- United Kingdom

- /

- Capital Markets

- /

- LSE:LWDB

Undiscovered Gems in the United Kingdom for November 2025

Reviewed by Simply Wall St

As the United Kingdom's market navigates through global economic challenges, particularly influenced by weak trade data from China, both the FTSE 100 and FTSE 250 indices have experienced slight declines. In such a climate, identifying undiscovered gems in the small-cap sector requires a keen eye for companies that demonstrate resilience and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anglo-Eastern Plantations | NA | 5.55% | 5.38% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| Law Debenture | 15.39% | 21.17% | 19.12% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★★★★

Overview: B.P. Marsh & Partners PLC focuses on investing in early-stage and SME financial services intermediary businesses both in the United Kingdom and internationally, with a market cap of £242.64 million.

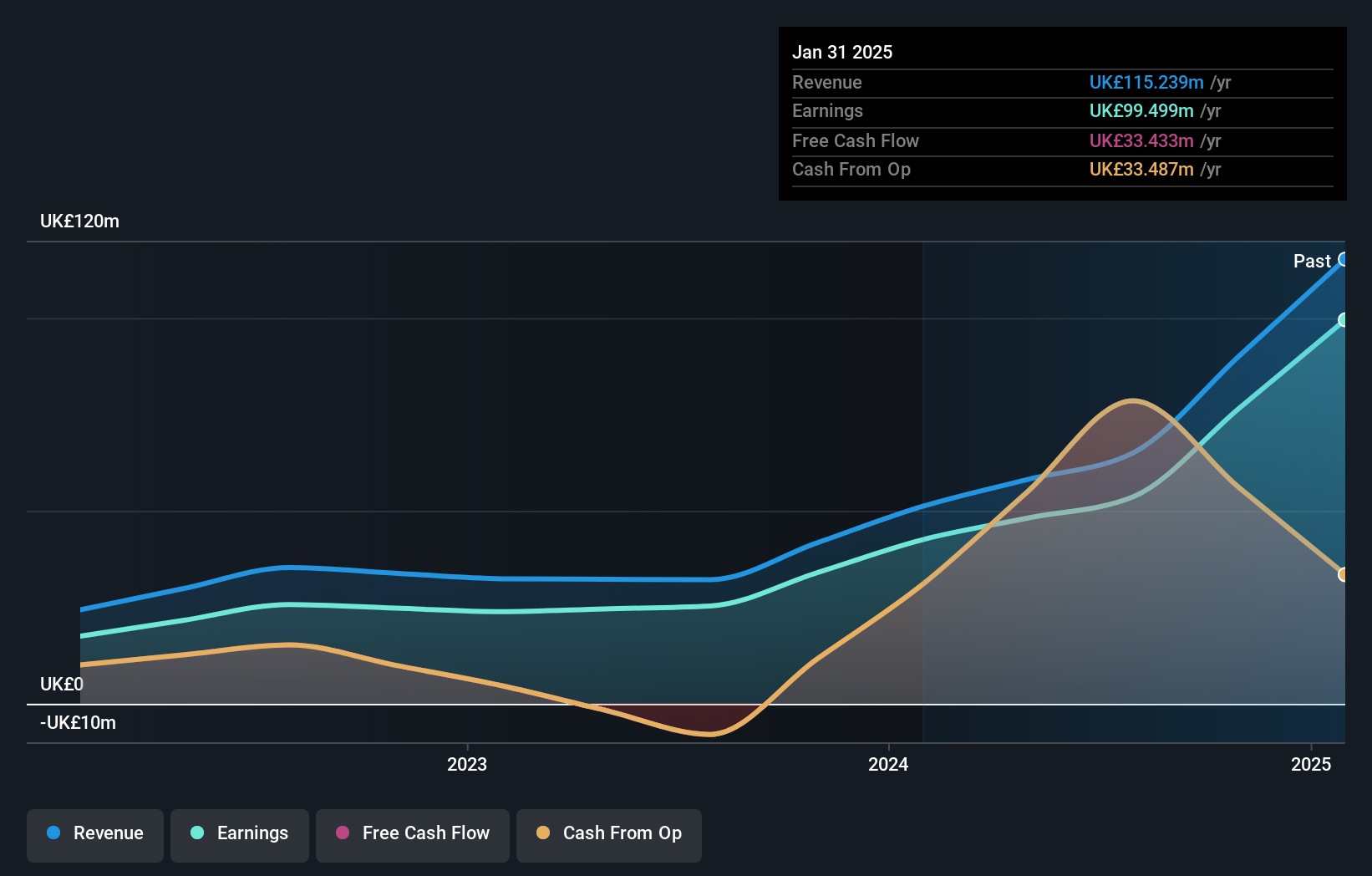

Operations: Revenue for B.P. Marsh & Partners comes primarily from consultancy services and trading investments in financial services, totaling £118.87 million.

B.P. Marsh & Partners, a financial services firm, showcases robust earnings growth of 94.8% over the past year, outpacing the Capital Markets industry average of 1.7%. With no debt on its books and trading at 49.1% below estimated fair value, it presents an intriguing opportunity for investors seeking undervalued assets. Recent half-year results reveal a revenue increase to £36.14 million from £32.51 million and net income rising to £31.55 million from £26.62 million year-on-year, indicating solid operational performance despite not being free cash flow positive currently due to high non-cash earnings levels.

- Navigate through the intricacies of B.P. Marsh & Partners with our comprehensive health report here.

Georgia Capital (LSE:CGEO)

Simply Wall St Value Rating: ★★★★★★

Overview: Georgia Capital PLC is a private equity and venture capital firm focusing on early-stage investments, organic growth, and acquisitions with a market capitalization of £798.48 million.

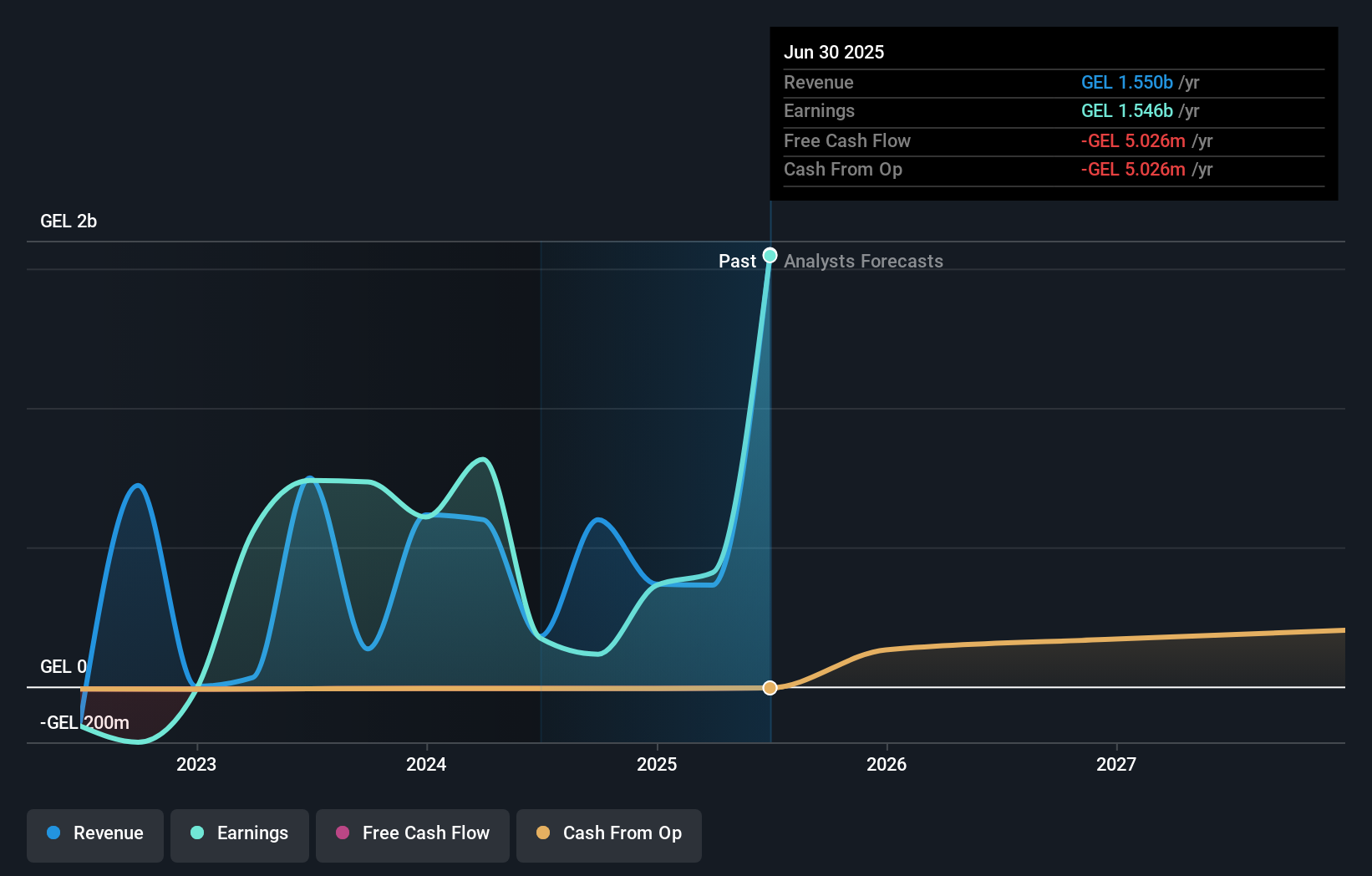

Operations: Georgia Capital generates revenue through its private equity and venture capital investments, focusing on early-stage ventures, organic growth, and acquisitions. The firm operates with a market capitalization of £798.48 million.

Georgia Capital, a player in the capital markets, has shown impressive earnings growth of 1381% over the past year, significantly outpacing its industry peers. The company is trading at 29.5% below its estimated fair value, presenting a potential opportunity for investors. Despite significant insider selling in recent months, Georgia Capital remains debt-free and has completed a share buyback program repurchasing 4.11% of shares for $44.6 million between August and October 2025. A large one-off gain of GEL1.4 billion influenced recent financial results, highlighting some volatility in earnings quality but also providing room for strategic maneuvers moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Georgia Capital.

Assess Georgia Capital's past performance with our detailed historical performance reports.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Law Debenture Corporation p.l.c. is an investment trust offering independent professional services globally, with a market cap of £1.39 billion.

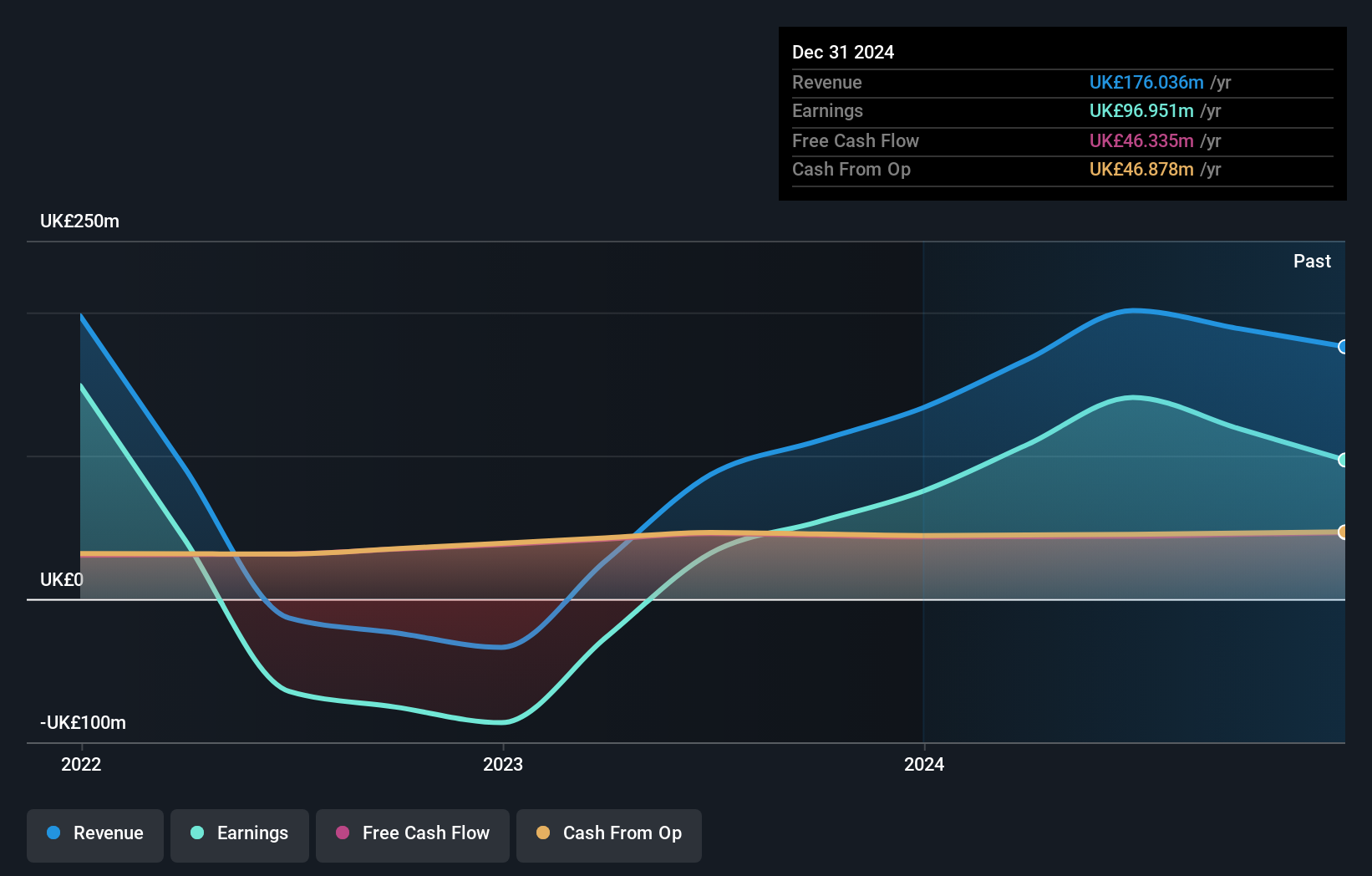

Operations: Law Debenture generates revenue primarily from its investment portfolio (£38.42 million) and independent professional services (£63.99 million). The company focuses on these two streams to drive its financial performance.

Law Debenture, a standout in the UK's smaller investment landscape, showcases a compelling profile with its price-to-earnings ratio of 8.2x, notably undercutting the UK market average of 16.1x. Over the past year, it has demonstrated robust earnings growth at 20.9%, outpacing the Capital Markets industry's modest 1.7% increase. The company's net debt to equity ratio stands at a satisfactory 15.2%, reflecting prudent financial management as it has decreased from 18.7% over five years. With high-quality earnings and well-covered interest payments (28.6x EBIT coverage), Law Debenture seems well-positioned for continued stability and potential growth in its sector.

- Click to explore a detailed breakdown of our findings in Law Debenture's health report.

Understand Law Debenture's track record by examining our Past report.

Where To Now?

- Unlock more gems! Our UK Undiscovered Gems With Strong Fundamentals screener has unearthed 54 more companies for you to explore.Click here to unveil our expertly curated list of 57 UK Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LWDB

Law Debenture

An investment trust, provides independent professional services to companies, agencies, organizations, and individuals worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives