- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

UK Growth Companies With High Insider Ownership September 2024

Reviewed by Simply Wall St

The United Kingdom market has shown resilience, with the Materials sector gaining 3.6% while the overall market remained flat over the last week and up 6.8% over the past year. In this environment of steady growth and optimistic earnings forecasts, identifying growth companies with high insider ownership can be particularly advantageous as it often signals strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.1% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.3% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Tortilla Mexican Grill (AIM:MEX) | 27.4% | 79.5% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

We're going to check out a few of the best picks from our screener tool.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc engages in the exploration, production, and development of oil and gas, with a market cap of £1.72 billion.

Operations: The company generates revenue primarily from its oil and gas exploration and production segment, which accounted for $1.69 billion.

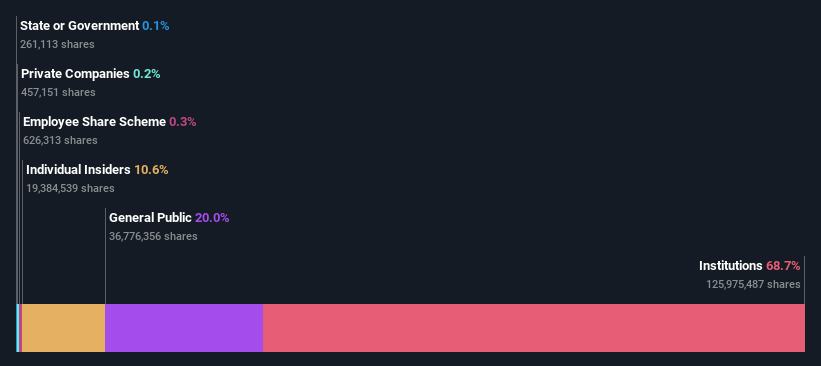

Insider Ownership: 10.6%

Earnings Growth Forecast: 27.4% p.a.

Energean plc, a growth company with high insider ownership, recently reported record production levels and significant year-on-year increases in both group and continuing operations output. H1 2024 saw sales of US$642.41 million and net income of US$88.54 million. The company has also initiated the Cassiopea field in Italy and taken a Final Investment Decision for the Katlan project in Israel, which will bolster future production. Despite some past shareholder dilution, earnings are forecast to grow 27.4% annually, outpacing UK market averages.

- Click here to discover the nuances of Energean with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Energean's share price might be too pessimistic.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the UK, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £621.48 million.

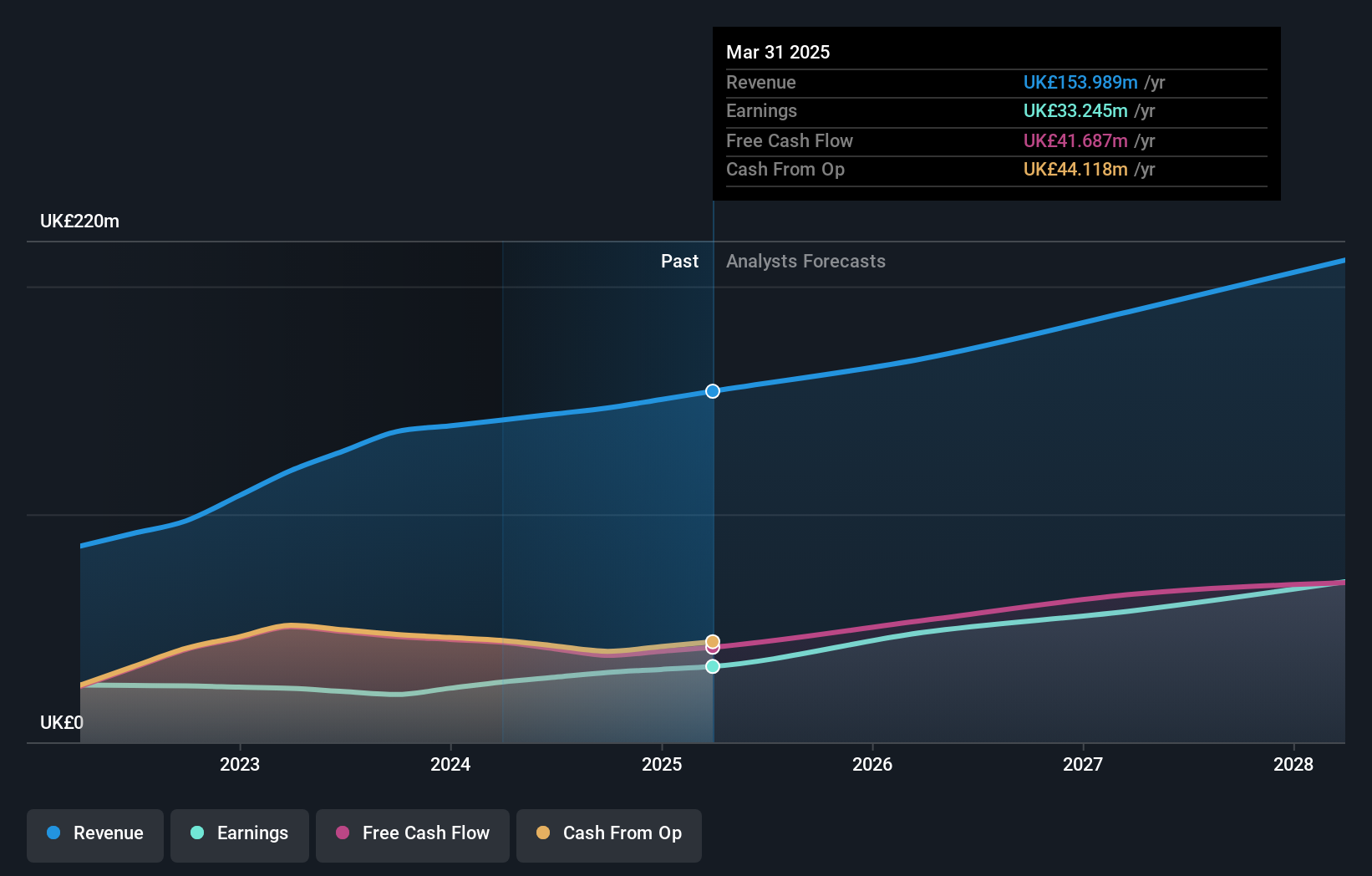

Operations: The company's revenue segments include £84.17 million from Infrastructure, £47.35 million from Private Equity, and £9.80 million from Foresight Capital Management.

Insider Ownership: 31.8%

Earnings Growth Forecast: 27.9% p.a.

Foresight Group Holdings has demonstrated strong growth potential with earnings projected to increase by 27.88% annually, significantly outpacing the UK market average. The company reported sales of £141.33 million and net income of £26.43 million for the fiscal year ending March 2024, reflecting solid financial performance. Despite a dividend yield of 4.13% not being well covered by earnings, insider ownership remains high, signaling confidence in future prospects and aligning management interests with shareholders'.

- Take a closer look at Foresight Group Holdings' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Foresight Group Holdings is trading beyond its estimated value.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £962.04 million.

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada, with a segment adjustment of $79.60 million.

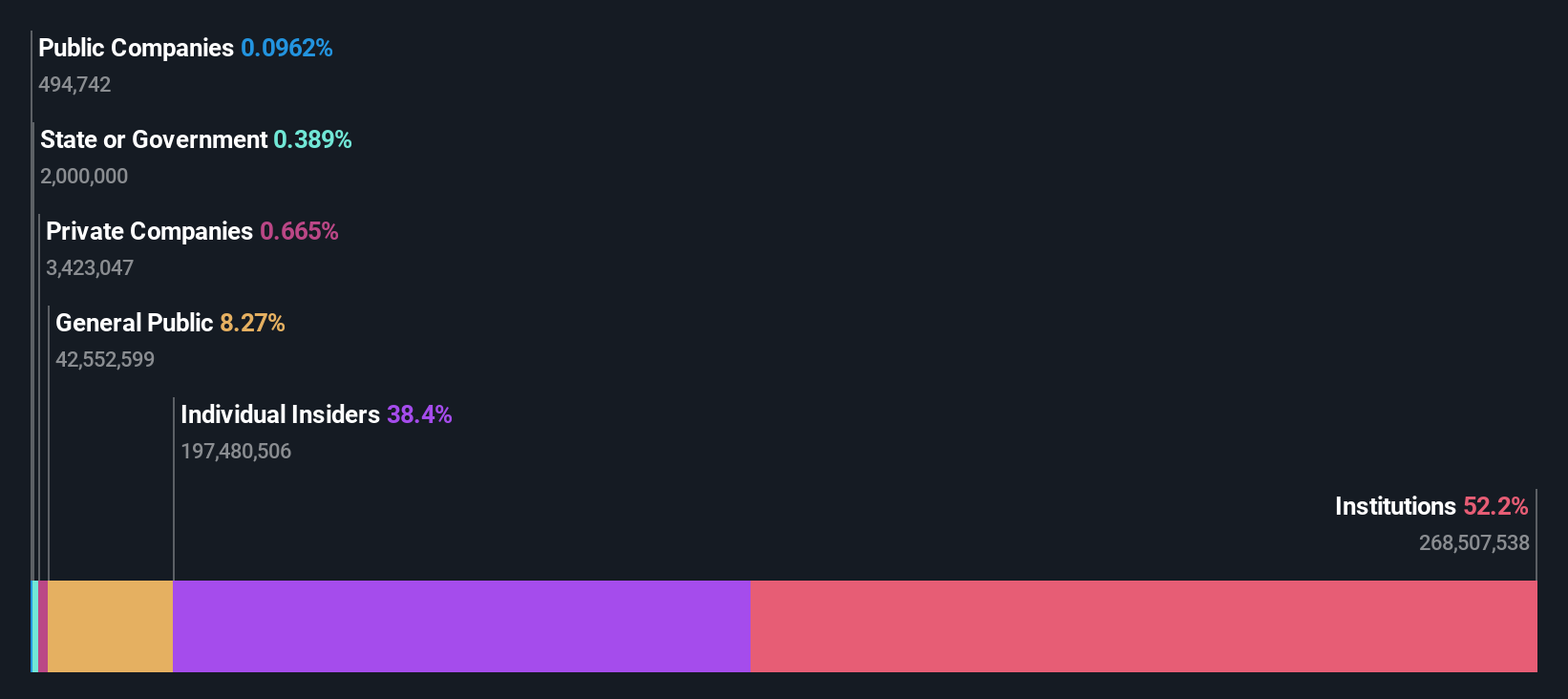

Insider Ownership: 38.4%

Earnings Growth Forecast: 43.8% p.a.

Hochschild Mining has shown strong growth potential, with earnings expected to grow 43.79% annually, significantly outpacing the UK market average. Recent H1 2024 results reported sales of US$391.74 million and net income of US$39.52 million, a turnaround from last year's loss. Despite high debt levels and volatile share prices, the company remains profitable this year with substantial insider ownership, indicating management's confidence in its future prospects.

- Dive into the specifics of Hochschild Mining here with our thorough growth forecast report.

- Our valuation report here indicates Hochschild Mining may be undervalued.

Turning Ideas Into Actions

- Get an in-depth perspective on all 64 Fast Growing UK Companies With High Insider Ownership by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United States, Canada, Brazil, and Chile.

Reasonable growth potential and fair value.