- United Kingdom

- /

- Oil and Gas

- /

- LSE:ZEN

We Think Shareholders Are Less Likely To Approve A Pay Rise For Zenith Energy Ltd.'s (LON:ZEN) CEO For Now

Key Insights

- Zenith Energy to hold its Annual General Meeting on 12th of October

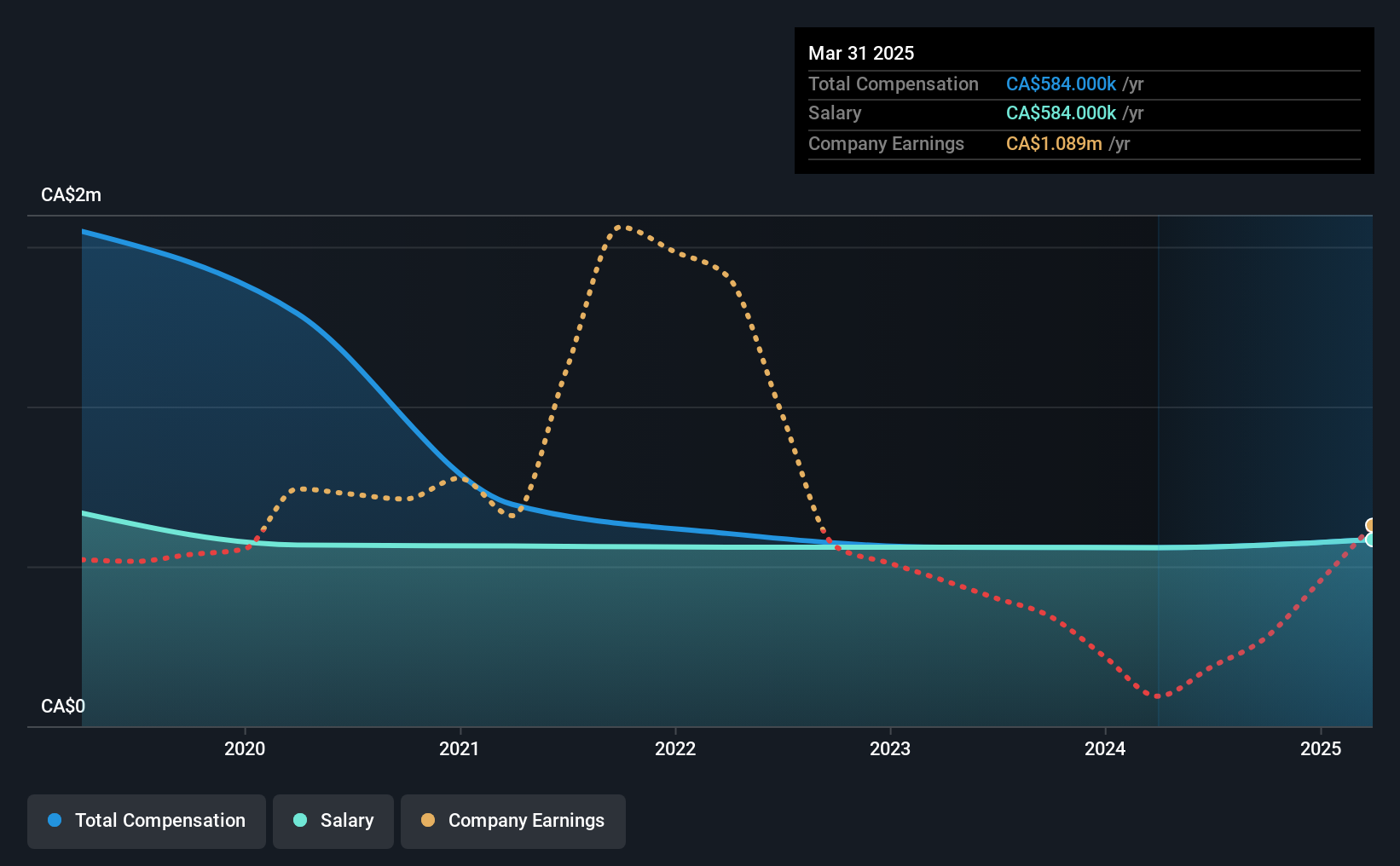

- Salary of CA$584.0k is part of CEO Adorno Cattaneo's total remuneration

- Total compensation is similar to the industry average

- Zenith Energy's three-year loss to shareholders was 61% while its EPS was down 82% over the past three years

In the past three years, the share price of Zenith Energy Ltd. (LON:ZEN) has struggled to grow and now shareholders are sitting on a loss. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 12th of October, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

See our latest analysis for Zenith Energy

Comparing Zenith Energy Ltd.'s CEO Compensation With The Industry

According to our data, Zenith Energy Ltd. has a market capitalization of UK£19m, and paid its CEO total annual compensation worth CA$584k over the year to March 2025. That's a fairly small increase of 4.5% over the previous year. It is worth noting that the CEO compensation consists entirely of the salary, worth CA$584k.

For comparison, other companies in the British Oil and Gas industry with market capitalizations below UK£148m, reported a median total CEO compensation of CA$584k. This suggests that Zenith Energy remunerates its CEO largely in line with the industry average. What's more, Adorno Cattaneo holds UK£2.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | CA$584k | CA$559k | 100% |

| Other | - | - | - |

| Total Compensation | CA$584k | CA$559k | 100% |

On an industry level, around 66% of total compensation represents salary and 34% is other remuneration. Speaking on a company level, Zenith Energy prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Zenith Energy Ltd.'s Growth Numbers

Over the last three years, Zenith Energy Ltd. has shrunk its earnings per share by 82% per year. It achieved revenue growth of 20% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Zenith Energy Ltd. Been A Good Investment?

With a total shareholder return of -61% over three years, Zenith Energy Ltd. shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Zenith Energy rewards its CEO solely through a salary, ignoring non-salary benefits completely. The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 7 warning signs for Zenith Energy (of which 4 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Zenith Energy, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Zenith Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ZEN

Zenith Energy

Engages in the exploration, development and production of oil and natural gas in Tunisia, Italy, and internationally.

Medium-low risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success