Stock Analysis

- United Kingdom

- /

- Capital Markets

- /

- LSE:SIHL

Symphony International Holdings (LON:SIHL) adds US$20m to market cap in the past 7 days, though investors from five years ago are still down 20%

It's nice to see the Symphony International Holdings Limited (LON:SIHL) share price up 10% in a week. But over the last half decade, the stock has not performed well. After all, the share price is down 33% in that time, significantly under-performing the market.

On a more encouraging note the company has added US$20m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

View our latest analysis for Symphony International Holdings

Given that Symphony International Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Symphony International Holdings grew its revenue at 24% per year. That's better than most loss-making companies. The share price drop of 6% per year over five years would be considered let down. So you might argue the Symphony International Holdings should get more credit for its rather impressive revenue growth over the period. If that's the case, now might be the smart time to take a close look at it.

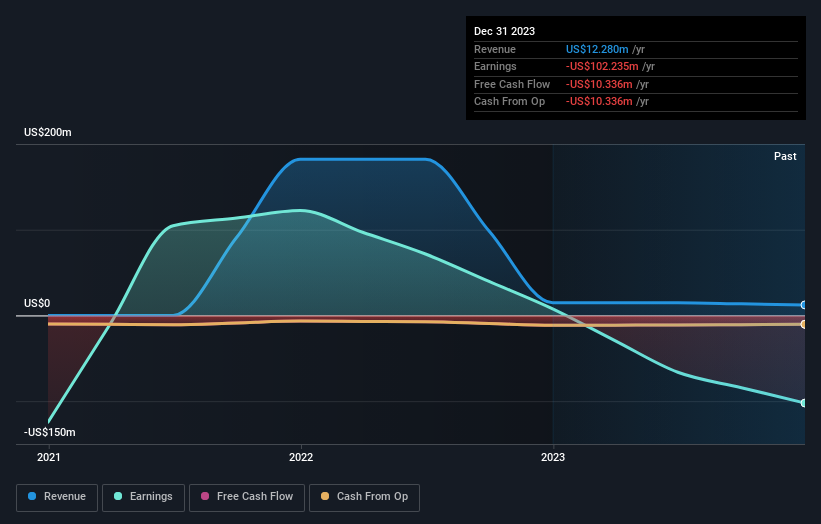

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Symphony International Holdings' TSR for the last 5 years was -20%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Investors in Symphony International Holdings had a tough year, with a total loss of 3.7% (including dividends), against a market gain of about 4.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 4% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Symphony International Holdings better, we need to consider many other factors. Take risks, for example - Symphony International Holdings has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Symphony International Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Symphony International Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SIHL

Symphony International Holdings

A private equity and venture capital firm specializing in investments in early stage, management buy-outs, emerging growth, management buy-ins, restructurings, special situations, and the provision of growth capital for later-stage development and expansion.

Flawless balance sheet second-rate dividend payer.