- United Kingdom

- /

- Medical Equipment

- /

- AIM:EKF

EKF Diagnostics Holdings plc's (LON:EKF) Has Performed Well But Fundamentals Look Varied: Is There A Clear Direction For The Stock?

Most readers would already know that EKF Diagnostics Holdings' (LON:EKF) stock increased by 8.8% over the past three months. However, the company's financials look a bit inconsistent and market outcomes are ultimately driven by long-term fundamentals, meaning that the stock could head in either direction. In this article, we decided to focus on EKF Diagnostics Holdings' ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for EKF Diagnostics Holdings

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for EKF Diagnostics Holdings is:

8.4% = UK£6.6m ÷ UK£79m (Based on the trailing twelve months to June 2020).

The 'return' is the amount earned after tax over the last twelve months. That means that for every £1 worth of shareholders' equity, the company generated £0.08 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

EKF Diagnostics Holdings' Earnings Growth And 8.4% ROE

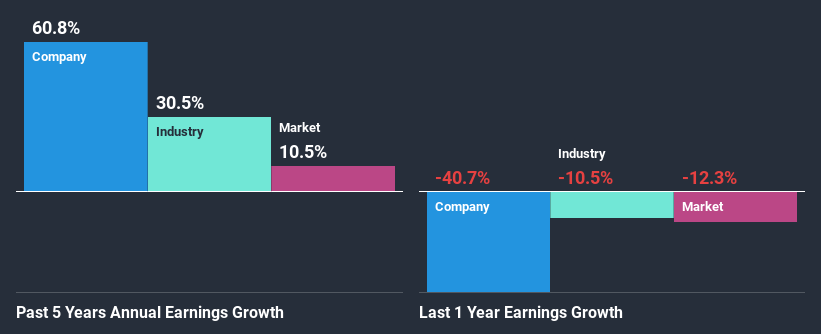

On the face of it, EKF Diagnostics Holdings' ROE is not much to talk about. Yet, a closer study shows that the company's ROE is similar to the industry average of 7.7%. Moreover, we are quite pleased to see that EKF Diagnostics Holdings' net income grew significantly at a rate of 61% over the last five years. Taking into consideration that the ROE is not particularly high, we reckon that there could also be other factors at play which could be influencing the company's growth. For instance, the company has a low payout ratio or is being managed efficiently.

We then compared EKF Diagnostics Holdings' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 30% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if EKF Diagnostics Holdings is trading on a high P/E or a low P/E, relative to its industry.

Is EKF Diagnostics Holdings Making Efficient Use Of Its Profits?

The high three-year median payout ratio of 90% (implying that it keeps only 9.5% of profits) for EKF Diagnostics Holdings suggests that the company's growth wasn't really hampered despite it returning most of the earnings to its shareholders.

Along with seeing a growth in earnings, EKF Diagnostics Holdings only recently started paying dividends. Its quite possible that the company was looking to impress its shareholders. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 55% over the next three years.

Conclusion

Overall, we have mixed feelings about EKF Diagnostics Holdings. While the company has posted impressive earnings growth, its poor ROE and low earnings retention makes us doubtful if that growth could continue, if by any chance the business is faced with any sort of risk. With that said, on studying the latest analyst forecasts, we found that while the company has seen growth in its past earnings, analysts expect its future earnings to shrink. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you decide to trade EKF Diagnostics Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EKF Diagnostics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:EKF

EKF Diagnostics Holdings

Engages in the design, development, manufacture, and sale of diagnostic instruments, reagents, and other ancillary products in the Americas, Europe, the Middle East, Asia, Africa, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives