- United Kingdom

- /

- Oil and Gas

- /

- AIM:JOG

Discovering Opportunities: Jersey Oil and Gas Among 3 UK Penny Stocks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines following weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, investors often seek opportunities in lesser-known areas such as penny stocks. These stocks, typically associated with smaller or newer companies, can offer a blend of affordability and potential growth when supported by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| FRP Advisory Group (AIM:FRP) | £1.42 | £348.23M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.14 | £806.26M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.915 | £473.73M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.29 | £426.67M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.42 | £121.23M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.57 | £183.08M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.08 | £194.41M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.398 | £215.61M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.48 | £188.48M | ★★★★★☆ |

| Character Group (AIM:CCT) | £2.74 | £51.44M | ★★★★★★ |

Click here to see the full list of 474 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Jersey Oil and Gas (AIM:JOG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jersey Oil and Gas Plc focuses on the exploration, appraisal, development, and production of oil and gas properties in the UK's North Sea with a market cap of £23.85 million.

Operations: No revenue segments have been reported for this company.

Market Cap: £23.85M

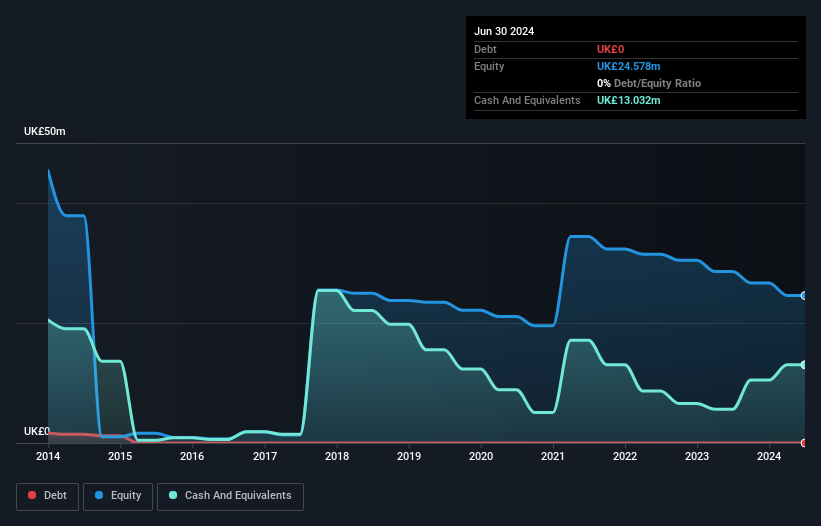

Jersey Oil and Gas Plc, with a market cap of £23.85 million, focuses on oil and gas exploration in the UK's North Sea but remains pre-revenue. The company is currently unprofitable, with a recent net loss of £2.62 million for the first half of 2024, slightly improved from the previous year. Despite its financial challenges, Jersey Oil and Gas maintains a strong cash position with sufficient runway for over three years if free cash flow trends continue. The board's experience averages nine years, potentially providing stability amidst high share price volatility and increased weekly volatility over the past year.

- Click here to discover the nuances of Jersey Oil and Gas with our detailed analytical financial health report.

- Explore Jersey Oil and Gas' analyst forecasts in our growth report.

Supreme (AIM:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Supreme Plc is involved in the ownership, manufacturing, and distribution of batteries, lighting, vaping products, sports nutrition and wellness items, as well as branded household consumer goods across the UK, Ireland, the Netherlands, France, wider Europe and internationally with a market cap of £183.08 million.

Operations: The company's revenue is derived from various segments, including Vaping (£82.79 million), Lighting (£16.50 million), Batteries (£40.53 million), Sports Nutrition & Wellness (£17.96 million), and Branded Household Consumer Goods (£63.48 million).

Market Cap: £183.08M

Supreme Plc, with a market cap of £183.08 million, has demonstrated strong financial performance, notably an 87.4% earnings growth over the past year, surpassing its five-year average and industry benchmarks. The company's debt is well-managed, with cash exceeding total debt and interest payments covered 23 times by EBIT. Despite a history of unstable dividends, Supreme recently declared a final dividend of 3.2 pence per share for the year ended March 2024. While revenue is forecast to grow modestly at 4.81% annually, significant insider selling in recent months may warrant investor caution regarding future prospects.

- Get an in-depth perspective on Supreme's performance by reading our balance sheet health report here.

- Assess Supreme's future earnings estimates with our detailed growth reports.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager with operations in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia, and has a market cap of £544.72 million.

Operations: The company generates its revenue from three main segments: Infrastructure (£84.17 million), Private Equity (£47.35 million), and Foresight Capital Management (£9.80 million).

Market Cap: £544.72M

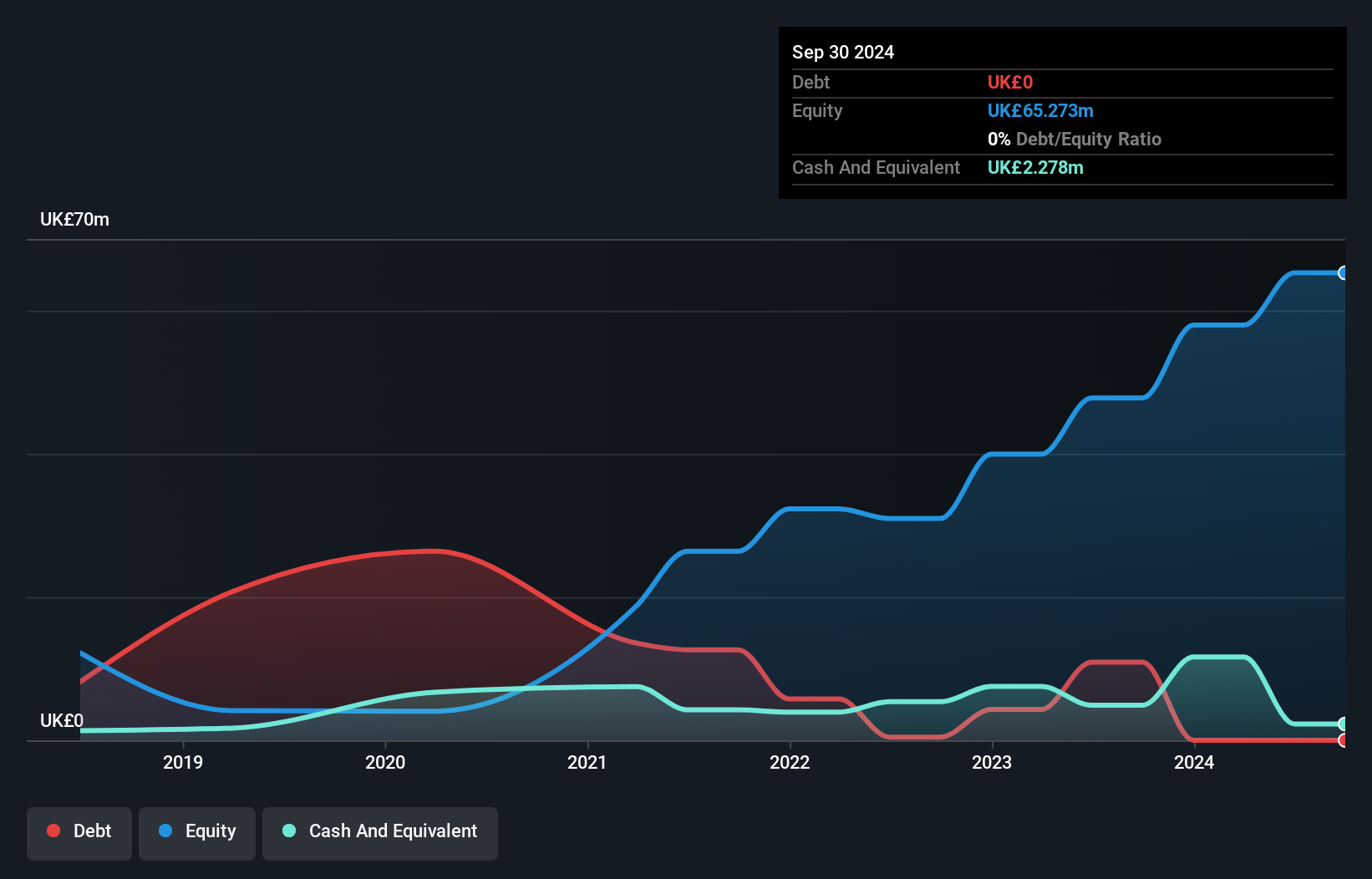

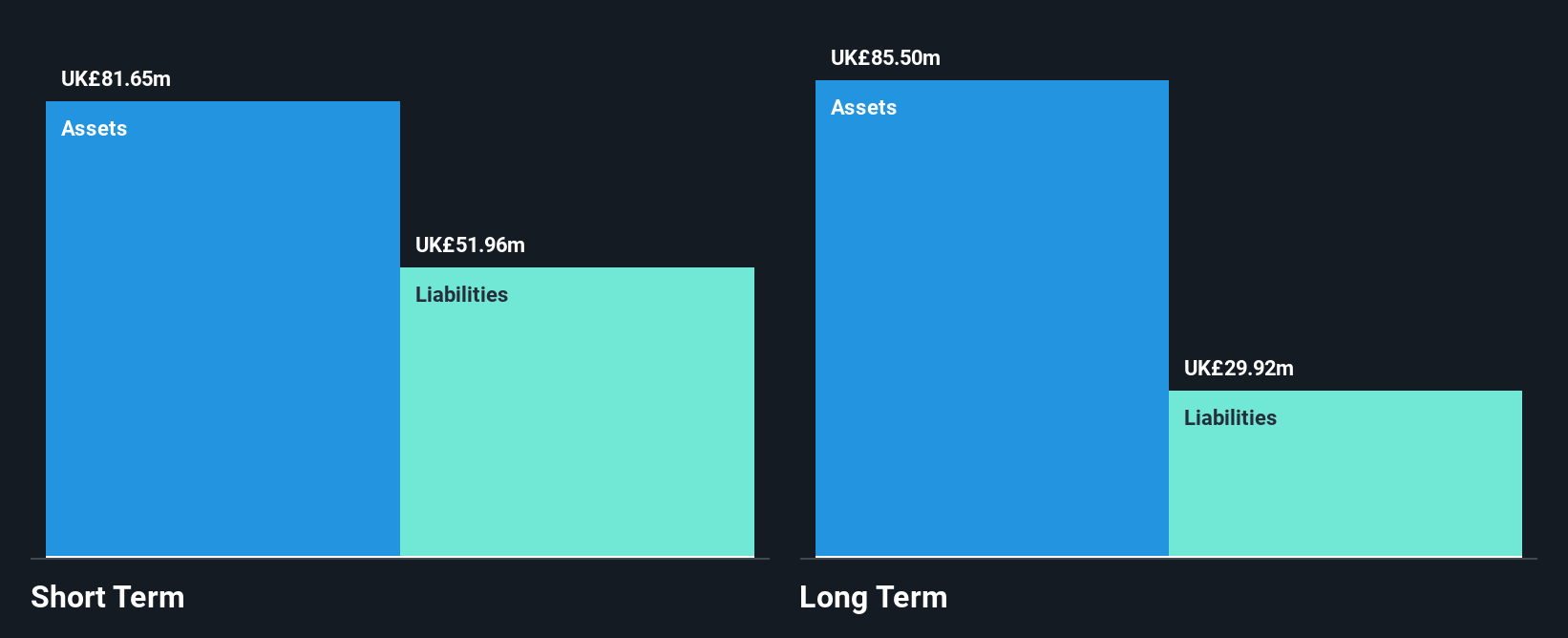

Foresight Group Holdings, with a market cap of £544.72 million, exhibits solid financial health, with short-term assets exceeding both short and long-term liabilities. The company has maintained high-quality earnings and a strong return on equity at 29.8%. Despite recent deceleration in profit growth to 11.9% over the past year compared to its five-year average of 29%, Foresight's debt is well covered by operating cash flow, indicating robust financial management. Recent inclusion in the S&P Global BMI Index and dividend affirmations underscore its stable market presence, though dividend coverage by earnings remains weak at 4.69%.

- Jump into the full analysis health report here for a deeper understanding of Foresight Group Holdings.

- Understand Foresight Group Holdings' earnings outlook by examining our growth report.

Seize The Opportunity

- Click this link to deep-dive into the 474 companies within our UK Penny Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JOG

Jersey Oil and Gas

Engages in the exploration, appraisal, development, and production of oil and gas properties in the North Sea of the United Kingdom.

Flawless balance sheet slight.