- United Kingdom

- /

- Capital Markets

- /

- LSE:WCW

The Market Doesn't Like What It Sees From Walker Crips Group plc's (LON:WCW) Revenues Yet As Shares Tumble 29%

To the annoyance of some shareholders, Walker Crips Group plc (LON:WCW) shares are down a considerable 29% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

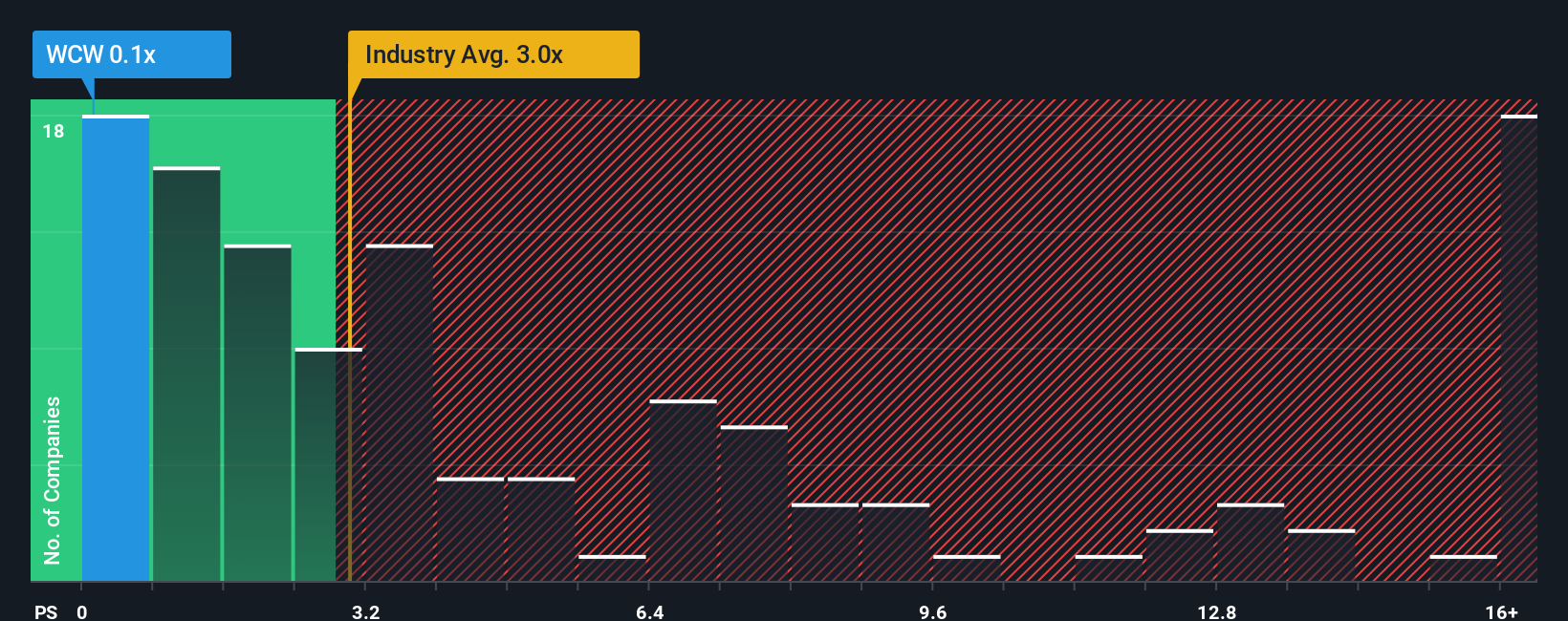

Following the heavy fall in price, Walker Crips Group's price-to-sales (or "P/S") ratio of 0.1x might make it look like a strong buy right now compared to the wider Capital Markets industry in the United Kingdom, where around half of the companies have P/S ratios above 3x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Walker Crips Group

How Has Walker Crips Group Performed Recently?

It looks like revenue growth has deserted Walker Crips Group recently, which is not something to boast about. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. Those who are bullish on Walker Crips Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Walker Crips Group's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Walker Crips Group?

Walker Crips Group's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 4.5% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 0.9% shows it's an unpleasant look.

With this in mind, we understand why Walker Crips Group's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Walker Crips Group's P/S?

Having almost fallen off a cliff, Walker Crips Group's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Walker Crips Group confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Plus, you should also learn about these 3 warning signs we've spotted with Walker Crips Group.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Walker Crips Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:WCW

Walker Crips Group

Provides financial products and services in the United Kingdom.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives