- United Kingdom

- /

- Professional Services

- /

- LSE:WIL

Undiscovered Gems in the United Kingdom for July 2024

Reviewed by Simply Wall St

The United Kingdom market has climbed 1.1% in the last 7 days and 5.9% over the past year, with earnings forecast to grow by 13% annually. In this promising environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 17.80% | 18.35% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc offers foreign exchange risk management and alternative banking solutions across the UK, Europe, Canada, and internationally, with a market cap of £1.10 billion.

Operations: Alpha Group International plc generates revenue primarily from its Alpha Pay (£64.30 million), Institutional (£61.29 million), and Corporate London (£45.42 million) segments, among others. The company's market cap stands at £1.10 billion.

Alpha Group International, a promising player in the UK market, has shown impressive earnings growth of 130% over the past year, far outpacing its industry. With a P/E ratio of 12.4x compared to the UK market's 16.5x, it offers good value. The company is debt-free and has been so for five years, which enhances its financial stability. Recently added to multiple FTSE indices and commencing share repurchases under a new mandate further underscore its robust position and future potential.

- Dive into the specifics of Alpha Group International here with our thorough health report.

Understand Alpha Group International's track record by examining our Past report.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Law Debenture Corporation p.l.c., an investment trust, offers independent professional services to a global clientele and has a market cap of £1.18 billion.

Operations: The company generates revenue from two primary segments: Investment Portfolio (£35.62 million) and Independent Professional Services (£61.55 million).

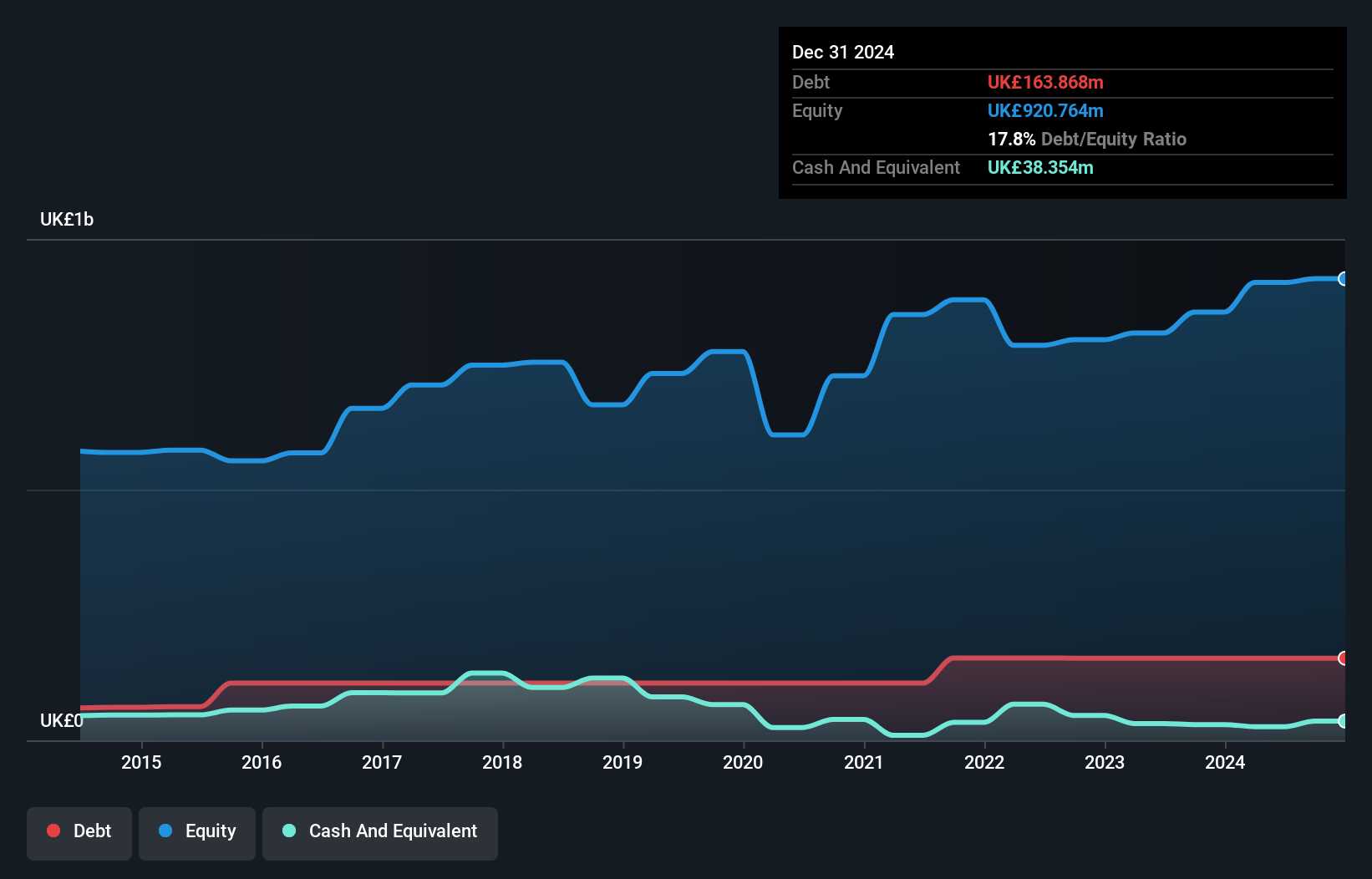

Law Debenture has shown remarkable growth, with earnings increasing by 340.1% over the past year, significantly outperforming the Capital Markets industry. Its debt to equity ratio has risen from 15.6% to 17.9% in five years, but interest payments are well covered by EBIT at 21.9x coverage. The company’s net debt to equity ratio is a satisfactory 15%, and its price-to-earnings ratio stands at an attractive 8.4x compared to the UK market's average of 16.5x.

- Get an in-depth perspective on Law Debenture's performance by reading our health report here.

Assess Law Debenture's past performance with our detailed historical performance reports.

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★★★

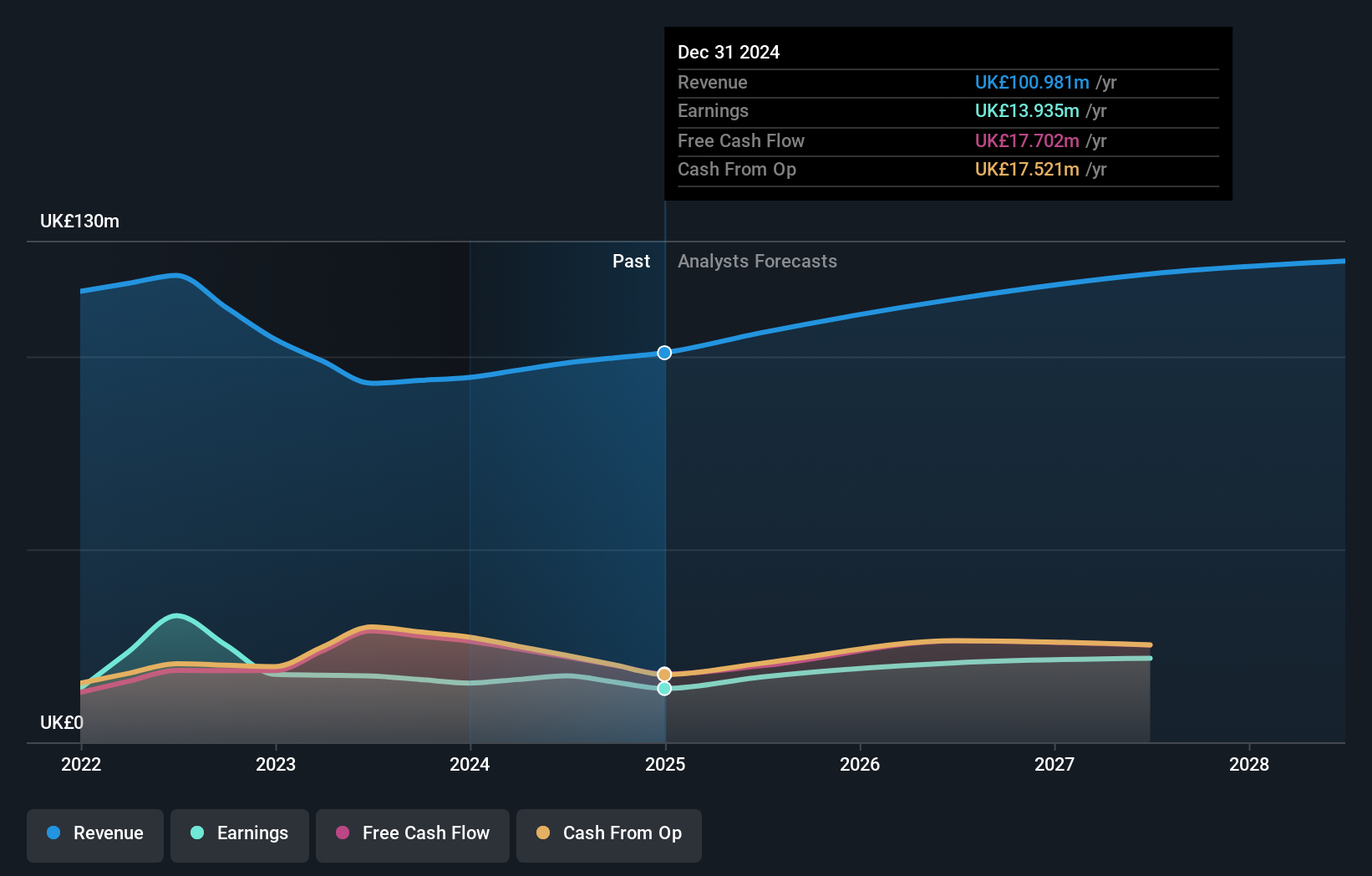

Overview: Wilmington plc, with a market cap of £352.41 million, provides information, data, training, and education solutions to professional markets in the United Kingdom, Europe, North America, and internationally.

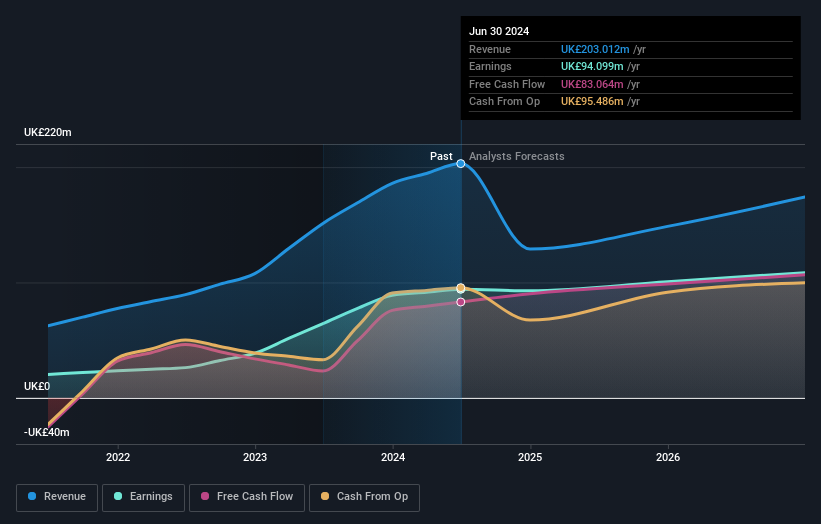

Operations: Wilmington generates revenue primarily from its Intelligence segment (£57.86 million) and Training & Education segment (£67.13 million).

Wilmington, a UK-based professional services firm, is trading at 29.2% below its estimated fair value and has seen earnings grow by 4.4% over the past year, outpacing the industry’s 2%. With no debt and high-quality earnings, it appears financially robust. However, projections indicate a potential average decline of 6.6% in earnings annually for the next three years. Despite these forecasts, Wilmington's debt-free status and positive free cash flow position it well within its sector.

- Unlock comprehensive insights into our analysis of Wilmington stock in this health report.

Evaluate Wilmington's historical performance by accessing our past performance report.

Taking Advantage

- Click here to access our complete index of 76 UK Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wilmington might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WIL

Wilmington

Provides information, data, training, and education solutions to professional markets in the United Kingdom, the rest of Europe, North America, and internationally.

Flawless balance sheet with proven track record and pays a dividend.