Stock Analysis

- United Kingdom

- /

- Biotech

- /

- LSE:GNS

Undervalued Small Caps With Insider Buying In United Kingdom October 2024

Reviewed by Simply Wall St

Amidst a challenging environment for the United Kingdom's markets, with the FTSE 100 and FTSE 250 indices recently closing lower due to weak trade data from China, investors are increasingly focusing on small-cap stocks that might offer potential opportunities. In such a climate, identifying small-cap companies with strategic insider buying can be an indicator of confidence in their future prospects despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 26.0x | 5.9x | 6.38% | ★★★★★☆ |

| NWF Group | 8.8x | 0.1x | 34.54% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 25.76% | ★★★★★☆ |

| CVS Group | 28.9x | 1.2x | 37.54% | ★★★★☆☆ |

| Essentra | 718.3x | 1.4x | 27.43% | ★★★★☆☆ |

| Genus | 178.9x | 2.1x | -6.35% | ★★★★☆☆ |

| Marlowe | NA | 0.8x | 39.74% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 41.35% | ★★★★☆☆ |

| Harworth Group | 11.8x | 6.2x | -572.62% | ★★★☆☆☆ |

| Oxford Instruments | 22.8x | 2.5x | -28.03% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

C&C Group (LSE:CCR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: C&C Group is a beverage company focusing on the production and distribution of cider, beer, wine, spirits, and soft drinks across Ireland and Great Britain with a market capitalization of approximately €1.17 billion.

Operations: The company's revenue primarily comes from its operations in Great Britain and Ireland, with Great Britain contributing significantly more to the total. Over recent periods, the gross profit margin has shown fluctuations, reaching 23.05% in February 2024. The cost of goods sold (COGS) consistently represents a substantial portion of revenue, impacting overall profitability. Operating expenses have also been significant, with general and administrative expenses forming a major part of these costs.

PE: -6.6x

C&C Group, a smaller company in the UK market, is gaining attention due to its potential for growth and recent strategic moves. While the company's liabilities are entirely from external borrowing, which carries more risk than customer deposits, earnings are forecasted to grow at 77% annually. Insider confidence is evident with share repurchases starting September 2024 under a €15 million program. The recent appointment of Sanjay Nakra as an independent director brings significant finance expertise to the board, potentially steering future growth positively.

- Navigate through the intricacies of C&C Group with our comprehensive valuation report here.

Evaluate C&C Group's historical performance by accessing our past performance report.

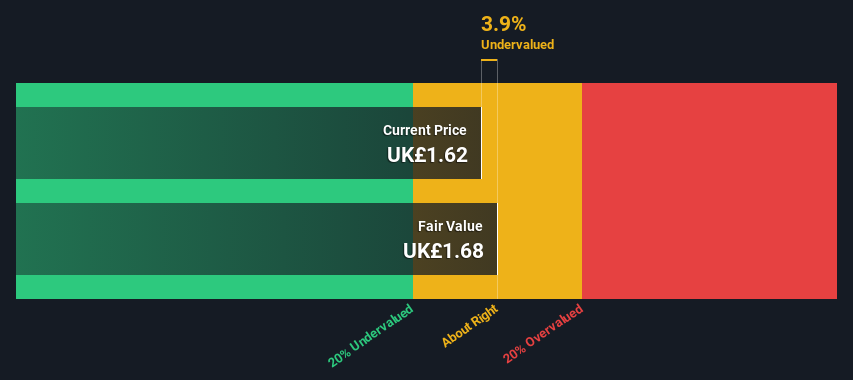

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates as a leading pizza delivery and carryout chain, generating income through sales to franchisees, corporate stores, advertising and ecommerce, property rentals, and various franchise fees, with a market capitalization of approximately £1.75 billion.

Operations: The company's revenue streams are primarily derived from sales to franchisees, corporate store income, and royalties. The gross profit margin has shown an upward trend over time, reaching 47.48% in the most recent period. Operating expenses include significant allocations towards general and administrative expenses as well as sales and marketing efforts.

PE: 15.2x

Domino's Pizza Group, a smaller UK-based company, is navigating financial challenges with strategic initiatives. Despite a drop in net income to £42.3 million for H1 2024 from £80.2 million the previous year, they remain confident about growth prospects and have announced share repurchases authorized by shareholders. The company has repurchased 6.12% of shares since May 2023 for £90.1 million, aiming to boost shareholder value amidst fluctuating profit margins and high debt levels.

- Delve into the full analysis valuation report here for a deeper understanding of Domino's Pizza Group.

Gain insights into Domino's Pizza Group's past trends and performance with our Past report.

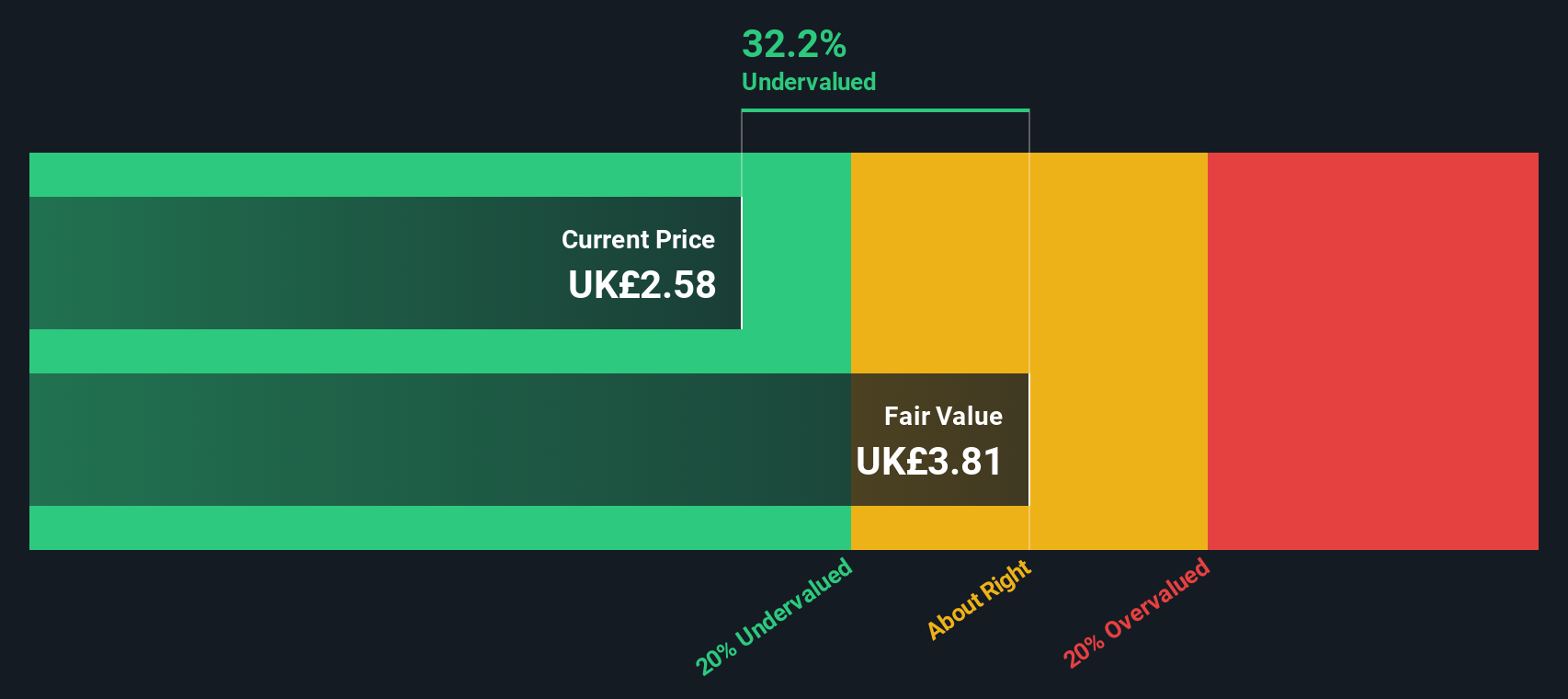

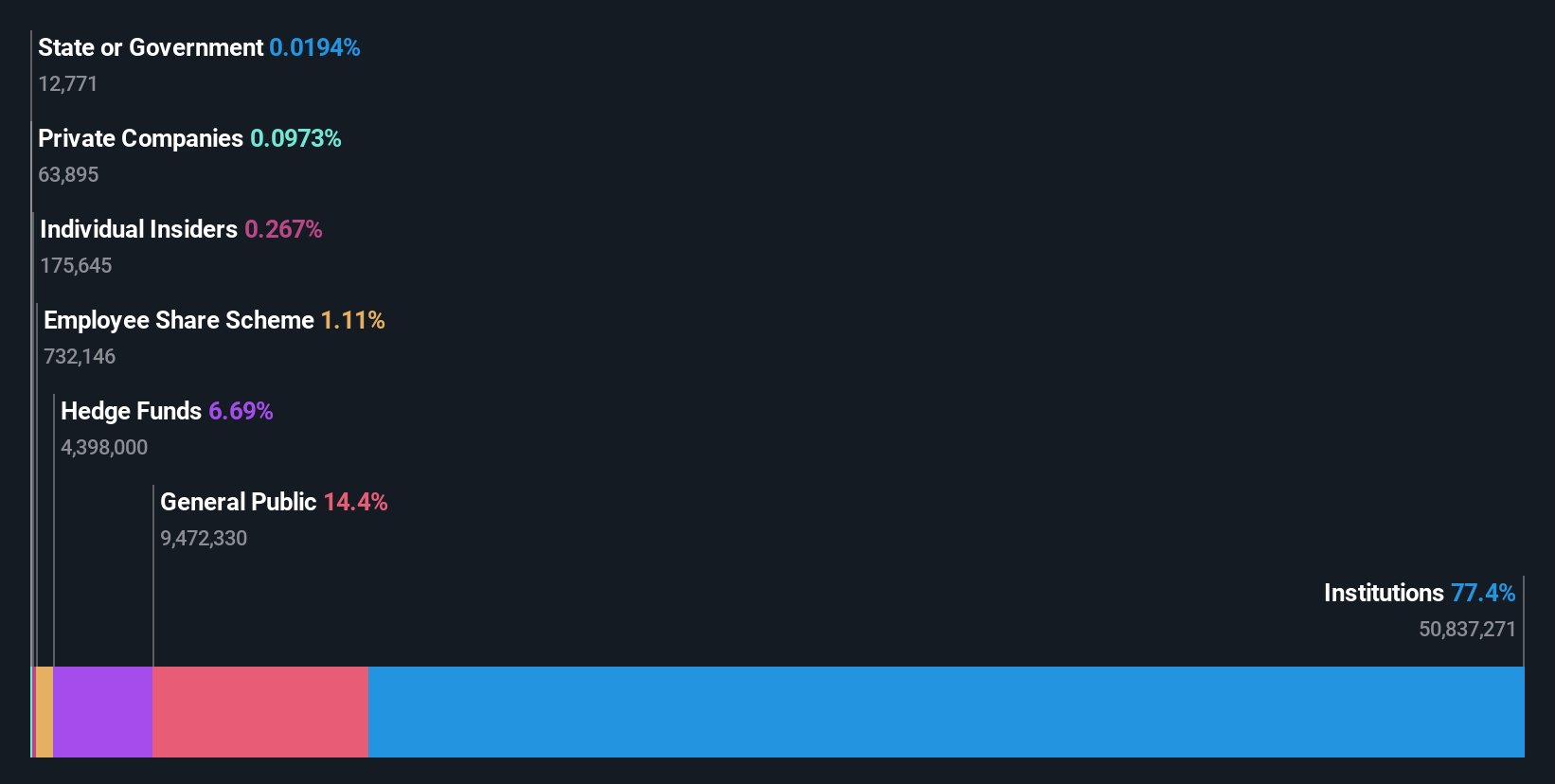

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Genus is a biotechnology company specializing in animal genetics, with operations focused on Genus ABS and Genus PIC segments, and has a market cap of approximately £1.58 billion.

Operations: Genus generates revenue primarily from its Genus ABS and Genus PIC segments, with recent financial data showing a gross profit margin reaching as high as 68.02% in March 2024. The company experiences significant operating expenses, which have impacted its net income margins over the years.

PE: 178.9x

Genus, a UK-based company, recently reported a dip in net income to £7.9 million from £33.3 million the previous year, despite sales of £668.8 million. Profit margins have decreased to 1.2%, down from 4.8%. The company's earnings are forecasted to grow at an impressive rate of 37% annually, highlighting potential for future growth despite current challenges. Insider confidence is evident through recent share purchases, suggesting belief in long-term prospects amidst external borrowing risks and consistent dividend payouts.

- Unlock comprehensive insights into our analysis of Genus stock in this valuation report.

Gain insights into Genus' historical performance by reviewing our past performance report.

Summing It All Up

- Embark on your investment journey to our 25 Undervalued UK Small Caps With Insider Buying selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Operates as an animal genetics company in North America, Latin America, the United Kingdom, rest of Europe, the Middle East, Russia, Africa, and Asia.