- United Kingdom

- /

- Beverage

- /

- LSE:DGE

Examining Diageo (LSE:DGE) Valuation Following Recent Share Price Slide

Reviewed by Simply Wall St

Diageo (LSE:DGE) has turned heads lately, with many investors wondering what’s really behind its ongoing share price slide. Even without a specific headline-grabbing event, the recent selloff puts the drinks giant front and center for anyone weighing whether this downward drift is a signal or just noise. For investors familiar with Diageo’s lineup of global brands, this kind of move is bound to fuel some healthy debate about where value and opportunity might intersect next.

Looking at the numbers, Diageo’s shares have drifted down this year, a decline that stands out given the company’s steady revenue and stronger growth in net profits. Short-term momentum hasn’t built much either, as the stock’s performance over the past month and quarter lags its historic highs. This subdued trend comes despite the company posting annual net income growth above 12%. Yet, the bigger picture shows that three-year and five-year returns have been negative, suggesting longer-term holders have not seen rewards keep pace with the broader market.

So the real question for investors is clear: with the stock’s recent slide and hints of stronger profitability, is Diageo undervalued at these levels, or are investors simply anticipating slower growth in years ahead?

Most Popular Narrative: 16.7% Undervalued

According to the most widely followed narrative, Diageo is trading at a notable discount to its estimated fair value. This suggests that the market may not be fully reflecting the company’s long-term earnings potential and planned growth strategy.

"Diageo is intensifying its focus on premiumization and category expansion, notably in tequila and ready-to-drink beverages, to capture rising consumer affluence and elevated brand preferences in both emerging and developed markets. This supports future revenue growth and gross margin expansion. The company is executing a multiyear overhaul to deepen locally tailored, occasion-led marketing and distribution strategies across key regions. In doing so, it is positioning itself to leverage demographic shifts such as urbanization and a growing legal drinking-age population, which are expected to drive volume and sales momentum over the long term."

Curious why this valuation bucks the market trend? The potential reason behind the projected upside is a blend of bold portfolio shifts and aggressive margin ambitions. However, there is a critical assumption about future growth driving these numbers. What could analysts be seeing that others aren’t? Take a closer look at the full narrative to discover the financial levers and expectations shaping Diageo's price target.

Result: Fair Value of £23.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts toward alcohol moderation and stricter regulations could dampen Diageo’s growth narrative if consumer habits or market conditions change unexpectedly.

Find out about the key risks to this Diageo narrative.Another View: Market-Based Valuation Paints a Different Picture

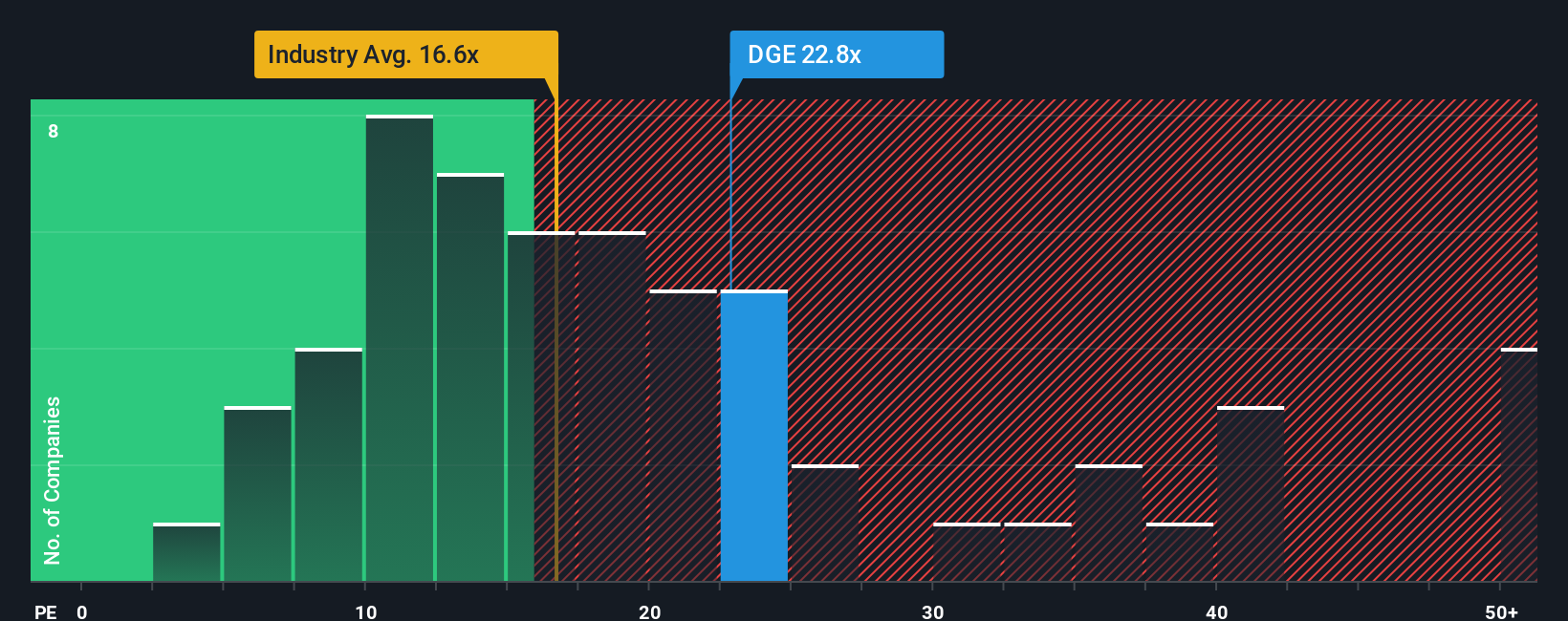

While some see long-term earnings potential, the market’s pricing using this yardstick suggests Diageo is trading higher than its industry average. Does this mean the current discount to fair value is overstated?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Diageo to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Diageo Narrative

If you have a different perspective or want to dig deeper into the numbers, you can craft your own Diageo narrative in just a few minutes using Do it your way.

A great starting point for your Diageo research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors always keep fresh opportunities in their sights. Don’t let others get ahead. Use these handpicked screens to uncover strong contenders now:

- Catch explosive potential in up-and-coming companies showing solid fundamentals with our list of penny stocks with strong financials.

- Tap into the surge of medical innovation driving real-world impact by checking out healthcare AI stocks.

- Collect reliable income and steady growth from our selection of dividend stocks with yields > 3%, set to reward shareholders year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About LSE:DGE

Diageo

Engages in the production, marketing, and distribution of alcoholic beverages in North America, Europe, the Asia Pacific, Latin America and Caribbean, and Africa.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success