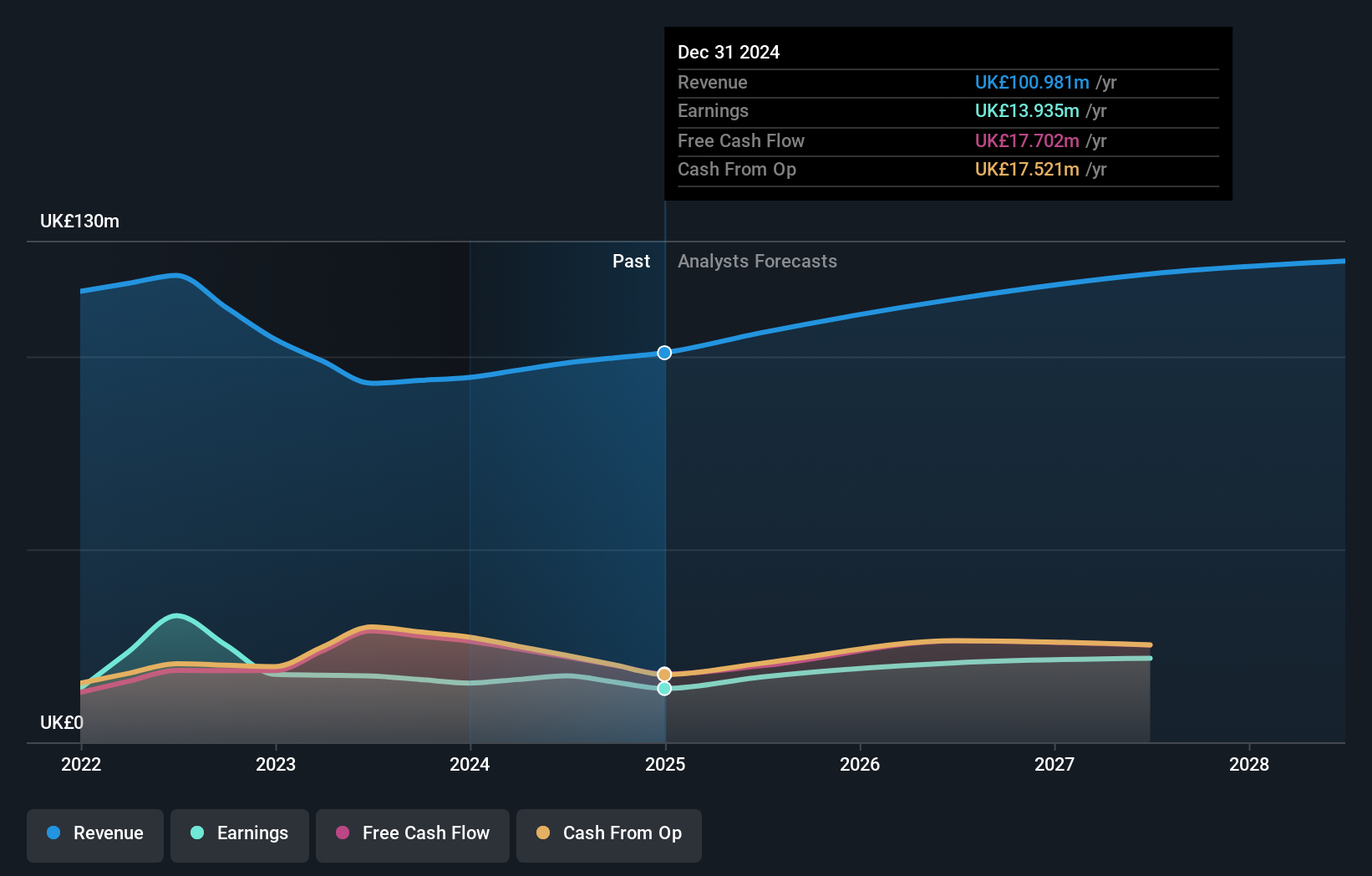

Operations: The company generates revenue primarily from its Own Brand segment (£96.72 million) and a smaller portion from Close-Out sales (£2.12 million).

Warpaint London, a nimble player in the UK's personal products sector, has shown impressive earnings growth of 106.1% over the past year, outpacing its industry. The company is debt-free and reported sales of £45.85 million for H1 2024, up from £36.69 million in H1 2023. Net income also rose to £8.02 million from £4.78 million a year ago, highlighting robust performance despite recent share price volatility and significant insider selling over the past three months.

- Unlock comprehensive insights into our analysis of Warpaint London stock in this health report.

Assess Warpaint London's past performance with our detailed historical performance reports.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc operates in the uranium sector with a market cap of £1.23 billion.

Operations: Yellow Cake plc generates revenue primarily from holding U3O8 for long-term capital appreciation, amounting to $735.02 million.

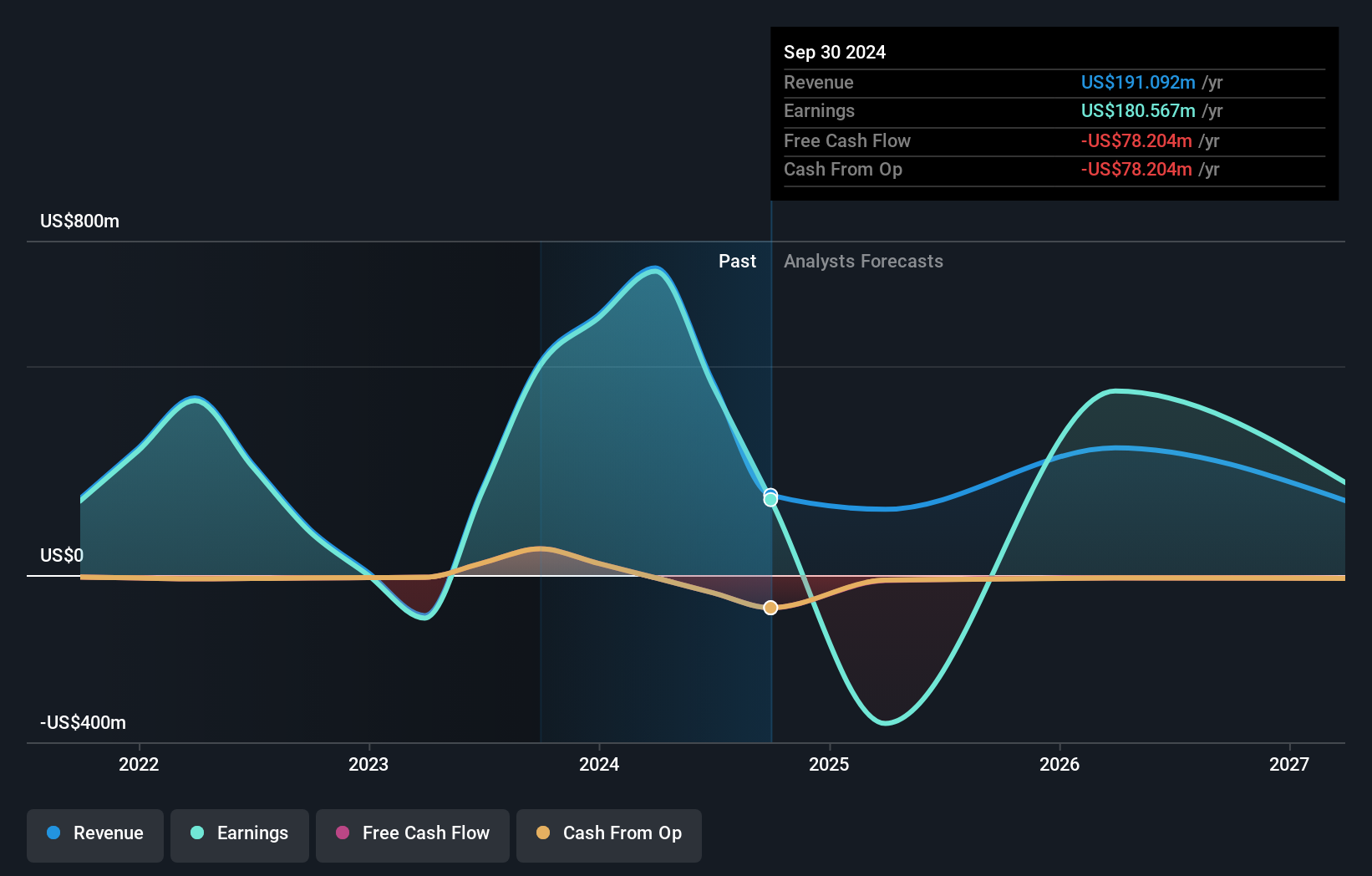

Yellow Cake has shown remarkable performance, achieving profitability this year with net income of US$727.01 million compared to a net loss of US$102.94 million last year. The company boasts a Price-To-Earnings ratio of 2.3x, significantly below the UK market average of 16.9x, indicating good value. Despite becoming profitable recently, earnings are forecasted to decline by an average of 91% annually over the next three years due to industry volatility and non-cash earnings adjustments.

- Navigate through the intricacies of Yellow Cake with our comprehensive health report here.

Evaluate Yellow Cake's historical performance by accessing our past performance report.

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Wilmington plc, with a market cap of £364.01 million, offers information, data, training, and education solutions to professional markets across the United Kingdom, Europe, North America, and internationally.

Operations: Wilmington derives its revenue primarily from the Finance segment (£68.85 million) and Legal segment (£15.99 million), with additional contributions from Health, Safety, and Environment (HSE) (£4.84 million).

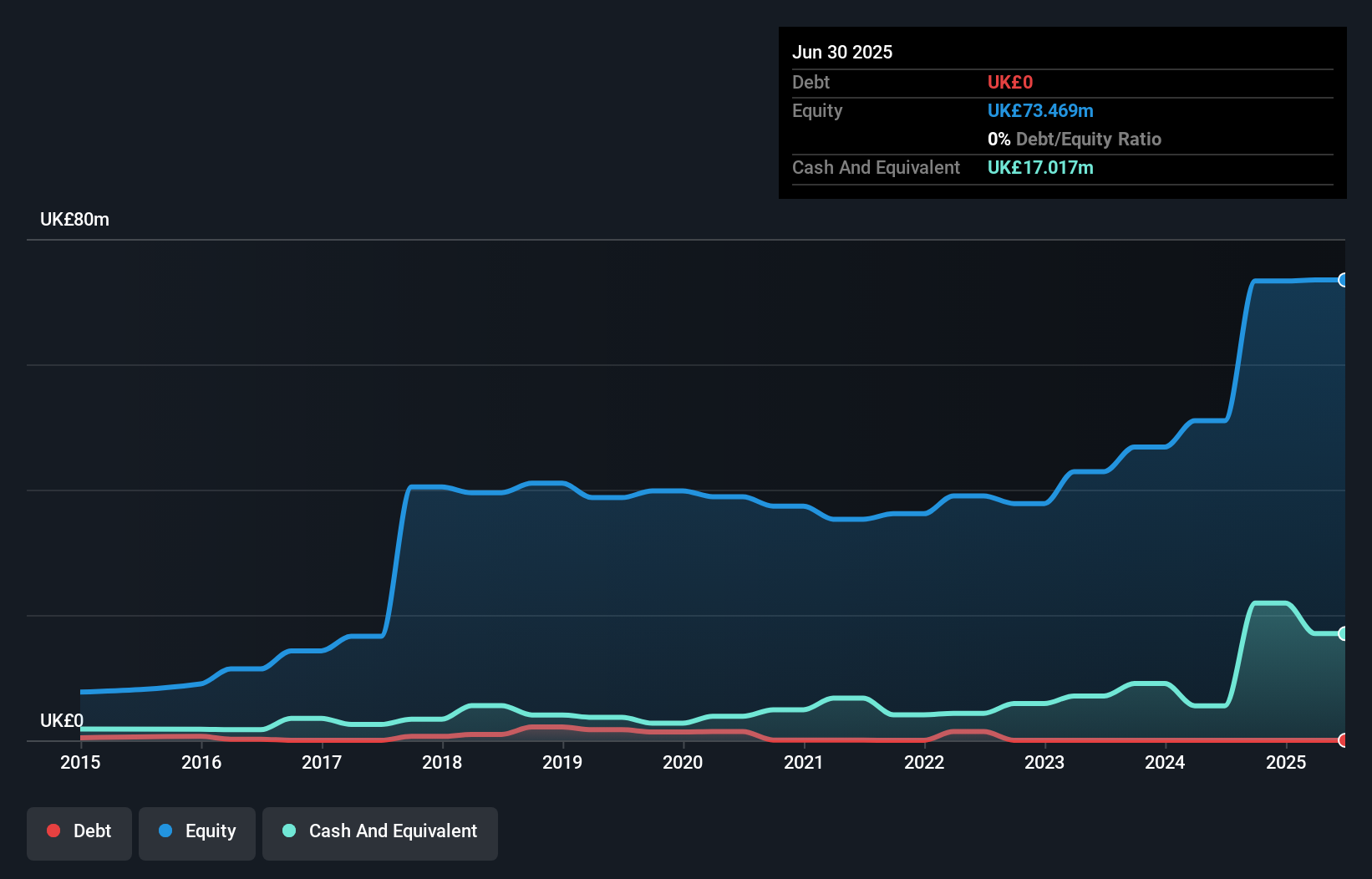

Wilmington, a UK-based professional services firm, reported full-year sales of £98.32 million, up from £93.07 million the previous year. Net income surged to £41.21 million from £20.2 million, reflecting strong performance despite a -14.8% earnings growth over the past year compared to the industry average of -12.2%. The company is debt-free and trading at 33.9% below its estimated fair value, indicating potential undervaluation for investors seeking quality earnings and stability in dividends, which increased by 13% this year to 11.3 pence per share.

- Click to explore a detailed breakdown of our findings in Wilmington's health report.

Explore historical data to track Wilmington's performance over time in our Past section.

Taking Advantage

- Delve into our full catalog of 80 UK Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YCA

Flawless balance sheet and good value.