Stock Analysis

- United Kingdom

- /

- Specialty Stores

- /

- AIM:CMO

December 2024's Top Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interconnectedness. Despite these broader market trends, investors may find opportunities in penny stocks—typically smaller or newer companies—that can offer unique value propositions. While the term "penny stocks" might seem outdated, these investments remain relevant for those seeking potential growth and financial resilience amidst fluctuating market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £1.04 | £164.05M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.09 | £93.02M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.825 | £182.42M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.292 | £199.26M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.39 | £177.02M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.335 | £431.14M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.458 | $266.25M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.12 | £84.82M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

CMO Group (AIM:CMO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CMO Group PLC operates as an online retailer of building materials and supplies in the United Kingdom, with a market capitalization of £10.26 million.

Operations: The company generates revenue of £64.95 million from its retail operations in construction materials.

Market Cap: £10.26M

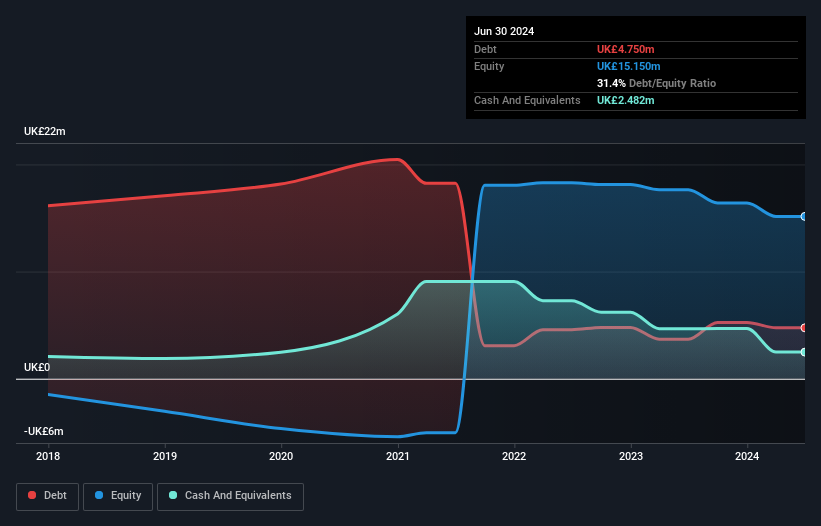

CMO Group PLC, with a market cap of £10.26 million, operates in the online retail space for building materials and faces financial challenges as it remains unprofitable with increasing losses over the past five years. Despite an experienced management team and board, its short-term assets (£9.8M) fall short of covering short-term liabilities (£16M), although they exceed long-term liabilities (£5.4M). The company has seen a decline in revenue expectations for 2024 to £62-63 million from £71.5 million in 2023, highlighting ongoing operational hurdles despite trading significantly below estimated fair value and having sufficient cash runway for over a year based on current free cash flow.

- Dive into the specifics of CMO Group here with our thorough balance sheet health report.

- Gain insights into CMO Group's outlook and expected performance with our report on the company's earnings estimates.

Pressure Technologies (AIM:PRES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pressure Technologies plc, with a market cap of £13.73 million, designs, manufactures, and sells high pressure systems for sectors including oil and gas, defense, industrial gases, and hydrogen energy across various international markets.

Operations: The company generates revenue through its Cylinders segment, accounting for £18.34 million, and its Precision Machined Components segment, contributing £14.88 million.

Market Cap: £13.73M

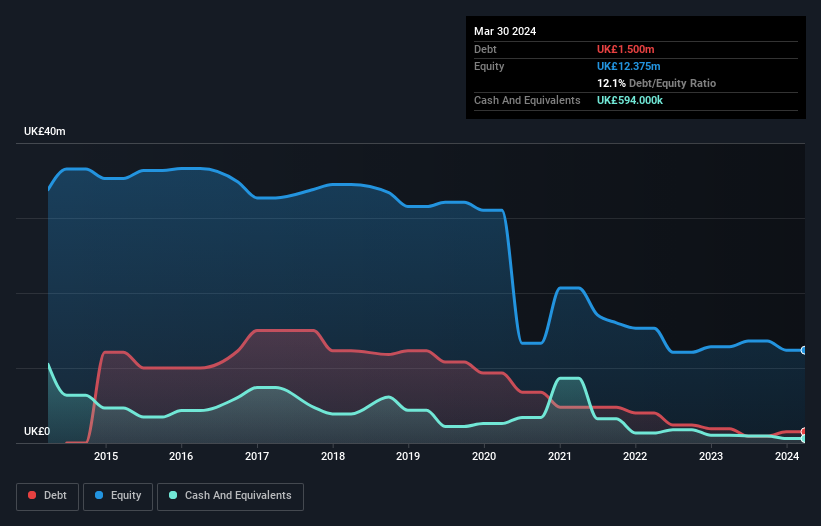

Pressure Technologies plc, with a market cap of £13.73 million, operates in high-pressure systems across various sectors and has shown resilience despite being unprofitable. The company benefits from a reduced debt to equity ratio of 12.1% over five years and maintains a satisfactory net debt to equity ratio of 7.3%. It possesses sufficient short-term assets (£14.1M) to cover both short-term (£9.2M) and long-term liabilities (£3.7M). With an experienced board but less seasoned management team, Pressure Technologies is trading significantly below its estimated fair value while having a positive cash flow runway exceeding three years.

- Click to explore a detailed breakdown of our findings in Pressure Technologies' financial health report.

- Explore Pressure Technologies' analyst forecasts in our growth report.

Record (LSE:REC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Record plc, with a market cap of £117.34 million, offers currency and derivative management services across the United Kingdom, North America, Continental Europe, Australia, and other international markets.

Operations: The company generates £45.02 million from its currency and derivatives management services.

Market Cap: £117.34M

Record plc, with a market cap of £117.34 million, specializes in currency and derivative management services. The company reported stable half-year sales of £21.12 million and net income growth to £4.96 million compared to the previous year. Despite negative earnings growth over the last year, Record maintains high-quality earnings with no debt burden and robust short-term asset coverage over liabilities (£28.2M vs £5M). However, dividends are not well covered by earnings or cash flows, and significant insider selling was noted recently. Trading below estimated fair value offers potential upside if profitability improves as forecasted at 8.16% annually.

- Get an in-depth perspective on Record's performance by reading our balance sheet health report here.

- Examine Record's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Embark on your investment journey to our 468 UK Penny Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CMO

CMO Group

Engages in the online retailing of building materials and supplies in the United Kingdom.